In recent years, with the improvement of the health literacy level of Chinese residents year by year, and the influence of the epidemic, the public has paid more attention to personal health. Taking health supplements has gradually become a living habit for many people and therefore, consumers’ demand for health supplements is also further expanding. Thanks to the rapid development of cross-border eCommerce, the overseas market is growing rapidly and more health supplement brands are entering the China market. According to the statistics of CBNData, the consumption scale and the number of consumers of health supplements on Tmall Global have maintained a good growth trend in recent years.

TMO has integrated, analyzed and summarized the sales data of overseas health supplements from July 2022 to June 2023, so that you can quickly, directly and accurately have a comprehensive understanding of the market conditions in the recent year. In response to the questions that readers are most concerned about, we will also answer them one by one in this article. If you are interested, be sure to read it patiently!

How was the overall market in 2022-2023?

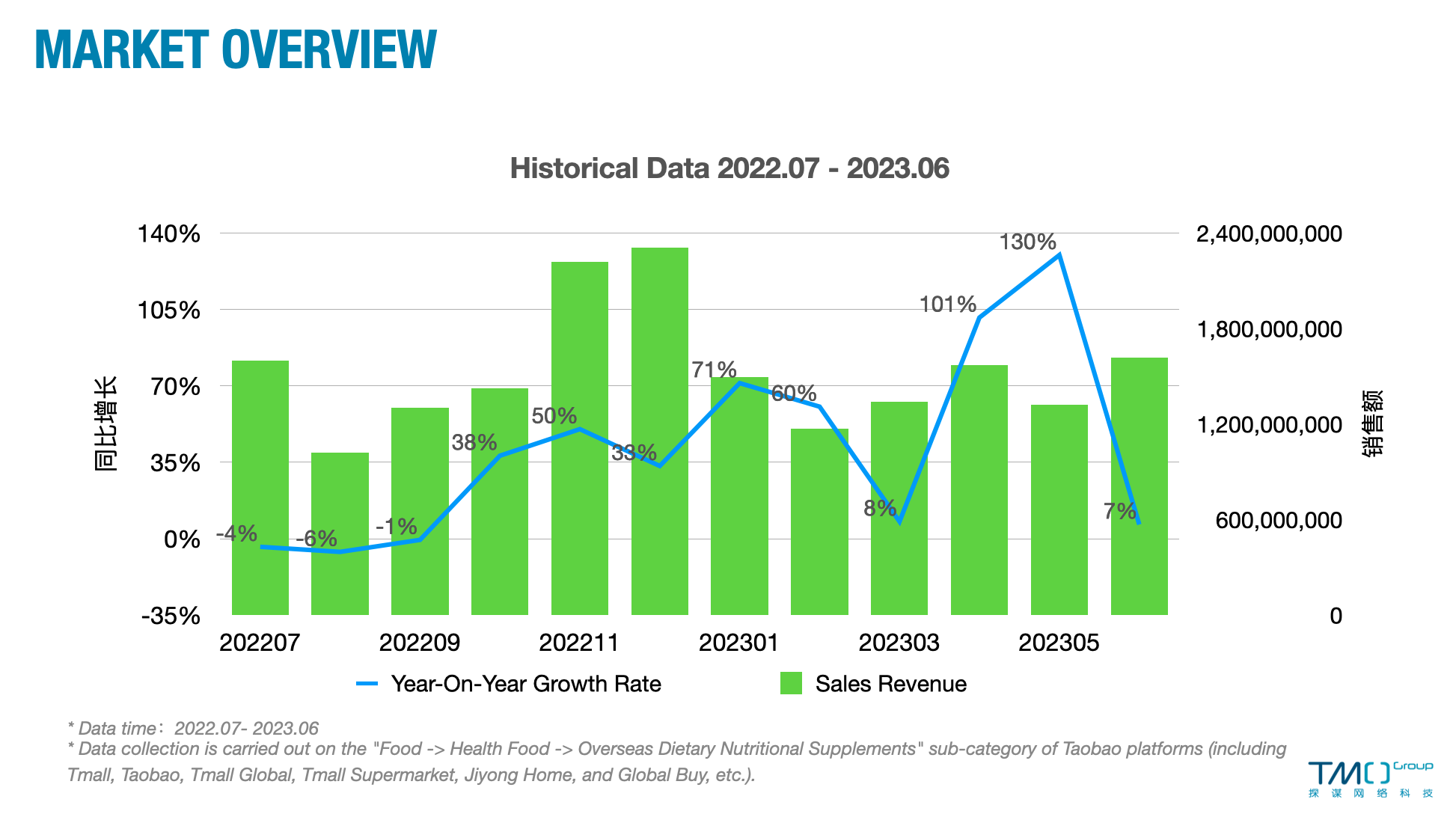

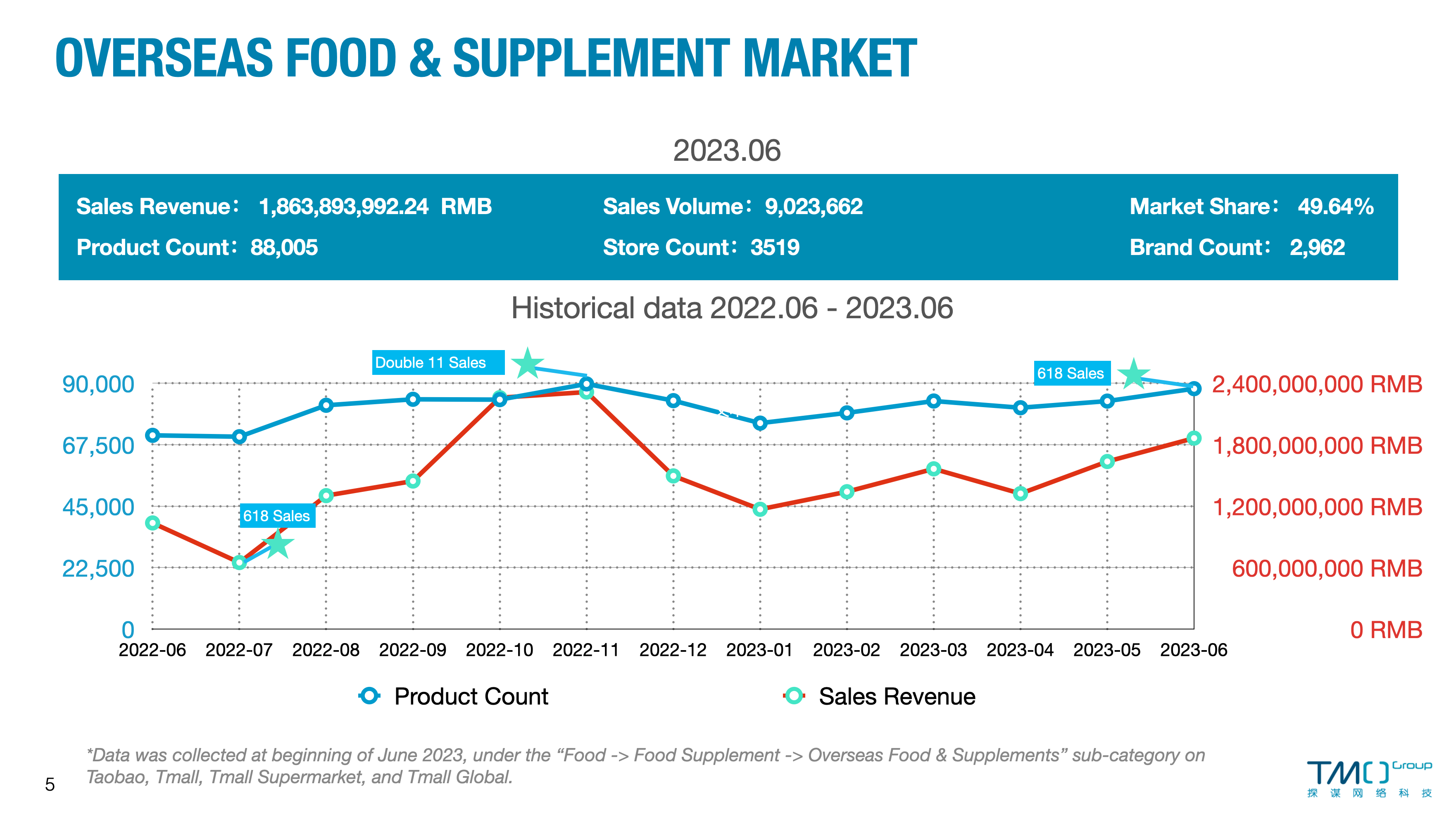

Overall, the recent year was still a year of rapid development for overseas health supplements. Judging from the sales data of Alibaba platforms, the sales revenue from July 2022 to June 2023 was close to 18.7 billion yuan, and the sales volume was about 82.29 million. In the two months with big promotions, sales reached 2.308 billion yuan in November and 1.864 billion yuan in June. It is worth noting that in the latest 618 promotion month, the sales of overseas health supplement on Taobao and Tmall platforms were lower than last year’s Double Eleven promotion month, with sales down 19% and sales down 7%. This shows that at a time with more and more eCommerce promotional festivals, it is a challenge to gain more attention from consumers who are less sensitive to promotions. TMO will use data insights to help brands and merchants improve their customer acquisition capabilities in an increasingly competitive market environment.

What are the best-selling sub-categories and products?

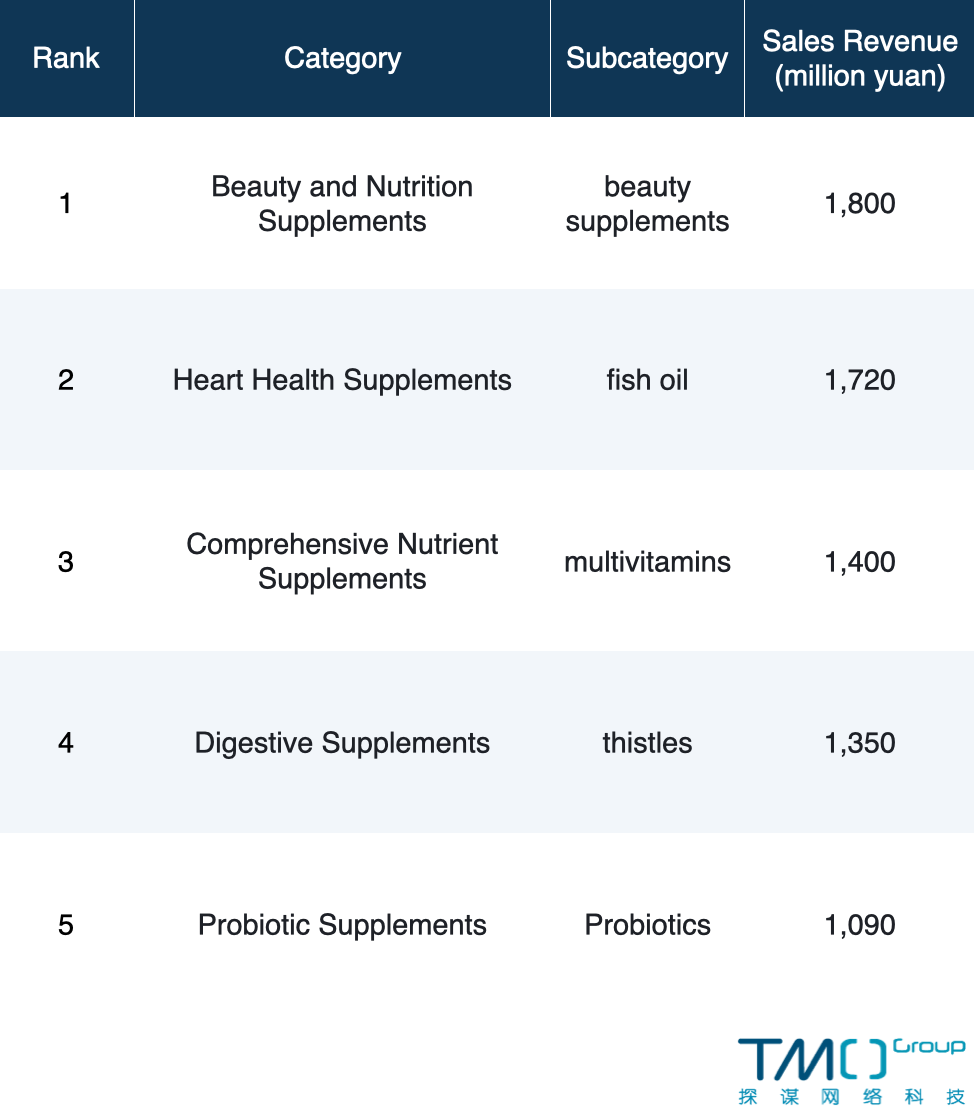

The best-selling sub-category from July 2022 to June 2023 is undoubtedly beauty supplements, with sales revenue of more than 1.8 billion yuan. Among them, oral collagen and anti-sugar products are especially popular. The “she economy” has driven more women to invest in their physical appearance as well as internal health, and the internal use of beauty and skin care ingredients has also become a new trend.

The top 10 sub-categories can be roughly divided into three groups: beauty enhancement (beauty supplements, collagens), immunity boosting (probiotics, multivitamins, thistles), cardiovascular health (fish oil). This is also highly consistent with the ingredients and benefits of the best-selling products. These four groups also happen to correspond to the three core consumer groups of health supplements: female beauty lovers, young people and the middle-aged and elderly. It can be seen that in China, health products have gradually penetrated into all age groups.

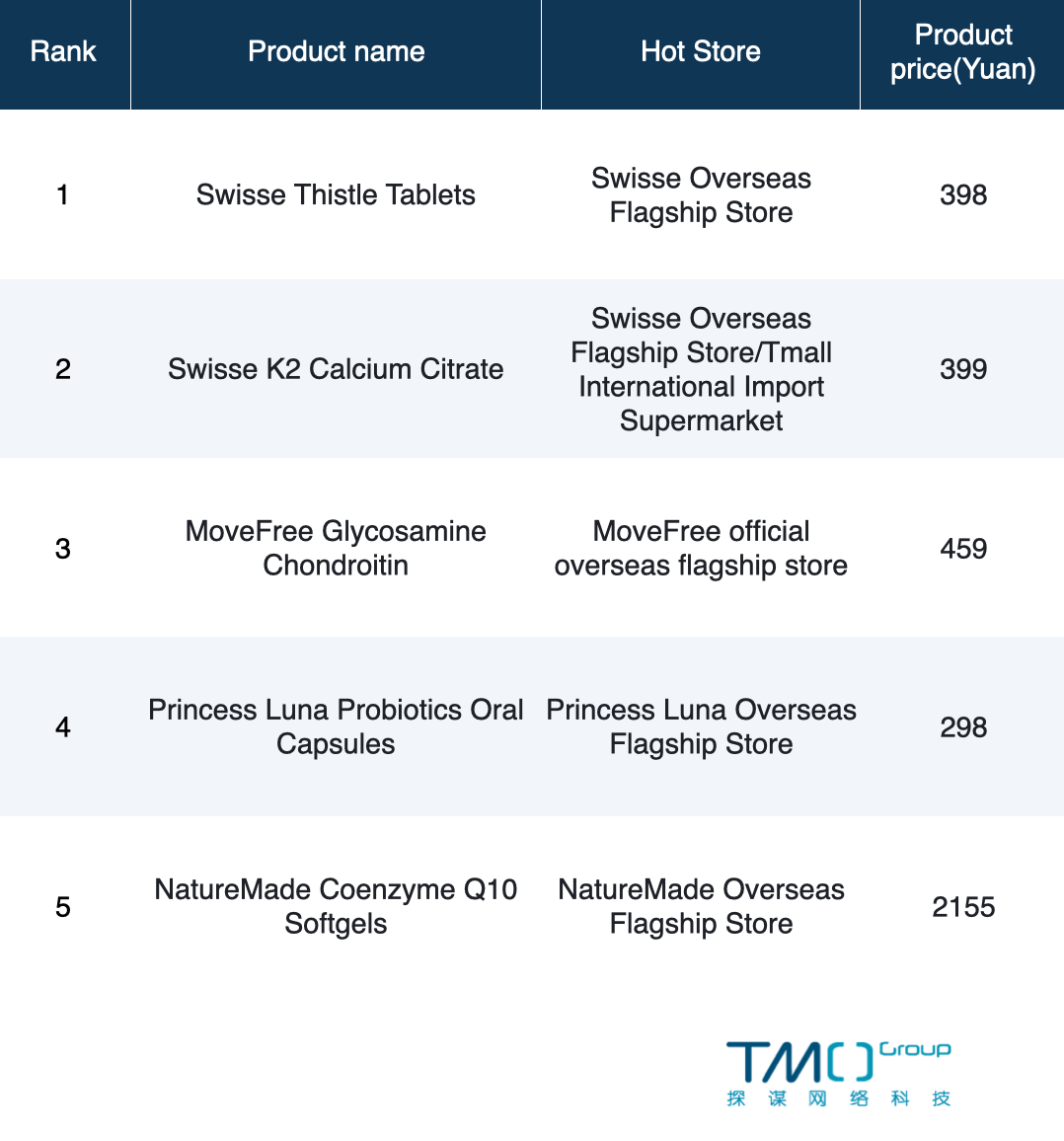

From the perspective of best-selling products, from July 2022 to June 2023, the following 5 products have occupied the monthly top selling lists for many times. Judging from the popular stores of Top 5 products, consumers trust and tend to go to the official flagship store of the brand to make purchases.

In general, the price range of the best-selling overseas health supplements from July 2022 to June 2023 is 100-400 yuan. Most consumers are still more willing to choose big brands and cost-effective products, but there are also quite a few consumers who are willing to spend money to buy high-end products with active ingredients of higher concentration and better effects.

Swisse’s Liver Detox Tablets and Calcium Tablets, Princess Luna’s Probiotics Capsules and NatureMade’s Coenzyme Q10 Softgels are the best-selling products within this time range. These products are often seen in the top 15 of the monthly sales list. Among them, the popularity of female probiotics reflects that external beauty is no longer the only pursuit of contemporary sophisticated women, and issues such as vaginal health, which were often avoided in the past but are actually of great importance, have begun to be paid more attention by women.

What are the consumers’ preferences for products?

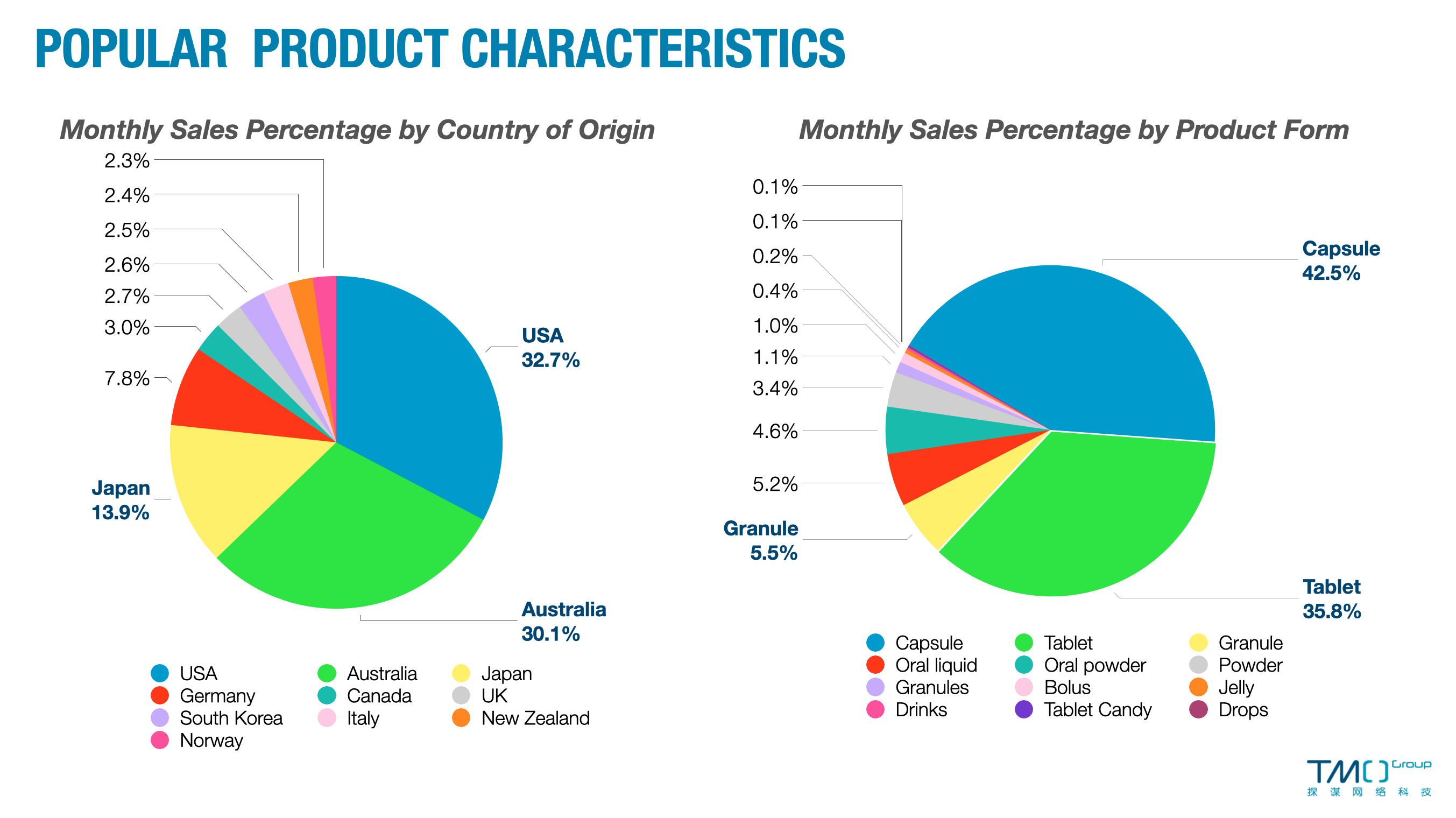

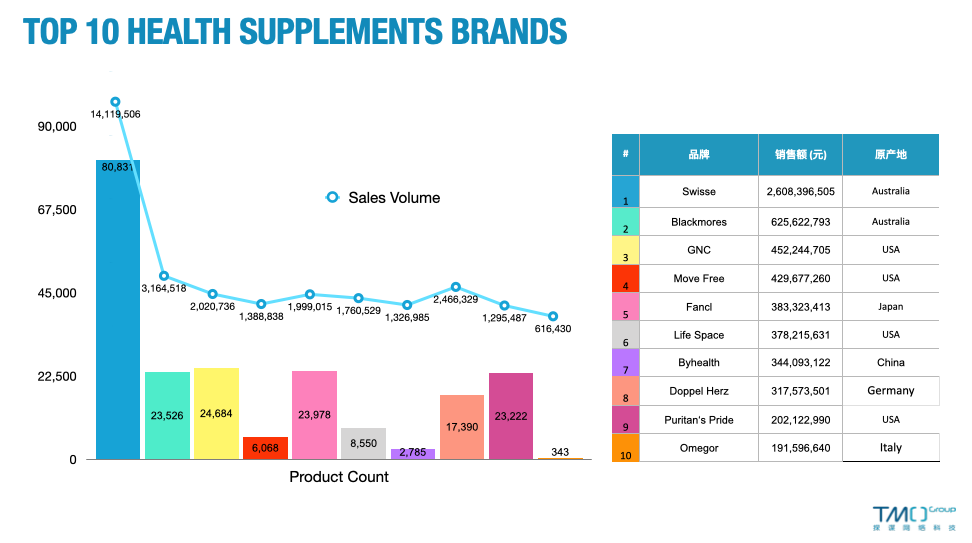

From July 2022 to June 2023, health products from US and Australia are still the first choice for Chinese consumers when purchasing imported supplements. And Swisse, relying on its high cost performance, multi-channel marketing and good brand image, has become the best-selling brand for many consecutive years. For entry-level consumers who are new to buying and taking supplements and are in lack of related knowledge, Swisse’s products are a safe bet that can’t go wrong.

For some specific categories, consumers will also choose more professional and well-known brands and products in this field, such as MoveFree’s glucosamine products and Life Space’s probiotic product. In addition, when consumers buy enzymes and other weight management products, they would prefer products from Japan.

In terms of product forms, consumers still buy the most health products in the form of capsules and tablets. However, in recent years, snack-formed health products (such as gummies and jelly) have become more and more popular among young Chinese consumers. The products that consumers usually buy in the form of snacks include probiotics, collagen and melatonin.

Which brands are the first choice of consumers?

From the top brands of "overseas health supplements" from July 2022 to June 2023, the Australian brand Swisse took the absolute lead, ranking first, with sales exceeding 2.6 billion yuan; the second is the Australian brand Blackmores, with sales of about 600 million yuan. Ranking third is the American brand GNC, with sales of about 460 million yuan. These three brands compete fiercely in the category of "cardiovascular and comprehensive nutritional supplements". In terms of the number of products and sales volume, Swisse has also distanced itself from other competitors, showing strong channel expansion and product development capabilities.

Judging by popular stores, the brands’ overseas flagship store, as a guarantee of genuine products, is still the most trusted purchasing channel for consumers. However, it is worth noting that to what degree the sales channels diverge is actually closely related to the brand influence. The flagship store of high-profile brands tend to account for a lower proportion of sales. For example, For example, the sales of several Swisse products in stores such as Tmall International Import Supermarket and Ali Health Pharmacy even exceeded the sales of flagship stores. In addition, for countries like US, Australia, Canada and Japan, the Daigou business is well-developed, and the C2C market is very large. The sales performance of a personal store with a good reputation can even be better than that of a flagship store.

Are consumers still crazy about Double 11 and 618?

Compared with the performance on Double 11 in previous years, the 2022 Double 11 sales did not show significant growth. The total sales in November increased from 4.52 billion yuan last year to 4.78 billion yuan, and the average transaction price increased from 308 yuan last year to 340 yuan. From the perspective of sales volume, number of products, and stores, a certain degree of decline happened in 2022 compared with the same period in 2021. However, the sales volume of the month is still the peak between mid-2022 and mid-2023, so Double 11 remains the hottest promotion festival of the year.

In the context of consumption recovery, as the first post-pandemic “618” shopping festival in China, this year’s Taobao “618” has lived up to expectations. Although the downgrade of consumption has become a hot topic recently, the large-scale promotions during the shopping festival can still arouse consumers' interest in hoarding goods. In June 2023, the consumption of overseas health supplements recovered strongly, with sales exceeding 1.8 billion yuan, reaching the peak since December last year, a year-on-year increase of 14.69% and a month-on-month increase of 15.12%. However, it is worth noting that the sales data of the 618 promotion month in 2023 is not as good as that of the Double 11 promotion month in 2022. This shows that at the moment when there are more and more eCommerce promotion festivals, how to get more attention from consumers who are less and less sensitive to promotions is an issue that brands need to think about.

TMO Group will continue to update eCommerce transaction trends for overseas health supplements, assisting brands and merchants in improving customer acquisition capabilities in the competitive market. For more information, go download our China Health Supplements Market Basic Data Packs (2023 Annual Collection)This collection includes the China health supplements market premium data packs from January issue to December issue 2023. In addition, source data excel sheets with comprehensive industry information are attached for your reference.China Health Supplements Market Data Pack! If more detailed market data for specific subcategories is required, please do not hesitate to check out our data service or contact us, and we will provide you with thorough data, customized analysis, and reports to fulfill your needs.