Although the Asia-Pacific region is estimated to remain the largest eCommerce market globally due to an ever expanding middle class as well as an increase in mobile sales, Europe presents another important combined market which accounts for 509.1 billion EUR. Most notably, Italy is the eCommerce market to watch as the rate of Italian eCommerce growth is expected to be over 20%. Today, 57% of European internet users make purchases online. However, only 16% of SMEs sell online, whereas only 7.5% of them sell across borders.

Italian eCommerce Developments

Contrary to the global trend, digitalization of Italian firms is quite low. And what is more, Italy has the lowest level of internet penetration among all European countries. eCommerce has lagged behind due to factors such as the high level of credit card fraud, lack of trust in the postal system, and the traditionally less favourable return policy of Italian merchants.

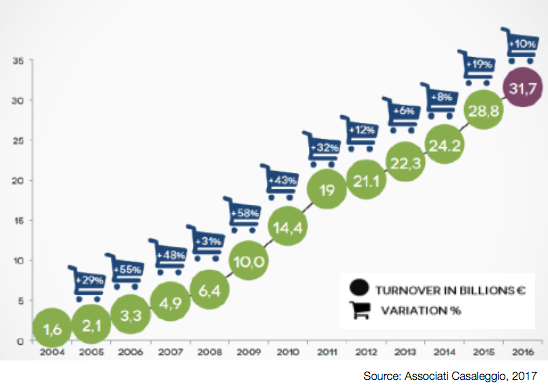

Despite the low level of internet penetration, an extraordinary portion of those who have internet access shop online. As you can observe in the figure below, Italian eCommerce revenue in 2016 reached 31.7 billion EUR. And as was aforementioned, the rate of eCommerce growth is anticipated to higher than 20%. Moreover, over half of those who shop online also do so from abroad. The top five countries from which to buy products online are the United Kingdom (20%), Germany (16%), China (13%), the United States (5%), and France (5%) respectively. The Italian eCommerce penetration over total retail expenditures increased from 4% in 2015 to 5% in 2016.

eCommerce in Italy

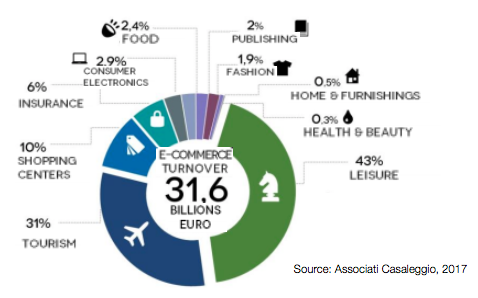

With respect to the distribution of turnover the leisure and tourism sectors continue to represent the largest share of the Italian eCommerce market, amounting to a whopping 74% of total turnover. However, the turnover generated in the leisure sector (43%) has slightly contracted compare to the previous year. Although the sector is growing in absolute terms.

The sectors that have grown the most in terms of turnover are health and beauty as well as food. Both grew with over 30%, to be specific, 36% and 33% respectively. Also the growth of online shopping centres continues, where the predominance of the great international players is yet again confirmed, which becomes the first destination for purchases of many consumers.

The fashion industry is growing, with the largest operators growing rapidly thanks to television advertising, and we observed the entry of new operators in the home and furniture sector. The online turnover of these sectors is however still low in absolute terms and in proportion to the other sectors. The publishing sector confirms the expected growth thanks to demand for digital and online services such as Spotify, Netflix, Infinity and products such as software and apps.

Distribution of eCommerce Turnover

Legal Regulations, Customs & VAT

Italy is characterised by a complex regulatory environment lacking transparency, clarity and certainty. Legislation in Italy may be either passed by the Italian parliament or the government. Whereas a variety of institutions are responsible to supervise and enforce these regulations including the Digital Italy Agency, the Competition Authority, the Data Protection Authority, and the Communications Regulatory Authority.

According to the Article 5 of the Consumer Code information that is intended for consumers and users must be given in Italian. Furthermore, consumer information must be appropriate to the means of communication used and expressed in a clear and understandable manner such as to assure consumer awareness.

The New Consumer Code offers a number of changes which should result in increased of consumers with regard to the total cost and any extra fees of products/services, more information duties for the traders, banning of pre-ticked boxes on websites, withdrawal delay extended to 14 days, elimination of surcharges for using credit cards and telephone lines, and protection of the consumer for digital products.

Since the completion of the internal market, goods can freely circulate between Member States of the European Union. Therefore, the "Common Customs Tariff" (CCT) applies to the imports of goods across the external borders of the EU. As such, the tariff is common to all EU members, but the rates of duty differ from one kind of import to another depending on what they are and where they come from. Where a tariff is the name given to the combination of nomenclature (classification of goods) and the duty rates which apply to each class of goods. In addition the tariff contains all other community legislation that has an effect on the level of customs duty payable on a particular product, for example the country of origin.

Online sales (that is, supplies of goods and services by electronic means) made by a foreign company to Italian customers are subject to VAT in Italy. In an effort to identify whether or not companies supplying goods and services in Italy are subject to VAT, it is necessary to distinguish between direct- and indirect eCommerce as well as B2B and B2C eCommerce.

Distribution

Italian consumers have grown used to a fairly slow and at times unreliable domestic postal service, though the increase of eCommerce is raising demands and expectations on speed and quality of service. While the range of delivery options available to online shoppers is expanding, with lockers and collection/return points rolling out across major cities in the past two years, these are still in their infancy, and 90% of online purchases (including digital products) are delivered to an address supplied by the shopper, typically their home.

The efficiency of logistics is increasingly becoming a strategic asset. Where the most important considerations for Italian shoppers are:

- Delivery costs.

- Ability to choose delivery location.

- Knowing the delivery day and time at the time of purchase.

Also, for over 70% of online Italian shoppers an easy return solution is a key decision factor in their buying decision. And another 66% will read the return policy before the actual purchase. Thus, merchants can drive sales and conversion by employing a solid returns policy. Strikingly, returns for online sales are only 5% for general goods, 15% for electronics, but over 40% for fashion

Mobile & Social Media

From 2015 onwards, mobile commerce has asserted its importance as well as weight in terms of sales channel and traffic generator to the Italian market. In early 2016, Italy has more than 22 million active users a month who connect through mobile devices, which is around 50% of the active online population.

In 2016 Italian merchants generated a turnover on the mobile channel of on average 26% of the total turnover of online sales, which is up from 5% and 13% since 2013 and 2014 respectively. The Growth opportunities resulting from mobile commerce are greater than ever before. Where global level eCommerce represents 37% of transactions and is estimated that mobile commerce will account for 45% of total commerce turnover by 2020. Globally this will equal to 284 billion USD, triple the value compared to 2016.

In order to increase sales from mobile commerce, the following activities are considered to be of priority by Italian ecommerce companies, namely: the development of the mobile version of the site (33%); the development of the smartphone app (19%), and the app for tablet (6%). These are followed by the activities such as advertising and promotion on mobile devices (3%).

Facebook is yet again the social media deemed most effective by Italian eCommerce companies. Where 72% consider it very effective. Surprisingly, Instagram has grabbed a second place with 37% considering it highly effective, surpassing Youtube which receives a rating of 32%.