China’s Health Supplement market, projected to exceed US $61 billion by 2028, offers foreign brands a compelling growth opportunity. However, successfully entering this lucrative space requires more than a high-quality product. Foreign health supplement brands must navigate a complex regulatory environment, understand evolving consumer preferences, and adopt effective market strategies to thrive in a highly competitive landscape.

TMO has over 7 years of experience offering Health and Beauty-tailored strategies for China entry and eCommerce growth.

From determining whether to establish a local legal entity, choosing an appropriate market entry model, managing logistics requirements, and identifying the most impactful sales channels—each decision carries weight in the success of your market expansion. This guide will explore the main considerations according to China's regulatory framework for the sale of health supplement products.

Roadmap for China Market Entry: What are your options?

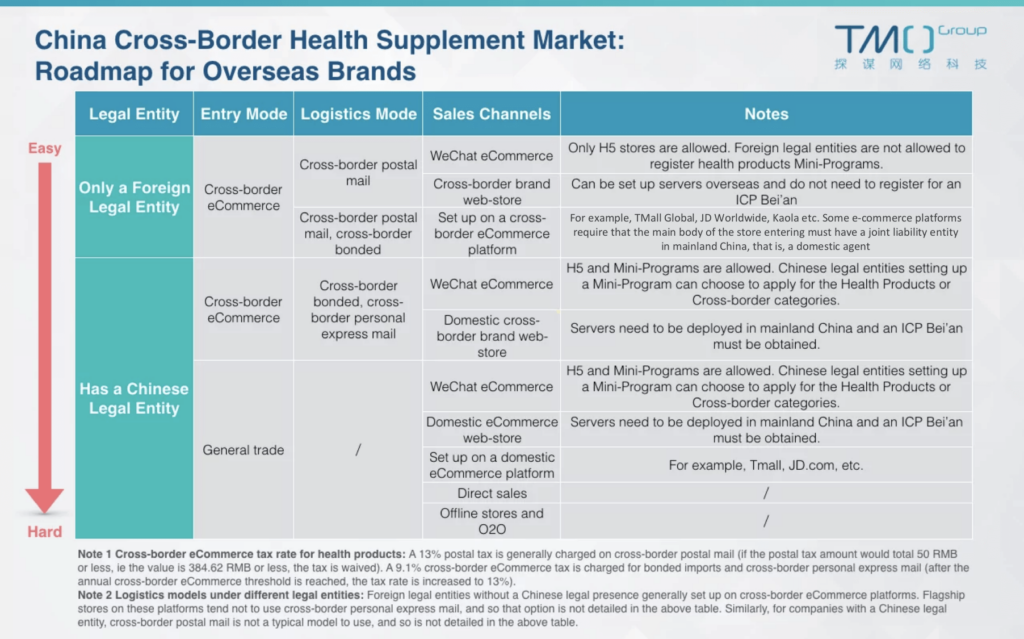

The decision to establish a legal entity in China is one of the most critical factors shaping the market entry strategies for foreign health supplement brands. This foundational choice will determine the available options for operating within China's regulatory framework, influencing everything from logistics models to sales channels and compliance obligations. As outlined in the roadmap shown above, market entry paths can range from easier cross-border eCommerce solutions to more complex alternatives that require a Chinese legal entity, each offering distinct opportunities and challenges. The 4 fundamental aspects to consider are:

- Legal Entity: Establishing a Chinese legal entity versus maintaining only a foreign legal presence.

- Entry Model: Selling via Cross-border eCommerce or a General Trade model.

- Logistics: How does your choice of logistics impact efficiency, taxes, and duties.

- Sales Channels: How can you build a robust ecosystem to remain competitive.

By assessing these 4 variables, foreign health supplement brands can gather the insights needed to choose the most effective strategy for entering and thriving in China’s dynamic market according to their investment and operational capabilities. In short, we can identify three main strategies for entering the Chinese market:

- Operating as a foreign entity through Cross-border eCommerce (CBEC)

- Establishing a Chinese legal entity and entering via either Cross-border eCommerce

- Establishing a Chinese legal entity and selling via General Trade.

Option 1: CBEC Sales as a Foreign Legal Entity

Foreign health supplement brands can leverage cross-border eCommerce (CBEC) channels to access the Chinese market without the need to establish a domestic Chinese counterpart or subsidiary. This way, international brands to directly sell to Chinese consumers while bypassing some of the complex regulatory requirements associated with general trade.

For an in-depth look at the current market, trends, and successful entry case studies, check out our China Health & Food Supplements Industry ReportThis report takes a broad view of the market for health supplements in China, and how an overseas brand can seize the many opportunities it presents.China Health & Food Supplements Industry Report.

This option offers a relatively easy entry path into the Chinese health supplement market, allowing brands to test market demand, establish a presence, and optimize their operations while adhering to essential compliance standards. Advantages of the CBEC Model include:

- Lower Barriers to Entry: Selling via CBEC offers a streamlined entry process compared to traditional trade. Companies can introduce their products without the time-consuming and costly requirements of setting up a local entity or completing full regulatory registrations, such as the "Blue Hat" certification for health supplements.

- Preferential Tax Treatment: Products sold through CBEC platforms benefit from lower tax rates. Typically, a 9.1% cross-border eCommerce tax applies, and a 13% postal tax may be levied on specific transactions, depending on volume and value thresholds.

- Established Platforms: Leading eCommerce platforms such as Tmall Global, JD Worldwide, and Kaola provide robust infrastructure, logistics, and compliance support for foreign brands. These platforms also offer extensive consumer reach, fostering brand trust and engagement.

Key Sales Channels:

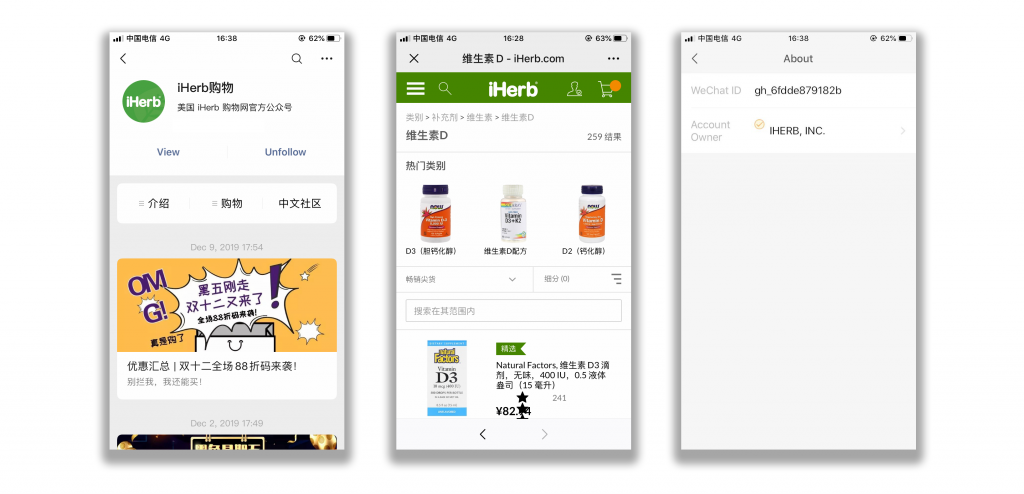

a) Reach Chinese audiences faster through a WeChat H5 Store

When it comes to WeChat, the "super app" now allows foreign companies with no Chinese legal entity to register public accounts and run H5 stores, which is a great way for new entrants to tap into this booming market and its social ecosystem. However, for now, such companies are not allowed to open a WeChat Mini-Program store in the Health Product category.

For an overview of the platform's options for eCommerce and a comparison of H5 and Mini-programs, read our WeChat eCommerce: Is your brand making the most out of it?From H5 Store & Mini-programs, to Service and Subscription Accounts, this is everything you need to know about WeChat's tools for eCommerce.Intro to Accounts and Store Types on WeChat.

b) Test the Market using an Overseas Self-operated CBEC Store

An online store that is hosted overseas, localized into the Chinese language, and enabled with features for Cross-border eCommerce, might offer the best time-to-market and a lower investment.

However, as much as it is a great way to test the market and gain initial traction, this is hardly a valid long-term strategy. Slower loading speeds, not being China SEO-friendly, and the barriers to consumer trust all difficult operating across borders as consumers have so many fast, convenient, and trustworthy options at home.

c) Expand your Reach through Third-party CBEC Marketplaces

An additional strategy you can leverage is setting up a flagship store in the Top 5 Chinese Cross-Border eCommerce Platforms (Updated 2024)Selling in China from Overseas? These 5 marketplaces are a must for growing your cross-border eCommerce operation as a foreign brand.most popular Cross-border eCommerce platforms such as How to Sell in China Online with Tmall Global Cross-Border (2025)Tmall Global is one of the central channels to enter Cross Border eCommerce in China. Here are the main things you need to know to start.Tmall Global and An Alternative to Tmall: How to Sell on JD.com (2025 Update)Entry guide for Jingdong, one of China's largest online third-party marketplaces—overview, store types, requirements, process, and fees.JD Worldwide, for which we've previously written detailed articles in our blog.

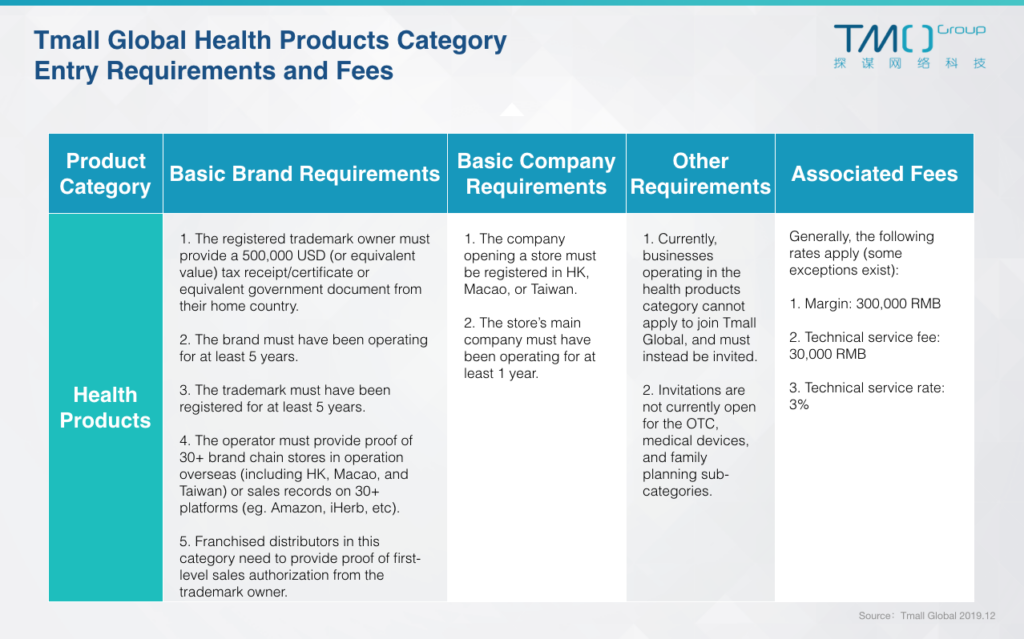

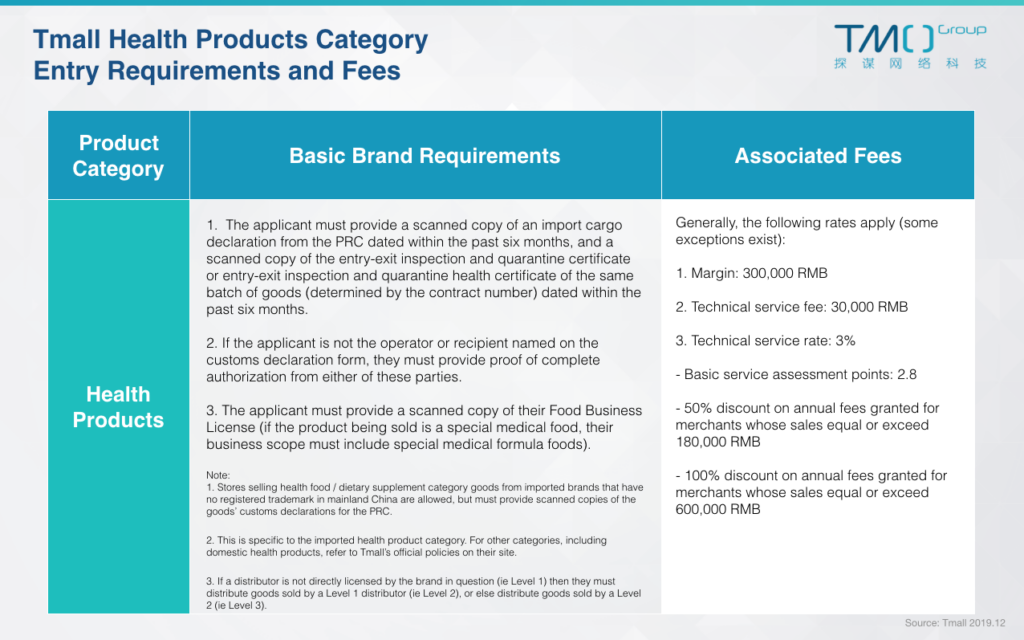

Specifically for brands selling in the Health Products category, restrictions and conditions for Cross-border eCommerce are stricter. Let's take Tmall Global as an example, an look at the criteria companies hoping to sell in this category must meet.

2024 Update: Until 2019, Tmall Global used an invite-only system for healthcare products, which meant brands could not apply on their own to set up shop. Currently, the process is generally open for direct application but will vary according to various factors such as:

- The Brand's Business Model

- Store Type and eCommerce Model

- Brand Type: Single or Multi-brand Group

- Product Sub-category

Tmall Global Health Products Seller Requirements and Fees

Option 2: CBEC Sales with a Chinese Legal Entity

Establishing a local legal entity in China provides foreign health supplement brands with a wider range of options for selling cross-border and within the general trade framework. While this path involves greater initial investment and compliance requirements, it opens doors to more robust market strategies, logistics capabilities, and sales channels.

Brands with a Chinese legal entity have the flexibility to operate under two primary cross-border models, both subject to the 9.1% cross-border tax previously mentioned:

- Cross-Border Bonded Warehousing: Products are stored in bonded warehouses within China, reducing delivery times and allowing for efficient customs clearance. This model can significantly enhance the consumer experience by providing faster shipping and increased product availability.

- Cross-Border Direct Mail: This mode remains an option, although it is more common for smaller orders and direct-to-consumer fulfillment.

We wrote about the main differences, advantages, and disadvantages of each in our China CBEC: Bonded Warehouse vs Direct Shipping ModelsDifferences, benefits, and challenges of Direct Shipping & Bonded Zone logistics models for overseas brands doing cross-border eCommerce in China.Bonded Warehouse and Direct Shipping Model Comparison.

In this model, you need to pay special attention to the development of cross-border eCommerce functions such as customs interconnection, China's PIPL: Overview & Key Considerations for eCommerceKey aspects of PIPL and its impact on cross-border & domestic eCommerce, with insights for foreign brands navigating China’s data laws.identity and personal data management, cross-border logistics, cross-border tax rates, and threshold and limit calculation.

Key Sales Channels:

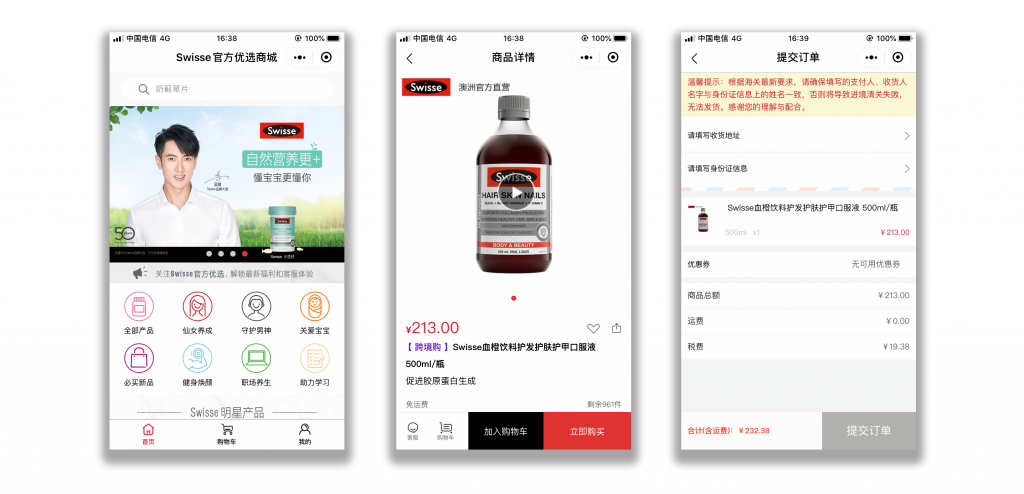

a) Leverage the WeChat Ecosystem with H5 Store or Mini-programs

Apart from the H5 store format mentioned above, brands with a local legal entity can also set up Mini-Programs on WeChat, which are not available to foreign-only legal entities. This provides direct access to Chinese consumers via social commerce, allowing for personalized marketing, promotions, and seamless shopping experiences.

You might be interested in reading WeChat Mini-Programs: 4 Successful Cases from Foreign BrandsRead how Lululemon, Starbucks, and other overseas brands leverage private traffic through WeChat's social commerce functions.4 Successful Cases from Foreign Brands using WeChat Mini-programs.

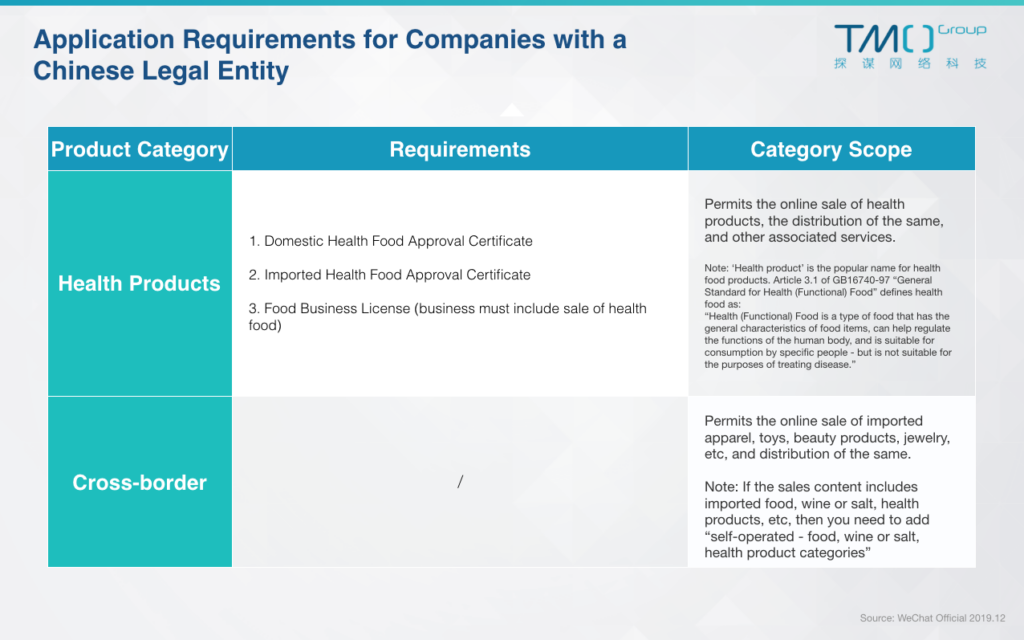

When applying to set up a WeChat Mini-Program, companies with a Chinese legal entity have two main choices: To operate in the Health Product category or the Cross-border Sales category.

b) Self-operated eCommerce with local Hosting

This option involves creating your own Chinese website and adding cross-border eCommerce functionality. In addition, you will need to apply for China ICP Registration Guide: Types, Requirements, & FAQs (2025)Any website or app operating in mainland China must secure an ICP (Internet Content Provider) registration. Read our overview on ICP Permits.ICP Bei'an registration for your site, use servers based in China, and pay close attention to China's Cyber Security Law and China's eCommerce Law to ensure your site is in full compliance.

Option 3: General Trade through a Chinese Legal Entity

Engaging in general trade through a Chinese legal entity offers health supplement brands a comprehensive route to market entry, allowing for broader distribution and visibility. However, it also entails strict regulatory compliance and adherence to Chinese standards for imported goods, including health and safety measures.

While cross-border eCommerce channels have traditionally focused on purchases intended for personal use, general trade opens up opportunities for larger-scale distribution and direct access to domestic eCommerce platforms and offline retail channels. Brands should be prepared to navigate stringent regulatory procedures to ensure their products meet Chinese standards and regulations, even if they have already undergone rigorous testing and quarantine procedures in their country of origin.

TMO's China Digital Compliance Services ensure your eCommerce operation in China is fully compliant with the latest regulations according to your industry and business model.

Key Regulatory Steps for General Trade Entry Include:

- 'Blue Hat' Registration or Filing for Health Food Products: Health supplements marketed for specific health functions must obtain 'Blue Hat' certification from China’s State Administration for Market Regulation (SAMR). This process ensures that products meet safety, efficacy, and labeling requirements.

- Customs Declaration and Inspection: All imported goods must undergo a customs declaration and inspection process to verify compliance with China’s import regulations, ensuring that the products are safe, properly labeled, and meet all necessary health standards.

- Sales Compliance: Once cleared, brands must comply with various sales regulations, including proper labeling, accurate health claims, and adherence to advertising laws.

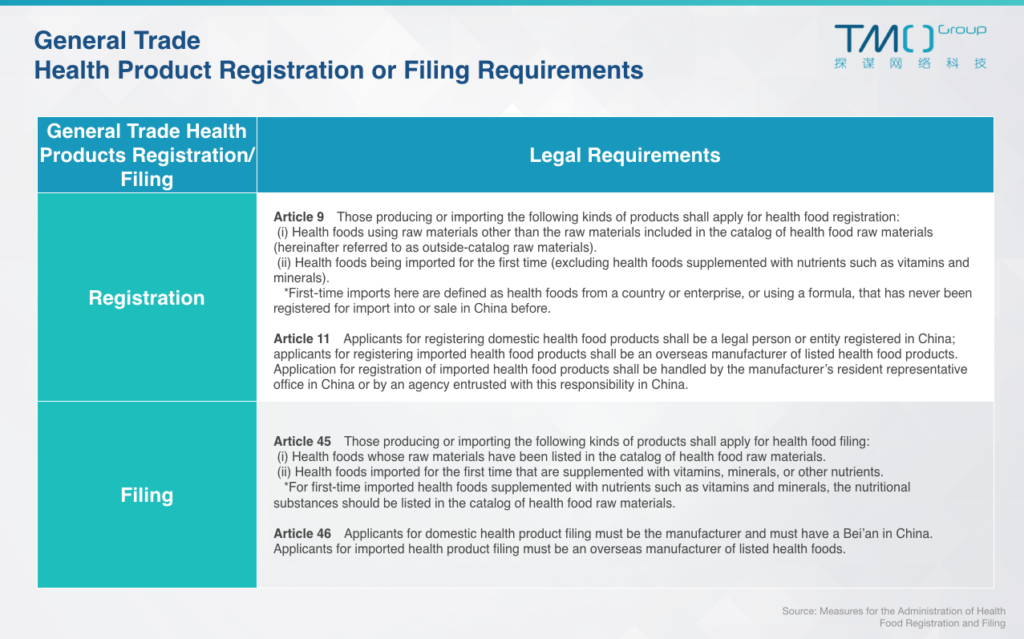

Additional Regulatory Framework: The Administrative Measures for the Registration and Filing of Health Food, implemented on July 16, 2016, introduced important provisions governing the sale and registration of both domestic and imported health products. These measures detail requirements for product safety testing, efficacy validation, and the documentation needed to legally market health supplements in China.

General import trade registration/filing requirements

Key Sales Channels:

a) WeChat H5 or Mini-program eCommerce options

Operating through a Chinese legal entity enables you to set up an H5 store or a Mini-Program store on WeChat, as mentioned above. The rules and requirements for setting one up are also the same as explained above, and so are not repeated here.

Looking for inspiration? Read 3 WeChat Loyalty Program lessons from top eCommerce brandsWe explore key eCommerce features from Loyalty Programs in the WeChat mini-program ecosystem & how top brands use them to drive sales.3 WeChat Loyalty Program lessons from top eCommerce brands.

b) Self-operated Domestic eCommerce

Creating your own Chinese eCommerce web-store is a simpler option when operating via general import trade. This is because you don't need to set up cross-border functionality. However, as noted above, you will still need to apply for ICP Bei'an registration for your site, use servers based in China, and pay close attention to China's Cyber Security Law and China's eCommerce Law to ensure your site is in full compliance.

c) Joining a Domestic Marketplace

Setting up a storefront on a domestic eCommerce platform is relatively simple for those operating locally. The costs on the more Top 15 eCommerce Platforms in China (2025)Selling online in China? We reviewed the largest online marketplaces that you must consider for a successful multi-channel eCommerce strategy.popular platforms (such as Tmall or JD.com) can be fairly high. Therefore while the potential rewards are considerable, this is not a market entry path we recommend. Below we show the requirements and criteria that must be met to set up on Tmall, as a representative example.

Requirements for setting up a storefront to sell health products on Tmall

d) Using a Direct Sales model

Direct sales for health products in China regained legal status with the 2005 Regulations on the Administration of Direct Marketing, but strict licensing and compliance standards apply. Foreign applicants must demonstrate strong financials, extensive global direct sales experience, and meet high production and quality standards.

For a deeper dive into this topic, explore our related articles:

- Direct Sales in China in 2025: Market Overview, Top Companies, TrendsDirect Sales is a rich although peculiar market in China. In this post we will look at the Direct Sales regulatory landscape, key players (international and local), and examine challenges and trends.Direct Sales in China in 2024: Market Overview, Top Companies, Trends

- Direct Selling in China: Multi-Level Marketing, But Not As You Know ItTraditional MLMs had to adapt their businesses to China's strict requirements on direct selling models, and now the business looks very different.Direct Selling in China: Multi-Level Marketing, But Not As You Know It

- Digitalization, Retailization, and Multi-channel Trends in China Direct Selling IndustryDiscover success cases and key measures as valuable references for overseas brands amidst the trend of digitization, retailization, and multi-channel sales in China's direct selling industry.Digitalization, Retailization, and Multi-channel Trends in China Direct Selling Industry

e) Offline Stores and O2O

Some brands also choose to open offline stores when they feel the time is right. Then they link their online and offline businesses through O2O strategies.

FAQs: Registration and Sales of Health Supplements in China

1. Is 'Blue Hat' registration required for Cross-border sales of health products?

If you don't promote your products' health benefits, you don't have to go through Blue Hat registration for these products. At present, most foreign health product manufacturers do not apply for Blue Hat registration. Generally, they sell their products as general food products through the cross-border eCommerce channel. Additionally, they only choose to emphasize the health benefits of specific ingredients or the like.

2. Are there any restrictions on advertising health products in China?

Yes, strict regulations govern advertising for health products. Claims must be truthful, scientifically substantiated, and approved by relevant authorities. Misleading or unauthorized health claims can lead to penalties. A summary of the compliance requirements for health products form China's Advertising Law of 2015 can be found below:

Restrictions on advertising health products under Chinese law

3. What are the key considerations for product labeling and packaging?

Products must comply with labeling requirements as per the Chinese National Food Safety Standards (GB Standards) and State Administration for Market Regulation (SAMR) guidelines., including ingredient lists, nutritional content, and any approved health claims. Labels must be in Chinese and adhere to local guidelines for size, placement, and language.

4. Are there any special considerations for ingredient approval in health supplements?

Certain ingredients, especially those derived from plants or animals, may require additional approvals or bilateral agreements before being imported and sold in China.

Implementing a Successful Entry Strategy for Health Products with TMO

Successfully entering China’s health supplement market requires careful planning, strategic decision-making, and a deep understanding of local regulations. Whether operating through cross-border eCommerce channels as a foreign entity or establishing a local presence, each pathway comes with its unique challenges and opportunities. By navigating regulatory compliance, optimizing logistics, and choosing the right sales channels, foreign brands can build a strong foothold and tap into China’s growing demand for health and wellness products.

TMO has successfully helped many well-known healthcare brands enter the Chinese market. We have also digitally empowered eCommerce development, mobile service development, and even direct sales and cross-border eCommerce businesses. Whether you are looking to enter the market or develop your existing presence, contact us now to receive a customized proposal to your needs.