Today, the China market is open—perhaps more than ever—to foreign brands wanting to sell cross-border. Overseas shopping, especially cross-border eCommerce, is developing well. The recovery after the epidemic has greatly boosted consumer confidence and consumption upgrades have also promoted the growth of cross-border eCommerce users and consumer demand for overseas shopping.

Assessing a China Market Entry? TMO specializes in China CBEC Solutions to help foreign brands establish a legal presence and develop winning go-to-market strategies.

Overview of China's Cross-border eCommerce Market

According to a spokesman for China’s General Administration of Customs, preliminary estimates place China's cross-border e-commerce trade at RMB 2.38 trillion for 2023, an increase of 15.6%, with exports amounting to RMB 1.83 trillion (up 19.6%) and imports being RMB 548.3 billion, a 3.9% increase.

International brands continue to accelerate their deployment in China's cross-border market. So for brands, how to choose a cross-border e-commerce platform now, and which platforms have more advantages?

For an overview of the two main CBEC Logistics Models and its advantages, check out our blog: China CBEC: Bonded Warehouse vs Direct Shipping ModelsDifferences, benefits, and challenges of Direct Shipping & Bonded Zone logistics models for overseas brands doing cross-border eCommerce in China.China Cross-border eCommerce: Bonded Warehouse vs Direct Mail Model

According to iiMedia data, the share of independent brand websites (eCommerce websites operated independently) doubled from 10% in 2016 to 20% in 2020. At the end of 2021, iMedia showed that the number of independent websites of Chinese companies in the overseas e-commerce market exceded 200,000, with the share increasing from 9.8% in 2016 to 25.6% in 2021, and expecting it to reach 50% in 2025.

With the focus on private domain traffic and data, we can expect the share of brand e-commerce outside the major platforms to grow further. This is not surprising, as independently operated stores have many advantages—special operating models like automatic renewal, flexible functionality and e-commerce policies, and full access to customer data. This is especially attractive for brands with private domain traffic.

Having said that, 80% of the market is still occupied by eCommerce platforms, and they remain the main platforms for foreign brands to sell their goods, providing a particularly competitive way for international brands to sell in China.

So how should brands choose between the many different platforms that cater to cross-border selling in China? To answer that, we list the top 5 Chinese cross-border eCommerce platforms in 2024.

1. Tmall Global

Market share: 37.6%

Website: www.tmall.hk

Information for new sellers: Tmall Global Merchant Recruitment

Opened in 2014, Tmall Global is the largest cross-border marketplace for foreign brands. It is operated by Chinese eCommerce giant Alibaba - the company behind such platforms as Taobao, Lazada, and the Chinese national version of TMall.

Unlike TMall, Tmall Global is not open to purely domestic mainland companies (the platform only cooperates with overseas companies that have a physical presence abroad). They must have an overseas registered trademark, and —as TMall puts it— “a stellar reputation and business standing abroad”.

This way, Tmall Global positions itself as a platform for the world’s top brands selling high-quality goods. The platform aims to cater to China’s high-end consumers, satiate their increasing demands for top-level items, and harness their high spending power.

Customers, who are mostly middle-class young women (up to 35 y.o.), living in large cities, know what they’re getting on Tmall Global: direct access to premium foreign brands and their catalogs.

For more information on how to enter China’s market through Tmall, you can check out ourHow to Sell in China Online with Tmall Global Cross-Border (2025)Tmall Global is one of the central channels to enter Cross Border eCommerce in China. Here are the main things you need to know to start. Tmall Global Guide.

2. JD Worldwide

Market share: 18.7%

Website: www.jd.hk

Information about cooperation:JD Worldwide Cooperation

Never one to let Alibaba snap up an eCommerce space without competing for a slice for themselves, Tencent set up JD Worldwide to compete in the cross-border market. Launched in 2015, JD Worldwide has succeeded by leveraging the large existing user base of JD.com – the second-largest Chinese marketplace.

JD Worldwide features almost 10 million SKUs from nearly 20,000 brands. Product categories run the gamut from nutrition and healthcare to home appliances and car-related items.

JD Worldwide is divided into multiple national and regional ‘pavilions’. The global cross-border eCommerce platform currently has a strong export focus. To facilitate this approach, it has established presences in Russia and Indonesia to support export merchants there.

For more information on how to enter China’s market through JD Global, you can check out ourAn Alternative to Tmall: How to Sell on JD.com (2025 Update)Entry guide for Jingdong, one of China's largest online third-party marketplaces—overview, store types, requirements, process, and fees. JD Guide.

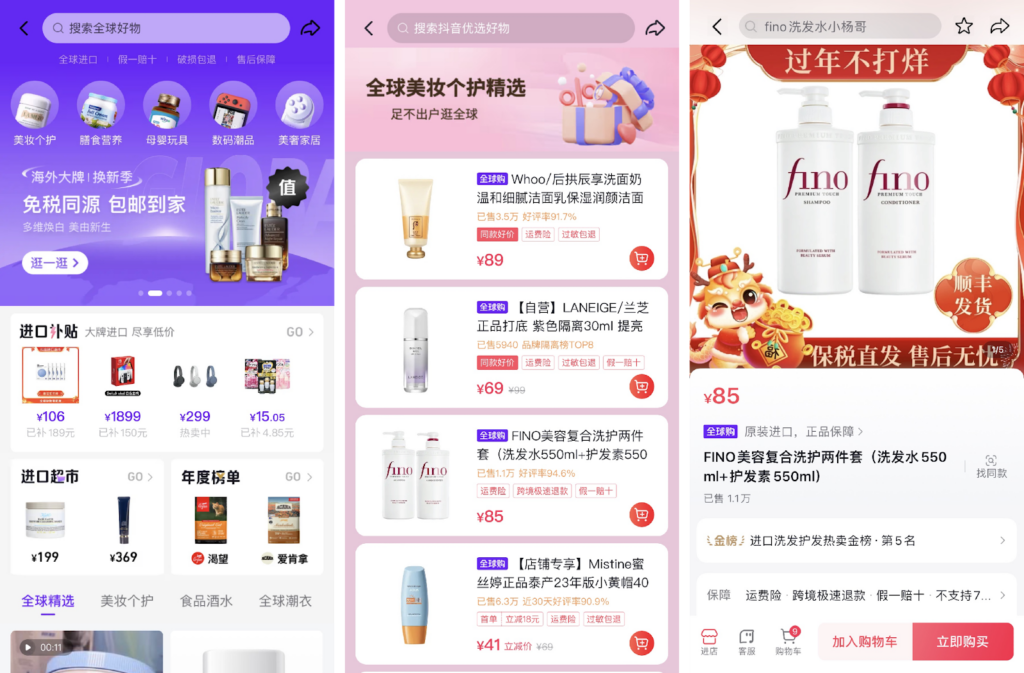

3. Douyin Global Shopping

Market share: 12.3%

Website: www.douyin.com (Global Shopping available on mobile)

Douyin Global Shopping is a new platform on the ranking this year. Since its launch in 2021, Douyin's global shopping users have continued to increase, sales have maintained rapid growth, and it has rapidly developed into a core platform for domestic purchases of cross-border consumer goods.

The large number of users also allows overseas brands to see the development potential of the platform. In recent years, the number of overseas brands entering the Douyin e-commerce global shopping platform has grown rapidly, and the five core categories have achieved growth on the Douyin e-commerce global shopping platform.

Douyin E-commerce Global Shopping provides overseas brands with a one-stop brand growth plan for entering China from "planting" to "purchasing". It is committed to providing Chinese consumers with all kinds of good products at good prices around the world. It is China's one-stop cross-border Imported B2C e-commerce platform.

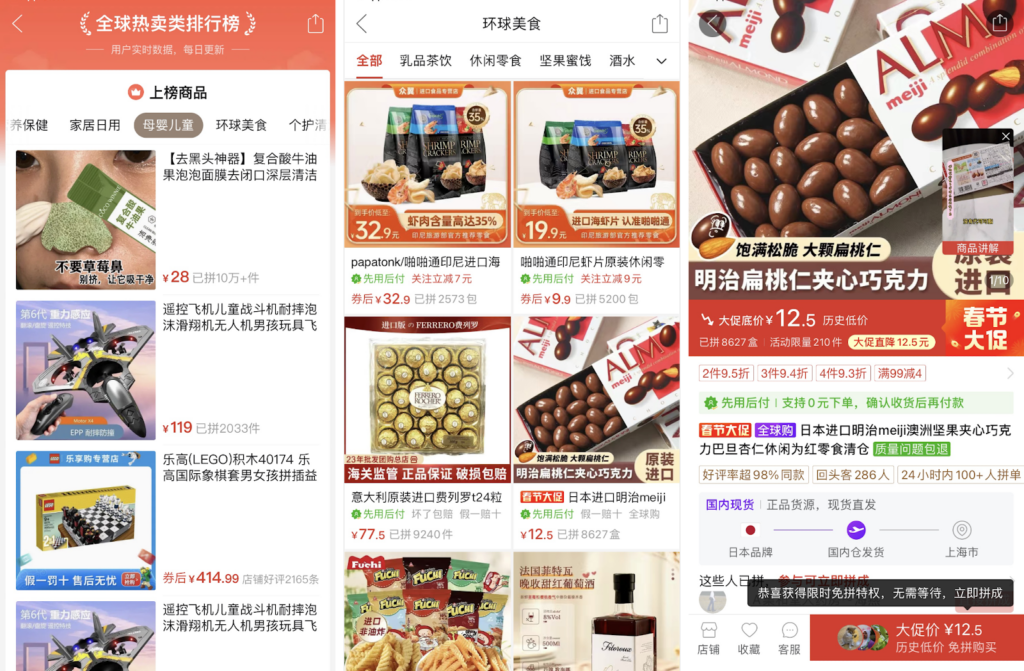

4. Pinduoduo Global Shopping

Market share: 5.9%

Website: www.pinduoduo.com (Global Shopping available on mobile)

Pinduoduo Global Shopping is your new platform this year. Pinduoduo launched Global Shopping in April 2019. As a globalization strategy of the Pinduoduo platform, it aims to bring users more choices of high-quality products from all over the world. For overseas merchants, entering Pinduoduo Global Shopping is not only an opportunity to expand the market, but also a window to connect to China’s huge consumer market.

Currently, Pinduoduo’s global shopping business covers nearly 200 bonded warehouses in 80 customs zones across the country. According to reports, in Pinduoduo’s global shopping business, 21 of the top 100 brands have achieved year-on-year growth of more than 300%, and 59 single products have sold more than one million yuan in a single day, driving international brands and products on the site. Continued hot sales, Michael Kors light luxury luggage increased by more than 200% year-on-year, Royal Mercure increased by 480% year-on-year, Essilor increased by 543% year-on-year, Zeiss increased by 220% year-on-year, Dyson official flag and overall sales increased year-on-year 200%.

5. VIP International

Market share: 4.1%

Website: www.vip.com

Information for sellers: VIP International

VIP Shop is China’s third biggest B2C marketplace and leading flash-sale eCommerce platform, and this sales model largely carries over to its cross-border branch.

Launched in 2014, VIP International ensures 100% authenticity for products sold on the platform. Similar to the way Kaola operated in the first years, VIP International is also self-operated, it uses direct overseas procurement alongside its own wing of delivery partners. Because of this, it is able to deliver some goods from its urban warehouses within 12 hours.

Lately, however, there are signs that cross-border eCommerce is losing its high-priority position for VIP Shop - the link to the international site is no longer featured on the main website.

* For more information on how to enter China’s market through JD Global, you can check out VIP International.

BONUS: Xiaohongshu

Xiaohongshu doesn't even have a proper desktop version - users are instructed to install the app.

Website: www.xiaohongshu.com

XiaoHongShu (literally “little red book”) was founded in 2013 as a product review platform. Following years of rapid growth in popularity, it is now transformed into what can be called a “Chinese Instagram”. Similar to Instagram, social posts are based on pictures or short videos, the majority of the user base is quite young (70% are below 30) and female (up to 80%).

An abundance of insightful customer-written product reviews earned XiaoHongShu a reputation as a reliable source of information for a variety of products. Early on, XiaoHongShu added eCommerce functionality to the platform, becoming one of the prominent domestic platforms. While it is still smaller than giants like TMall or JD, its very young audience and unique social-media-based model have a lot of potential (especially for fashion and luxury brands) that can be realized in upcoming years.

The international division of XiaoHongShu is called RED Mall and would also be a great place to sell for brands targeting younger, dynamic audiences.

* For more information on Xiaohongshu’s rise to prominence, you can check out our article Revealing the Strategy Behind Chinese Social Commerce App XiaohongshuHow can eCommerce companies use the Chinese app Xiaohongshu for their business? What is the best strategy? Read on to learn the answers!here.

Designing a Winning CBEC Strategy with TMO

The above five are the most successful Chinese cross-border eCommerce platforms as of 2023. These all represent exciting opportunities for companies wishing to sell their goods cross-border to China.

However, going back to what we started this article with, with the popularity of such platforms, it’s also very possible for your products to get lost among the huge variety of available goods. For companies wanting a bit more control over product presentation, promotion, and performance, a tantalizing option can be to set up one’s own specialized platform. This does mean a lot more of your own research, preparation, development, and operations – but it will pay off in the end through greater visibility, flexibility, and overall control of your operations.

TMO Group has considerable experience and expertise in this area and has successfully guided multiple major brands to cross-border eCommerce success in China. If you’re interested in seeing what TMO can do for you and your brand, check out our China Cross-border eCommerce Solutions page or get in touch with us!

*Updated in February 2024, the above ranking data comes from the "China Cross-border Import Retail E-commerce Market Quarterly Monitoring Report" released by Econometrics at the end of 2023. The market share is the cross-border import retail eCommerce market transaction share.