At an estimated US $15B in sales, China is one of the largest direct-selling markets in the World, only behind the United States ($36.7B), Germany ($19.76B), and Korea ($16.3B). While the local market still grew at a 4.82% CAGR in 2024, the industry as a whole is still in a tough period due to the strict control on direct selling practices, with 88 firms holding direct selling licenses. Recently, Sanzhu Fuer Pharmaceutical, which once set a record for 8 billion yuan (US $1.1B) sales in China, announced the cancellation of its Direct Selling License and withdrawal from the market.

We've previously discussed Direct Selling in China: Multi-Level Marketing, But Not As You Know ItTraditional MLMs had to adapt their businesses to China's strict requirements on direct selling models, and now the business looks very different.how global companies had to adapt their businesses to China's restriction on multi-level-marketing (MLM).

While Direct Selling in China: 6 Positive Signals for 2025 Regulation ChangesBased on 2 key government gatherings that took place this year, we cover 6 welcoming changes for the direct selling industry in China.the latest developments signal favorable policy changes for direct selling in China, the harsh domestic regulatory environment has forced many firms to expand into overseas markets in recent years. However, faced with challenges such as differences in overseas market regulations, consumer behavior habits, and payment and logistics systems, how to formulate effective overseas market expansion strategies has become the key to a company's success.

In this article, we will go over successful overseas expansion cases from top Chinese direct-selling firms, and draw 3 important lessons to take for brands aiming to breakthrough in the global market.

TMO has 10+ years experience designing and implementing fully compliant cross-border and multichannel eCommerce strategies for overseas direct selling brands.

1. Overseas Direct Selling Markets: Overview and Opportunities

According to the World Federation of Direct Selling Associations (WFDSA), worldwide retail sales for the direct selling industry reached US $167.6B in 2023, with emerging markets such as Southeast Asia and Latin America developing rapidly.

In addition, Direct Selling penetration—that is, sales volume in proportion to the countries' GDP—is the highest in the aforementioned regions, with Malaysia, Korea, Peru, Bolivia, Ecuador, Colombia, Taiwan, Germany, Thailand, and Mexico making up the top 10 list.

The Asia-Pacific region, which overall is experiencing fast development, has some of the countries with the highest 3-year direct selling market CAGR, with Malaysia and India showing an impressive 8.1% and 8.4% growth respectively.

We previously covered how Digitalization, Retailization, and Multi-channel Trends in China Direct Selling IndustryDiscover success cases and key measures as valuable references for overseas brands amidst the trend of digitization, retailization, and multi-channel sales in China's direct selling industry.Digitalization, Retailization, and Multichannel are reshaping China's Direct Selling industry with new approaches and sales models.

The above data goes to show that, while all in all Direct Selling experienced a small contraction worldwide, the industry opportunities, especially in emerging markets, are still plenty. And seems like some Chinese firms—thanks to their rich product resources, strong supply chain advantages, and mature social marketing models—are already taking note of these potential markets. However, they still face many challenges in their development of overseas markets, including legal compliance, brand recognition, and sales model adaptation. So, how have top brands like Infinitus and Tiens had a breakthrough in new markets? Let's take a look!

2. Successful Market Expansions from Direct Selling Companies

Infinitus: Build Brand Trust through Endorsement and build "Health" as a concept

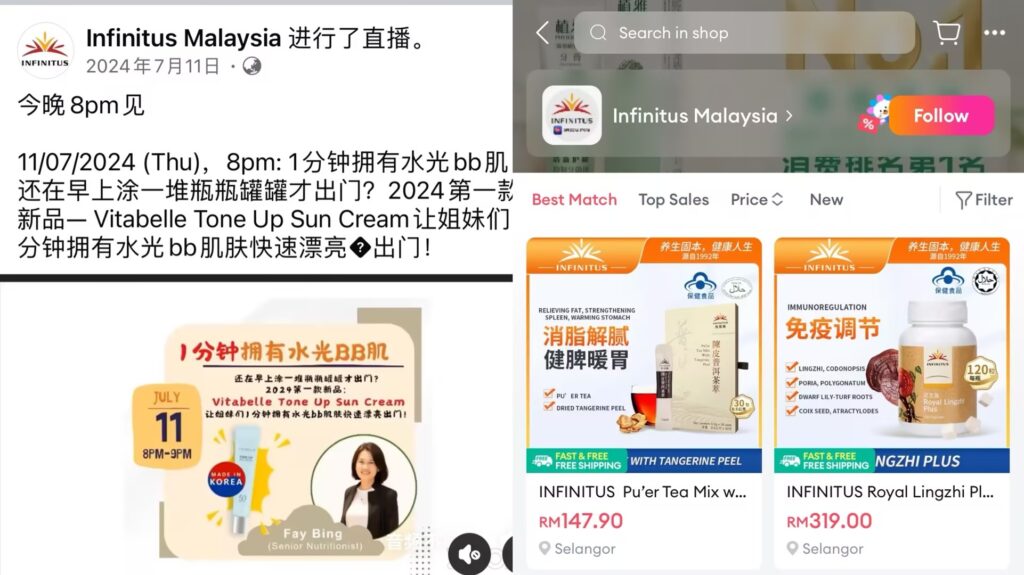

According to MLM industry research firm BFH, Infinitus ranked fifth worldwide in revenue for 2023, according to data on The 500+ Largest Direct Sales Companies In The World 2024, with annual sales reaching US $3.5B. As China's leading direct selling company for health products, Infinitus adopted a strategy of endorsement to build brand trust endorsement, as well as focus on marketing the concept of health when entering overseas markets, achieving remarkable results in the North American and Southeast Asian markets.

Similarly, when Infinitus had just entered the Canadian market, it found that Canadian consumers were extremely concerned about the safety and scientific basis of health products. Therefore, by cooperating with well-known local laboratories and universities to conduct authoritative research and obtain relevant certifications, such as the Canadian Health Department registration required for processing plants selling natural health products locally, which proves that Infinitus' product production and quality management level has met the requirements of Canada's natural health product GMP (Good Manufacture Practice), successfully shaping a professional and trustworthy brand image and improving consumer acceptance.

In the Southeast Asian market, especially in Malaysia and Thailand, Infinitus found that young consumers have a strong demand for natural and organic health products. Therefore, the brand strengthened the concept of "natural, healthy, and balanced health", launched health science short videos on social platforms such as Facebook, and invited well-known doctors, health consultants, and other KOLs to endorse. In addition, Infinitus also sells through local eCommerce platforms such as Lazada and Shopee, allowing consumers to purchase products more conveniently.

Social Commerce, hybridization, and a multichannel approach are essential for Health & Beauty eCommerce success. TMO can help you build a winning market entry strategy.

Tiens Group: Leveraging Social Commerce and a Strong Supply Chain Advantage

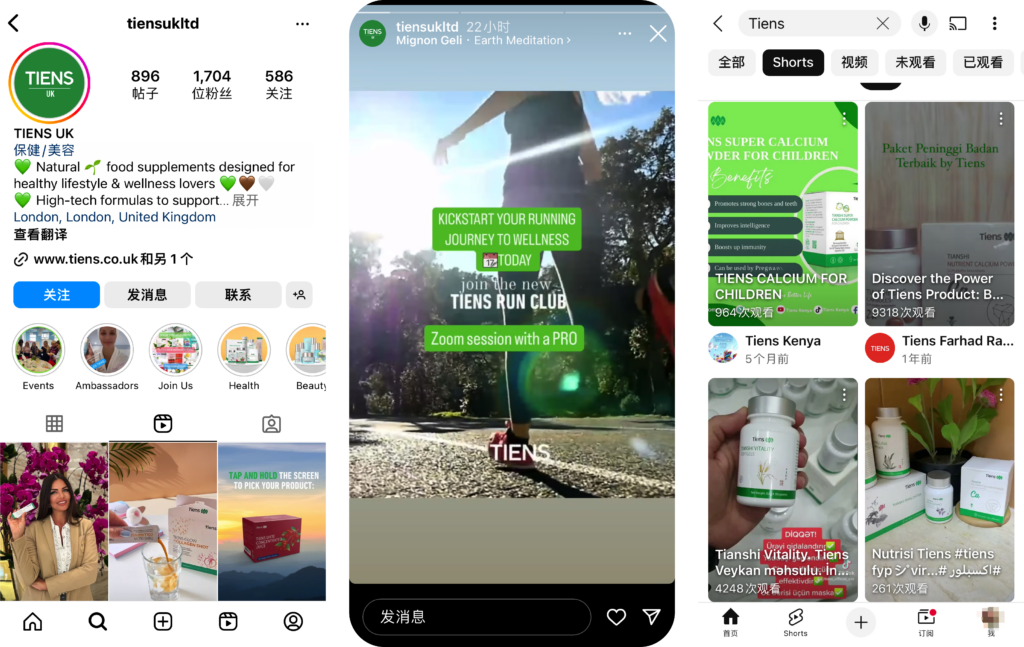

Tiens Group is another well-known direct-selling company from China, operating in more than 110 countries around the world, and it is said that Tiens' overseas markets currently account for more than 70% of its business. In January 2024, Tiens held a press conference on its 2024 global business development strategy and shared how the company has increased its investment in markets such as Southeast Asia and Europe, as well as having greatly improved its market competitiveness through social e-commerce and overseas warehouses and a local supply chain layout.

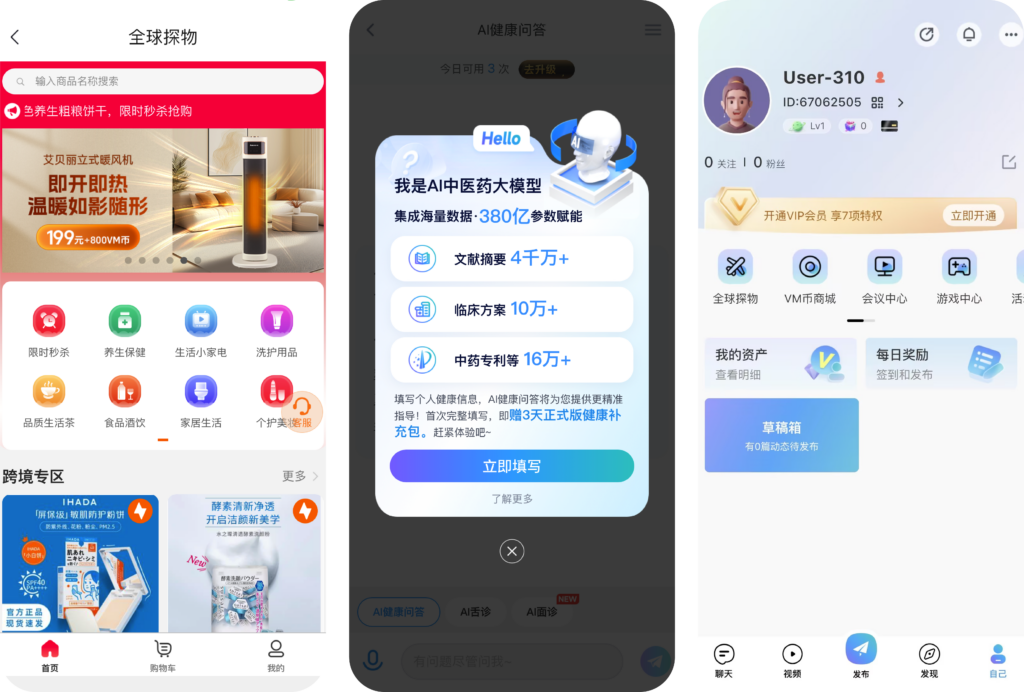

Tiens remains firmly committed to social commerce as a key piece of its global strategy. In early 2024, Tiens launched V-Moment, a global user-generated content (UGC) social platform in the field of health, with all-around, multi-functional, and multi-carrier functions, covering 224 countries and regions and supporting multiple languages.

Users can use the platform to conduct cross-border shopping, instant messaging, post updates, participate in interest group discussions, watch educational courses, attend global conferences, and use new features such as AI health Q&A.

In addition, Tiens closely follows the trend of social media and focuses on short video platforms such as TikTok, Instagram Reels, and YouTube Shorts. These platforms have a wide influence among Generation Z and Millennials and are suitable for attracting users through short video content, showing product features and usage scenarios through entertaining, educational, and interactive content, and stimulating user-generated content.

In Southeast Asia, especially in the Indonesian market, Tiens Group found that cross-border logistics take a long time and are costly, which seriously affects consumers' purchasing experience. To solve this problem, the company cooperated with local logistics companies to set up an overseas warehouse in Jakarta and introduced an intelligent inventory management system, using advanced technologies such as the Internet of Things (IoT) and machine learning (ML) to optimize inventory management and achieve localized distribution. In this way, consumers can receive products within 2-3 days after placing an order without having to wait for cross-border transportation, which greatly improves the shopping experience.

In the European market, Tiens Group found that European consumers pay more attention to the concept of "sustainable development". Therefore, the company adjusted the packaging materials, adopted a more environmentally friendly design, and emphasized the green and healthy concept of the brand in marketing. In addition, the company also set up a local customer service center in Germany, providing multilingual support to ensure that consumers can get timely after-sales service.

3. Key Lessons for Direct Selling expanding Overseas

Based on successful cases, if direct selling companies want to achieve breakthroughs in overseas markets, they must formulate a systematic growth strategy, including core elements such as localized operations, digital marketing, and supply chain optimization:

a) Localize Operations and Strategies that Build Brand Trust

When formulating a localized operation strategy, you must first understand local laws and regulations to ensure that the direct sales model is compliant. It is also very important to establish a local operation team and study consumer preferences, adjust products and marketing strategies accordingly, and cooperate with local authorities to obtain certification and endorsement to enhance consumer trust in product quality and safety.

b) Use Social Commerce to Amplify Brand Reach

In recent years, social e-commerce has become a new trend in expanding the market, especially attracting young consumers through professional social platforms and short video platforms (such as TikTok and Instagram), combining user-generated content (UGC) and influencer marketing to increase brand exposure and user interactivity.

c) Improve Competitive Advantages with efficient Supply Chain Systems and Channels

Optimizing the supply chain layout is also an important factor for success. Enterprises should build localized supply chains according to the characteristics of the local market, and improve logistics efficiency and consumer experience through overseas warehouses and smart inventory management. At the same time, they can also combine local third-party marketplace platforms (such as Amazon, Shopee, or Lazada) and DTC brand official websites to expand sales channels.

Accelerate your Overseas Expansion with TMO

The overseas market has huge opportunities, but the challenges that come with competing in a new market cannot be ignored, and MLM companies are no exception to this. As can be seen from these cases, even the world's largest firms are adapting their traditionally relationship-driven business model to one that leverages online channels and a D2C hybrid model.

At TMO, we specialize in creating compliant Cross-border eCommerce and social commerce models for overseas direct selling companies. We can help you plan the most suitable approach to introduce your brand and seize the market. Feel free to contact us to discuss a strategy that is tailored to your business and industry!