The health supplement industry in Asia is experiencing rapid growth, driven by a combination of increasing health consciousness, aging populations, and evolving consumer habits. Across the region, individuals are becoming more proactive in managing their well-being, leading to a surge in demand for dietary supplements, functional foods, and wellness products. This trend is especially pronounced in China, Japan, South Korea, and Southeast Asia, where digital commerce is playing an increasingly significant role in shaping purchasing behaviors, leading to many leading brands moving towards hybrid models that blend Direct Selling with eCommerce, live commerce, and social selling.

TMO Group specializes in helping brands explore and successfully enter the Asian markets via eCommerce. Read more about our Scale to Asia Solutions.

For foreign brands, this represents an immense opportunity. However, entering and succeeding in these markets is not as simple as launching a product and expecting immediate results. Each country has unique consumer preferences, regulatory landscapes, and competitive dynamics that brands must navigate to establish a strong foothold. So, what are the trends in Asia's biggest markets for Health Food and Dietary Supplement products?

This article is based on the "Growth opportunities in Asia’s Supplement marketThis free PDF looks at Asia's health supplements market opportunities, covering China, Japan, South Korea and Southeast Asia: market size, sales channel distribution including direct selling, top selling categories, hot products and much more.Growth opportunities in Asia’s Supplement market" Industry Report, which you can download for free to see the full analysis.

1. Asia Supplements Market Size: A $64B Blue Ocean

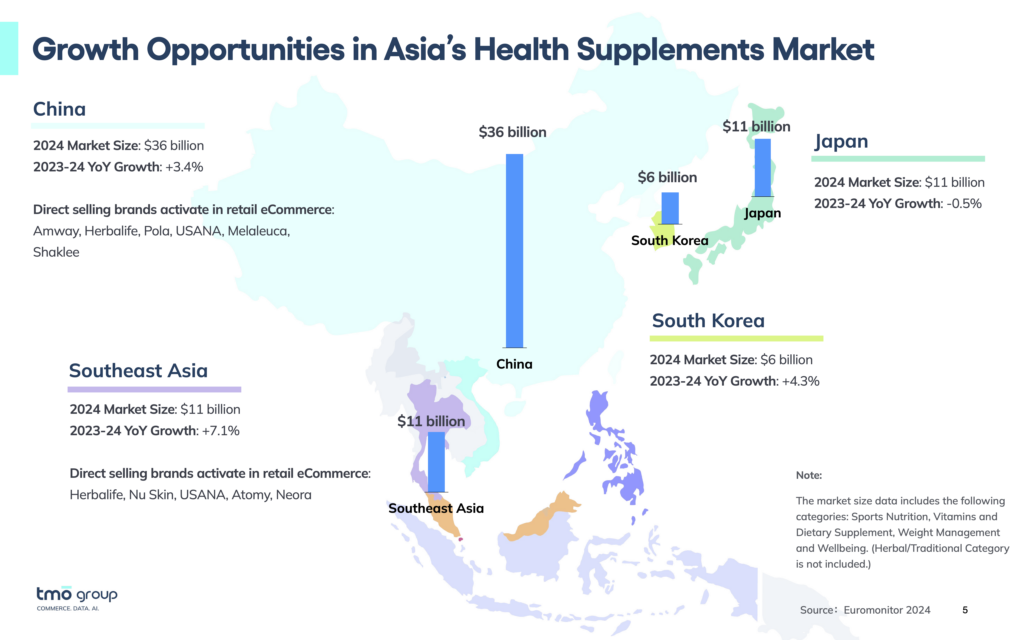

At a combined market size of US $64 billion out of which nearly 52% takes place online, the health supplement market in Asia's largest markets is vast and continuously expanding, presenting lucrative opportunities for foreign brands. With rising disposable incomes and a growing focus on preventative healthcare, consumers across China, Japan, South Korea, and Southeast Asia increasingly incorporate dietary supplements into their daily routines. However, the scale and nature of demand vary significantly across these markets, making it essential for brands to tailor their strategies based on regional dynamics.

Southeast Asia: The Fastest-Growing Market in the Region

While China and Japan dominate in market size, Southeast Asia is experiencing the highest growth rate, reaching US $11 billion in 2024 with 7.1% YoY growth. Countries like Thailand, Indonesia, Vietnam, Malaysia, the Philippines, and Singapore are seeing an explosion in supplement consumption, largely driven by eCommerce and social commerce.

One of the key factors fueling this growth is consumer affordability and accessibility. Unlike in Japan or China, where premium supplement brands hold significant market share, Southeast Asian consumers are highly price-sensitive and often look for affordable yet effective options. The widespread use of Shopee, Lazada, and TikTok Shop has enabled local and international brands to sell directly to consumers, bypassing traditional retail markups.

Growth opportunities in Asia’s Supplement marketThis free PDF looks at Asia's health supplements market opportunities, covering China, Japan, South Korea and Southeast Asia: market size, sales channel distribution including direct selling, top selling categories, hot products and much more.Download the industry report for the complete breakdown and trends by country.

Vietnam and Malaysia, in particular, are experiencing rapid adoption of cross-border eCommerce, allowing foreign brands to enter without establishing a local presence. Meanwhile, in Thailand and Indonesia, direct selling and community-driven marketing continue to play a crucial role in supplement sales, especially for weight management and herbal supplements.

Japan: A Market Focused on Beauty and Functional Health

Japan’s supplement industry, valued at US $11 billion, maintains a steady demand for health and wellness products despite a small contraction of -0.5%. Japan remains an attractive destination due to its well-established supplement culture and consumer preference for functional foods and beauty-oriented health products and exhibits a strong shift towards online retail.

Unlike in China, where supplements are often consumed for medical or long-term health benefits, Japanese consumers tend to seek multi-functional supplements that support skincare, anti-aging, and digestive health. Collagen-based supplements, probiotics, and enzyme-based dietary aids are among the best-selling categories. Japan also has stringent regulations regarding health claims and functional labeling, making compliance an essential consideration for brands entering this market.

South Korea: A Trend-Driven Supplement Market

South Korea’s US $6 billion supplement market is heavily influenced by beauty and wellness trends, with a significant focus on probiotics, ginseng-based products, and skin-enhancing supplements. The country’s K-beauty and holistic health culture have driven demand for innovative formulations that go beyond traditional vitamins and minerals.

Another defining characteristic of South Korea’s market is its advanced digital commerce ecosystem. ECommerce penetration is extremely high, and brands rely on influencer marketing, social commerce, and subscription-based wellness programs to engage with consumers. Companies looking to enter South Korea must build a strong digital presence and leverage platforms like Naver Shopping, Coupang, and KakaoTalk to maximize visibility.

China: The Powerhouse of the Region

China dominates the Asian health supplement industry, with a market valued at US $36 billion in 2024. While its 3.4% year-over-year (YoY) growth is relatively moderate compared to emerging markets, the country’s sheer size and spending power make it a critical market for supplement brands. The demand is primarily driven by specialty supplements, particularly those catering to cardiovascular health, liver detoxification, and bone health. Aging demographics and heightened awareness of chronic disease prevention have made these products especially popular among middle-aged and elderly consumers.

The Chinese market is also unique in its dual-track regulatory system, where locally manufactured "Blue Hat" Certificate: 3 Options for Selling Health Food in ChinaBlue Hat Registration, Licensing, or Sell as General Food? These are China's regulations for foreign health supplements entering the market.health supplements must go through a strict “Blue Hat” certification, while cross-border eCommerce (CBEC) allows foreign brands to bypass this requirement and sell directly to Chinese consumers. This system has enabled many global brands to enter China profitably without investing in full-scale local production.

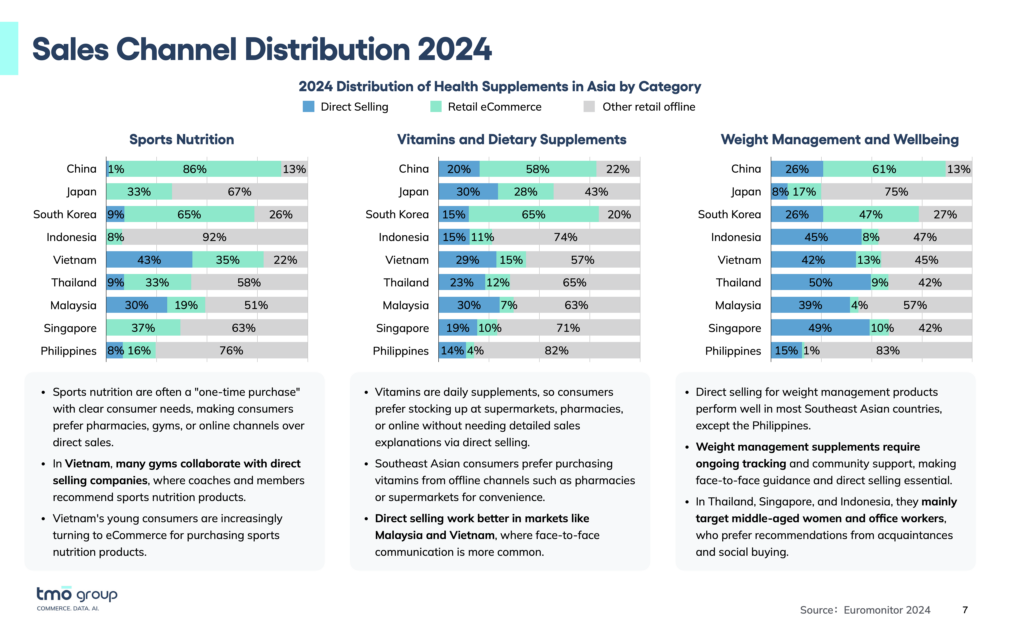

2. Sales Channels: Surge in eCommerce and the Role of Direct Selling

As digital commerce continues to evolve, Asia’s health supplement industry is increasingly shifting toward online sales channels, with eCommerce platforms, direct selling, and live commerce emerging as dominant distribution methods. While traditional brick-and-mortar retail remains relevant in some markets, foreign brands looking to scale must prioritize digital-first strategies to stay competitive.

Direct Selling has long been a major force in Asia’s supplement industry, with brands like Amway, Herbalife, Nu Skin, and Atomy using network-driven sales models to engage consumers. However, with the rise of digital commerce, social media, and influencer-driven sales, the industry is shifting towards an omnichannel approach that combines traditional relationship-based selling with modern digital strategies. Rather than competing with eCommerce, Direct Selling is now merging with digital sales channels to create a seamless customer journey.

Online Retail: The Backbone of Supplement Sales

eCommerce has become the primary sales channel for health supplements in Asia, with platforms like Shopee, Lazada, Tmall, JD.com, Rakuten, and Coupang driving the bulk of online transactions. Consumers are drawn to these marketplaces due to their convenience, price transparency, and the ability to compare multiple brands in one place.

In China, the health supplement eCommerce market is valued at $24.3 billion, growing at a 60.6% YoY rate. Platforms like Tmall Global and JD Worldwide allow foreign brands to sell directly to Chinese consumers through cross-border eCommerce (CBEC), bypassing the strict regulatory hurdles of domestic sales. This model has made it easier for international brands to establish a foothold in the market without investing in local manufacturing.

From WeChat eCommerce to self-operated eCommerce, private traffic and multichannel remain critical to developing a successful China market entry strategy.

In Southeast Asia, Shopee and Lazada dominate supplement sales, with countries like Vietnam (+72.8% YoY) and Malaysia (+83% YoY) seeing record eCommerce growth. These platforms offer a low-barrier entry for foreign brands, enabling them to test product-market fit before committing to large-scale expansion. Additionally, the rise of super apps like Grab and GoTo has created new sales avenues, as consumers increasingly purchase supplements through food delivery and lifestyle apps.

In Japan and South Korea, eCommerce is also crucial, but consumers tend to prefer trusted domestic platforms like Rakuten, Amazon Japan, and Naver Shopping. Foreign brands must focus on building credibility and strong local partnerships to compete effectively in these markets.

Direct Selling: Thriving in Asia’s Supplement Industry

Despite the rise of eCommerce, direct selling remains a powerful sales model for health supplements in Asia, particularly in China and Southeast Asia. Many global brands, including Amway, Herbalife, Nu Skin, USANA, and Atomy, have successfully combined traditional direct selling with digital platforms, creating hybrid models that leverage eCommerce, community-driven sales, and live commerce.

In China, direct selling has historically been highly regulated, but brands have adapted by integrating WeChat private communities and social selling strategies to maintain engagement with customers. These private groups allow for personalized product recommendations, repeat purchases, and long-term customer relationships.

See how TMO helps implement successful hybrid cross-border eCommerce strategies for direct selling brands in Asia.

In Southeast Asia, direct selling remains strong, especially in Malaysia, the Philippines, and Thailand, where community trust and face-to-face recommendations play a crucial role in consumer decision-making. While direct sales often complement online channels, brands that fail to establish an omnichannel approach risk losing market share to competitors who engage with consumers through multiple touchpoints. As Shopee, Lazada, and TikTok Shop become increasingly popular, some Direct Selling distributors operate as independent sellers on these marketplaces.

In Japan and South Korea, Direct Selling plays a more niche role, with subscription-based wellness programs and premium retail slowly evolving. Brands that succeed in this region use LINE groups (Japan) and Naver Blog recommendations (South Korea) to build credibility and engage customers digitally.

Live Commerce & Social Selling: The New Frontier

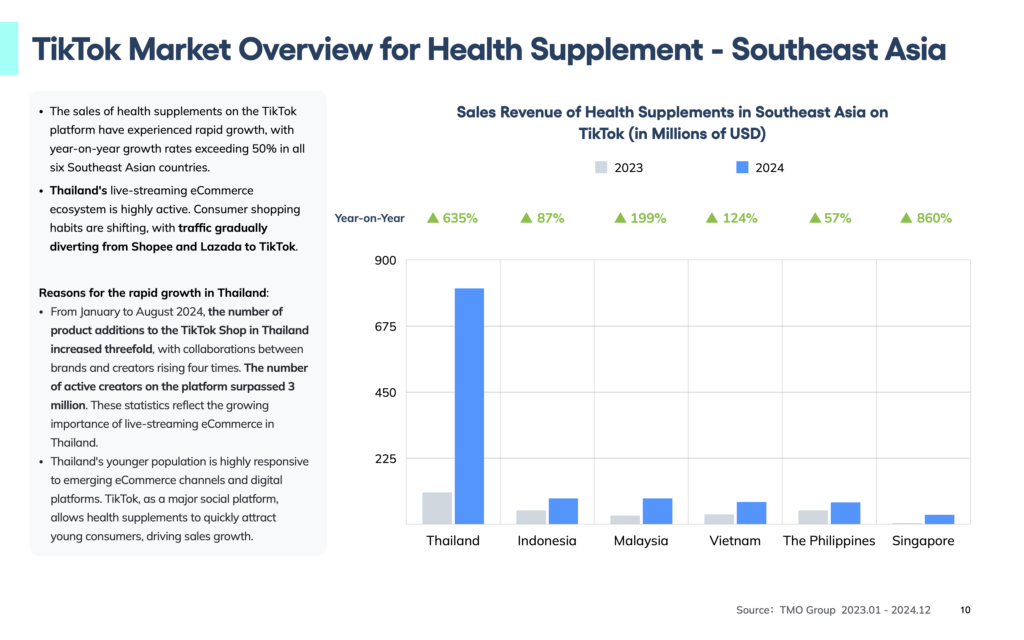

Live commerce is revolutionizing how consumers discover and purchase supplements in Asia. Platforms like TikTok Shop, Douyin (China’s version of TikTok), and WeChat Mini Programs are transforming the shopping experience by combining real-time engagement with entertainment-driven selling.

In China, live commerce has become one of the fastest-growing sales channels for supplements, with influencers and key opinion leaders (KOLs) playing a significant role in driving product recommendations. Douyin and Kuaishou have become go-to platforms for supplement brands, particularly those targeting younger, digitally native consumers.

In Southeast Asia, TikTok Shop has experienced explosive growth, with health supplement sales increasing by over 50% YoY across all major markets. Thailand, in particular, has become a live commerce hub, where local influencers and brand ambassadors drive supplement sales through interactive product demos and limited-time promotions.

Meanwhile, Japan and South Korea have also embraced social commerce, though in different ways. Japanese consumers prefer subscription-based services that deliver personalized supplements monthly, while South Korea’s strong influencer culture has led to a surge in Instagram-driven shopping and Naver Blog endorsements.

Instead of face-to-face sales, live commerce on Douyin (China), TikTok Shop (Southeast Asia), and Naver Shopping Live (South Korea) allows Direct Sellers to engage audiences in real time. Brands like Herbalife and Amway are increasingly hosting live shopping events to demonstrate products, answer questions, and drive conversions. Similarly, community-driven sales become increasingly common, with private groups on platforms like WeChat, LINE, and KakaoTalk acting as digital extensions to maintaing close customer relationships.

Offline Retail: Still Relevant but Declining

While online channels dominate, brick-and-mortar stores still play a role, particularly in countries where pharmacy trust remains high. In Japan and South Korea, major pharmacy chains like Matsumoto Kiyoshi and Olive Young are important supplement retailers. In Southeast Asia, physical retail is still relevant for mass-market vitamins and multivitamins, but online sales are rapidly outpacing traditional retail.

Foreign brands looking to enter offline channels must consider distribution partnerships and retail placement strategies carefully. Large pharmacy chains, specialty supplement stores, and even supermarkets can offer an additional touchpoint for consumer engagement, particularly for premium brands that benefit from in-store sampling and expert recommendations.

3. Market Entry: Key Considerations for Foreign Brands

Successfully entering and scaling in Asia’s diverse health supplement market requires more than just a strong product—it demands a well-researched, localized, and strategic approach. While each country presents unique challenges, there are several strategies that foreign brands can leverage to establish themselves and gain traction in each market.

Southeast Asia: eCommerce and Social Selling as a Market Entry Shortcut

Unlike China and Japan, Southeast Asia offers a faster and more accessible entry route through eCommerce and social commerce. The region is highly digital, with platforms like Shopee, Lazada, and TikTok Shop dominating online retail. Consumers here are also more influenced by social proof, influencer marketing, and flash sales.

Key entry strategies include:

- Launch on CBEC-friendly platforms – Shopee and Lazada allow foreign brands to sell without local registration, making them ideal for market testing.

- Capitalize on Social Commerce – TikTok Shop has emerged as a high-growth channel, particularly in Thailand, Indonesia, and Vietnam, where live shopping is booming.

- Adjust Pricing for Local Sensitivities – Unlike Japan or Korea, price competitiveness is crucial in markets like Indonesia and the Philippines.

Japan & South Korea: Prioritizing Brand Credibility and Local Partnerships

Japan and South Korea are highly competitive, premium-driven markets where trust and scientific validation play crucial roles. Consumers in these countries are not as price-sensitive as in Southeast Asia but demand clinically tested, well-documented products.

Brands looking to succeed here should:

- Secure Functional Health Certifications – Japan’s Food with Functional Claims (FFC) and South Korea’s Health Functional Food (HFF) certification can enhance credibility and boost consumer trust.

- Leverage Local eCommerce Platforms – Rakuten (Japan), Coupang (South Korea), and Naver Shopping are preferred over global platforms like Amazon.

- Emphasize R&D and Innovation – Japanese and Korean consumers favor science-backed formulations, especially in beauty-related and functional supplements.

China: Leveraging CBEC and Building Brand Trust

Given China’s complex regulatory environment, cross-border eCommerce (CBEC) remains the best entry strategy for most foreign supplement brands. A combination of self-operated eCommerce and third-party marketplaces specialized in CBEC allows brands to sell directly to Chinese consumers without needing full domestic registration.

However, selling on CBEC alone is not enough. Chinese consumers place a high value on brand reputation, quality assurance, and peer recommendations. Companies that thrive in China tend to focus on:

- Social Proof & Word of Mouth – Partnering with Key Opinion Leaders (KOLs) and Key Opinion Consumers (KOCs) on WeChat, Xiaohongshu (Little Red Book), and Douyin to generate authentic product reviews and endorsements.

- Private Traffic Channels – Establishing WeChat Mini Programs and private customer groups for exclusive deals, education, and retention.

- Localized Content & Transparency – Highlighting scientific research, certifications, and ingredient sourcing to build credibility.

3 Steps to a Winning Health Supplement Strategy

Expanding into Asia’s health supplement market requires data-driven insights, localized strategies, and seamless execution across multiple channels. From understanding consumer behavior to navigating complex regulations, foreign brands need expert guidance to ensure a smooth market entry and sustainable growth.

With extensive experience in eCommerce data research, market entry strategy, and health & beauty-focused digital solutions, TMO Group is uniquely positioned to help brands scale successfully across China, Japan, South Korea, and Southeast Asia.

As for Direct Selling firms, brands should recognize how the model is evolving in Asia’s fast-paced markets. Successful brands are those that embrace omnichannel engagement, blending community-based sales with digital innovation. To remain competitive, these companies:

- Utilize private traffic strategies (WeChat, LINE, Naver Blog) to keep Direct Selling relationships strong in the digital age.

- Leverage live commerce and video-driven selling as a digital alternative to traditional face-to-face presentations.

- Expand their presence on eCommerce platforms, allowing distributors to sell through official Shopee, Lazada, and Tmall storefronts.

1. Data & Market Insights: Make Informed Decisions

Before entering a new market, brands must have accurate and actionable market intelligence. From custom research reports to continuous marketplace monitoring, our eCommerce Data Services are tailored to understanding your industry and target audience.

2. Health & Beauty eCommerce Solutions: Build a Digital-First Presence

Selling supplements in Asia requires a strong eCommerce strategy optimized for local consumer preferences. Our Health & Beauty eCommerce Solutions cover:

- Custom website development for Shopify Plus, Magento, and headless commerce solutions.

- Localized UX/UI design to enhance brand trust and customer engagement.

- Conversion-optimized product pages that comply with local regulations while appealing to regional shopping behaviors.

3. Market Entry Strategy: Navigate Regulations & Scale Efficiently

Each country in Asia has distinct regulations, consumer preferences, and digital ecosystems. TMO Group helps brands:

- Identify the best market entry strategy (CBEC, direct sales, local distribution, etc.).

- Ensure regulatory compliance with China’s Blue Hat certification, Japan’s FFC, and South Korea’s HFF certification.

- Develop pricing and localization strategies that align with regional market expectations.

Whether you’re exploring new markets, refining your eCommerce strategy, or need help with regulatory compliance, TMO Group is your trusted partner for unlocking growth in Asia’s booming health supplement industry. Contact us today to discuss your global expansion project!