It is estimated that global eCommerce market will reach 1.7 trillion dollars in 2015. And it will be reach 2 trillion dollars in 2017. Furthermore, cross border eCommere will increase 21%.

Generally speaking, we assume that people all over the world paid by credit card when shopping online. But actually in some popular international market it's not true. Take some examples:

- In China, only 1% of consumers paid by online credit card

- In Brazil, only 30% of credit cards have the function of onlne payment

- In Germany, three quarters people don't like to use credit card to pay online.

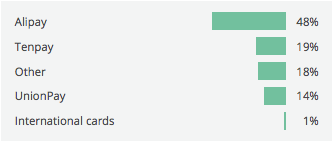

In addition, there are many different local payment methods. For example in China they have Alipay, unionpay and Tencent pay. Also Boletos in Brazil, SEPA, sofort and Giropay in German. Then let's see the report from Adyen, which shows top payment methods in world's leading countries.

China

China is the biggest retail e-commerce market in the world,

and Chinese online shoppers are overwhelmingly young and located in major cities. A majority (70%) of shoppers in the market have completed a purchase using their smartphone. The three major payment methods are China Unionpay, Alipay and Tenpay.

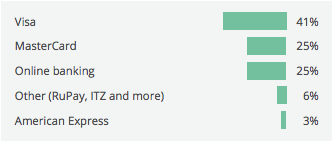

India

Traditionally a market with low credit card market share, non-cash transactions are rapidly growing in popularity in India, and online banking, debit cards, and prepaid cards are experiencing increasing popularity. However, it should be noted that while our data focuses on digital payment methods, cash on delivery is still the predominant payment method for retail goods.

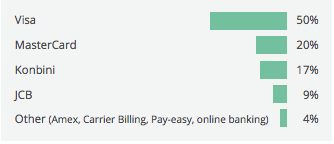

Japan

Japan is the world’s fourth-biggest e-commerce market, and although dominated by cards, a popular way to pay there is via Konbini, which allows for online payments to be completed offline in 24/7 convenience stores.

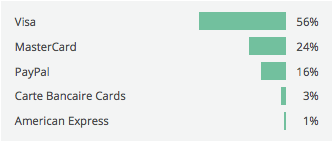

France

In France, Carte Bancaire ( an interbank scheme that requires a connection to a local acquirer) cards dominate the payments landscape and are usually co-branded with Visa or MasterCard.

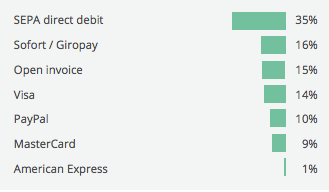

Germany

Germans are some of the most open shoppers in the world when it comes to cross-border e-commerce, with over 50% of online retail purchases taking place on an international website. Yet despite this willingness, non-credit card payment methods such as SEPA direct debit, and Giropay account for the majority of online transactions.

In addition to these methods, another popular payment method in Germany is open invoice, where a third party pays the merchant for products and services purchased by shoppers, and then collects payment from shoppers after delivery.

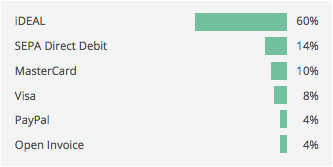

The Netherlands

While purchasing from international websites is relatively common in the Netherlands, the most popular payment method – iDEAL – is local to the Dutch market. iDEAL is an inter-bank system covered by all major Dutch consumer banks, allowing shoppers to use their bank account for online purchases. Direct debits and open invoice payments are also fairly popular.

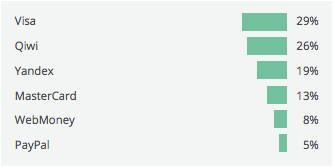

Russia

In Russia, payments through ATMs have been very popular for a long while, and the increasing sophistication of the terminals has resulted in a more seamless payments environment that now includes automatic top-ups and recurring payments.

Spain

Card use is very popular in Spain, with over 85% of the population in possession of at least one debit or credit card. Using prepaid virtual cards for online purchases is increasingly popular.

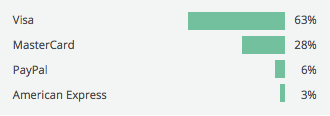

The UK

UK shoppers are world leaders in terms of mobile shopping and e-tail adoption. Credit and debit cards are very popular, with the average shopper holding between 2-3 cards. Cards account for approximately 90% of all online payments, with online banking being virtually non-existent.