The Double 11 Festival in 2022 was very challenging for all major e-commerce platforms and companies, particularly those involved in the overseas health supplement industry. On the one hand, the traditional platforms and companies were affected by the tightening general environment and user growth hitting "bottleneck". People's health awareness has increased as a result of the pandemic, and they have begun to actively employ health supplements to help build their immunity. Furthermore, with the involvement of new channels like Douyin (Chinese version of Tiktok) and Xiaohongshu, the trend of multi-platform diversion sharing is unavoidable.

We previously discussed the main China Market Entry: A 2025 Guide for Foreign Supplement BrandsFrom establishing a legal entity to selecting entry mode, logistics, & sales channels, these are the key routes for a successful China entry.Entry Models and Sales Channels for Foreign Supplement Brands in China.

In such circumstances, how did China's health supplement industry perform? Each month, TMO Group compiles data from Alibaba's family of eCommerce platforms (including Taobao, Tmall, Tmall Global, and Tmall Supermarket) regarding sales of health supplements both domestically and across borders, and presents the analysis results to readers in a visual way of combining charts and texts to help readers gain insight into the latest consumer behavior and market trend.

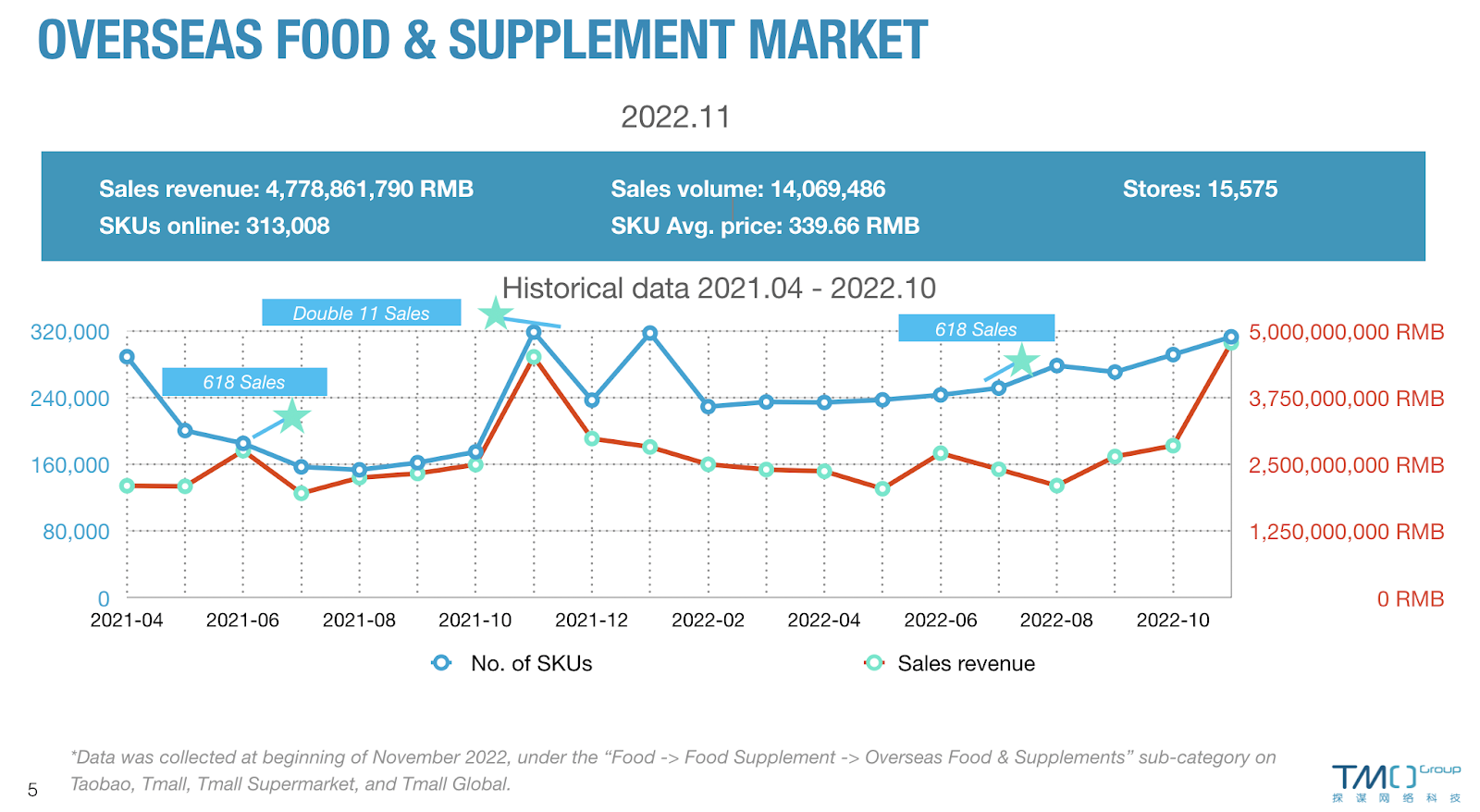

Overview of the overseas health supplement market in November

In comparison to the success of the overseas health supplement market at Double 11 Festival in previous years, this year it has been sluggish. In November, the total market sales grew to 4.78 billion RMB from 4.52 billion RMB the previous year, while the average transaction price jumped to 340 RMB from 308 RMB the previous year. However, as compared to the same period last year, sales volume, online product volume, and shop amounts have all decreased this year. However, when compared to the 618 promotion in the middle of the year, sales in November soared by 76% compared to June, reaching the peak of the year. Despite the constraints that conventional domestic e-commerce platforms face, November remains one of the most significant promotion months. How to grasp the right time and the pain points of consumers, so as to successfully enter the market and occupy a long-term position is worthy of thinking and planning for business people coveting this industry.

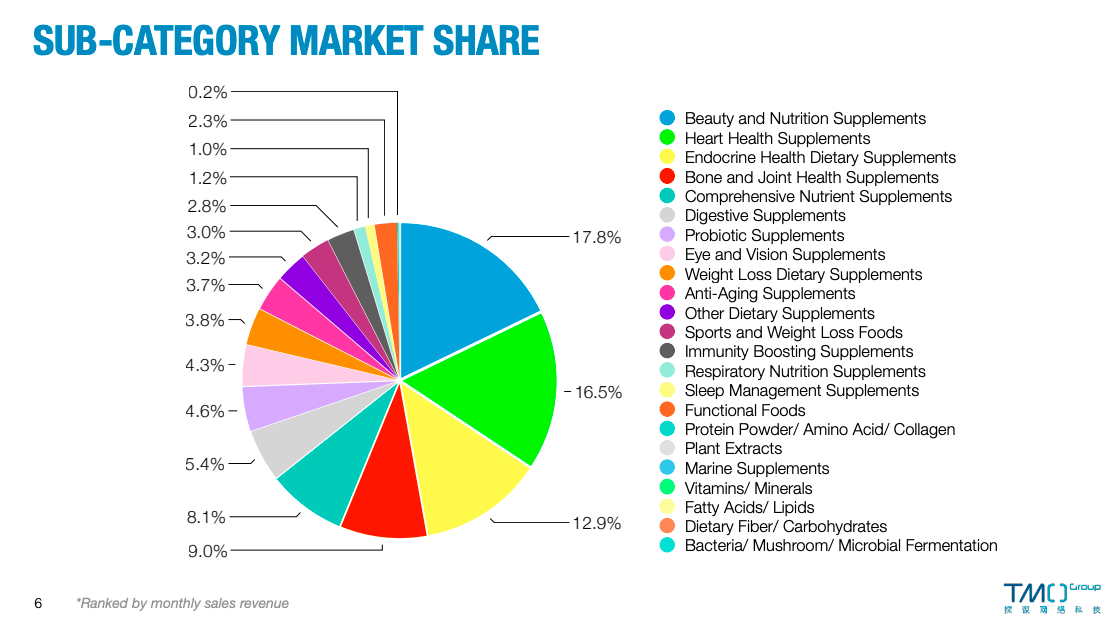

Top-selling Subcategories Analysis

Top 1: Overseas Beauty and Nutrition Supplements (Top 1 during the same period last year)

Beauty and Nutrition Supplements have long occupied the first place in the subcategory market share, and November was no exception. The total sales volume was about 850 million RMB, but slightly decreased by 3% compared with the same period. From the perspective of price distribution, the overall price was between 1000-2000 RMB. Compared with last year, astaxanthin was the subcategory with more year-on-year sales growth, reaching 49%. Astaxanthin has become more and more popular with women who love beauty and men who love sports in recent years because of its strong antioxidant effect.

Top 2: Overseas Heart Health Supplements (Top 2 during the same period last year)

In November, the sales volume of Heart Health Supplements was about 790 million RMB, ranking second in all subcategories. Among them, fish oil products increased by 61% year on year. Autumn and winter are the seasons of high incidence of cardiovascular diseases, which shows that consumers still have a certain demand for such health supplements.

Top 3: Overseas Endocrine Health Dietary Supplements (Top 12 during the same period last year)

The sales volume of Endocrine Health Dietary Supplements in November was about 610 million RMB, with the fastest year-on-year growth among the top three categories of market shares, reaching 74%. The top ten products in sales volume were all blood sugar conditioning foods. Among them, Funrich and TimesGate were the main contributors of sales. In recent years, diabetes is no longer the "patent" of middle-aged and elderly people. With the irregular diet, more and more young people are also troubled by diabetes. Endocrine supplements represented by blood sugar conditioning foods will get more and more attention from the market.

Top 4: Overseas Bone and Joint Nutrition Supplements (Top 3 during the same period last year)

In November, the sales volume of Bone and Joint Nutrition Supplements was about 430 million RMB, occupying the fourth place in market share of the subcategory, with a year-on-year growth of only 7%. The top categories of sales were calcium and ammonia sugar, among which the main brand competitors are mostly health product giants, such as Swisse, Move Free and Blackmores. In addition, the sales of vitamin D and bone collagen also grew rapidly, with a growth rate of 68% and 52% respectively.

Top 5: Overseas Comprehensive Nutrient Supplements (Top 4 during the same period last year)

The sales of overseas Comprehensive Nutrient Supplements in November exceeded 380 million RMB, up about 5% year on year, and the market share was about 8.1%. The Covid pandemic has forced people to enhance their health awareness. The main products under the category of comprehensive nutrients, complex vitamins and B vitamins, have the effect of enhancing immunity, so they are sought after by many consumers. Among them, the sales of B vitamins in November increased by 51% compared with the same period last year.

Top 6: Overseas Digestive Supplements (Top 7 during the same period last year)

The sales volume of Digestive Supplements was about 260 million RMB, significantly higher than that of the same period last year and in June this year. Among them, the most important product category was thistle, represented by Swisse liver protection tablets, with a year-on-year growth of 56%. The sales of Swisse liver protection tablets alone reached 18.28 million RMB, with a contribution rate of 7%. Since the liver is the body's cleansing and metabolism organ, it is critical to nourish and preserve it. In a social setting where young people's pressures are quickly growing, liver protection products have progressively become "life-saving" critical health supplements for many office employees.

Best-Selling Products and Brands

Top 1:

Product: Beauty Supplements

Brand: Faihapy

Original price: 15,662 RMB

Price: 15,662.22 RMB

Sales revenue: 20,642,806 RMB

Sales volume: 1,318

Top 2:

Allnature DHA Algae Oil Complex

Product: Fish oil/deep sea fish oil

Brand: Allnature

Original price: 589 RMB

Price: 589.01 RMB

Sales revenue: 18,625,085 RMB

Sales volume: 31,621

Top 3:

Swisse Liver Detox 120 Tablets

Product: Thistle

Brand: Swisse

Original price: 398 RMB

Price: 221.58 RMB

Sales revenue: 18,280,350 RMB

Sales volume: 82,500

Top 4:

Product: Beauty Supplements

Brand: Faihapy

Original price: 15,497 RMB

Price: 15,497.12 RMB

Sales revenue: 17,418,763 RMB

Sales volume: 1,124

Top 5:

Funrich A60 Powdermax Solid Beverages

Product: Blood sugar conditioning food

Brand: Funrich

Original price: 2159 RMB

Price: 2159.03 RMB

Sales revenue: 17,056,337 RMB

Sales volume: 7,900

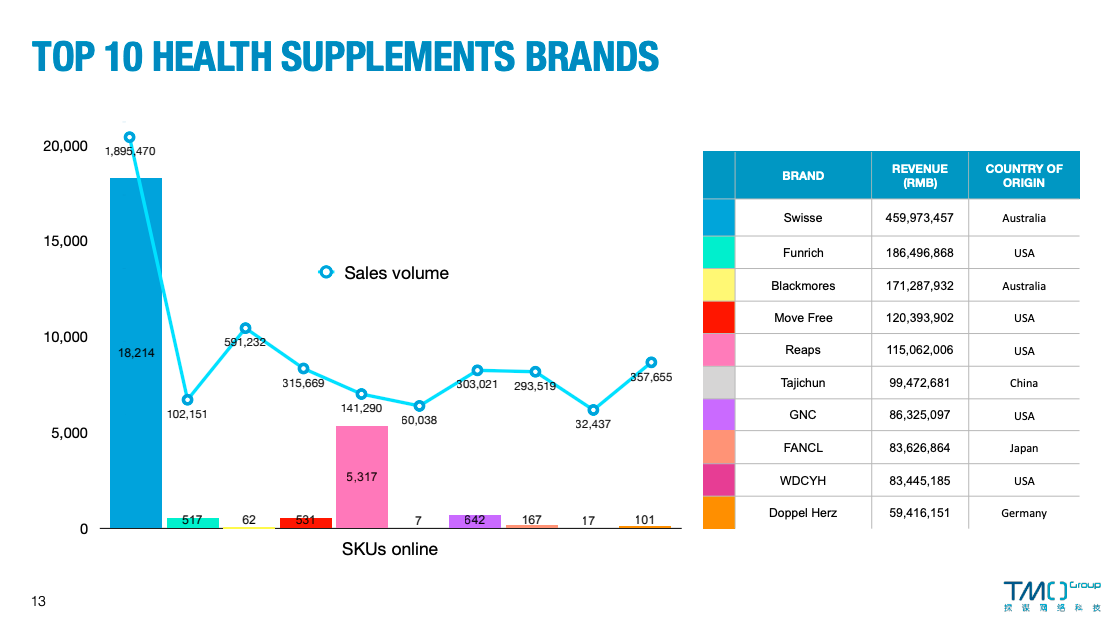

Top 1:Swisse

In November, Swisse was still the brand with the largest market share of overseas health supplements products, with a total sales volume of about 460 million RMB. Among all the products ranked by sales volume in November, the top three came from Swisse, including the star products VD Calcium Citrate and Liver Protection Tablets. The transaction price was between 300 and 400 RMB. Such products were the first choice of many entry-level consumers of health supplements products.

Top 2:Funrich

Funrich, in second place, sold around 190 million RMB, with an average transaction price of up to 1,826 RMB. Its goods encompassed blood glucose conditioning and uric acid conditioning meals. Its best-selling products were mostly small molecule saponin glucose gum, which aids in sugar metabolism. It is worth mentioning that the brand began to be offered on the Tmall platform in March this year, and we will continue to track the future sales of Funrich.

Top 3:Blackmores

The sales volume of Blackmores, the third place, was about 170 million RMB. As a leading natural nutrition company in Australia, its products mainly covered vitamin and mineral nutritional supplements, and the transaction price of its products was mainly 200 to 400 RMB. Its hot-selling products were mainly fish oil and glucosamine.

Popular product Characteristics

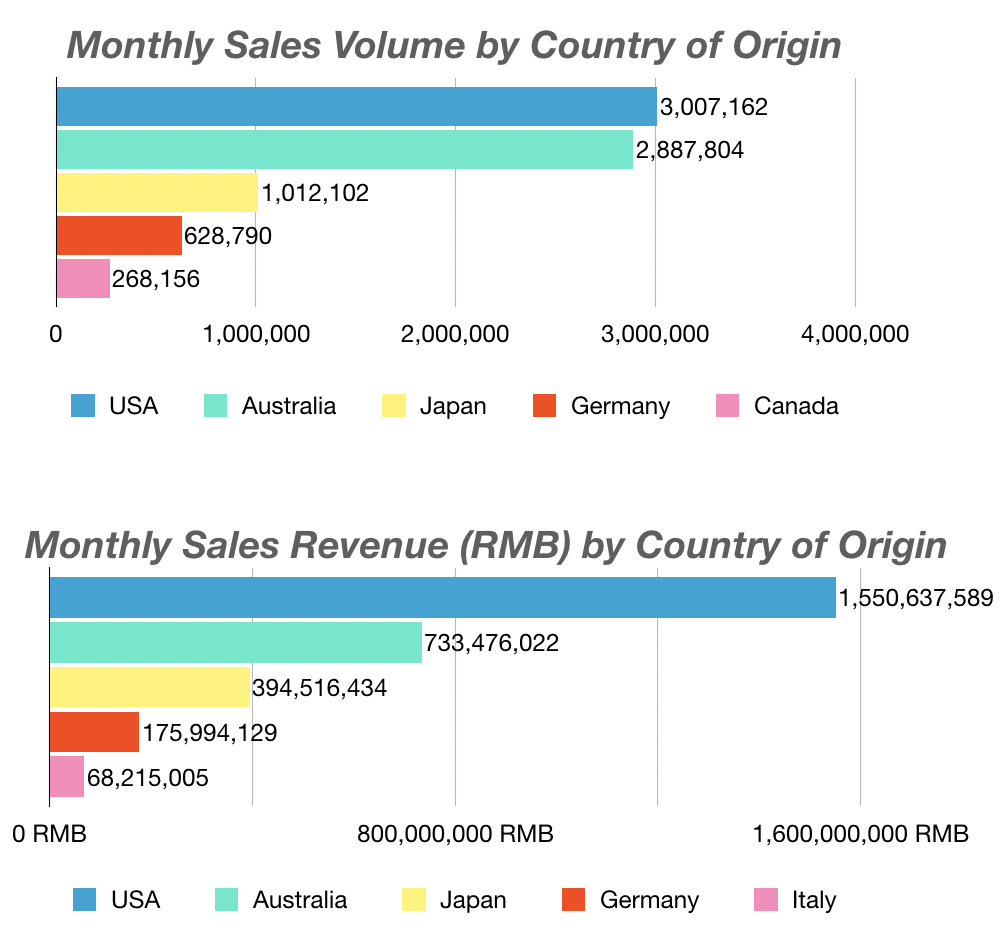

Country of origin

Health supplement brands in Australia and the United States have consistently ranked first and second in the sales of this industry. Swisse and Move Free are two worldwide titans in the health supplement market, and many domestic customers are familiar with them. Following extensive growth, health supplements in these two nations now span nearly all subcategories. Natural and gentle components are more common in Australian products, but high-quality and scientific formulae are more common in American items. Ranking the third, the best-selling categories of Japanese health supplements are very focused, with enzymes, dietary fiber, and multivitamins (represented by Fancl) as the primary categories, with functions mostly focusing on slimming or digesting, responding to the needs of Chinese female consumers

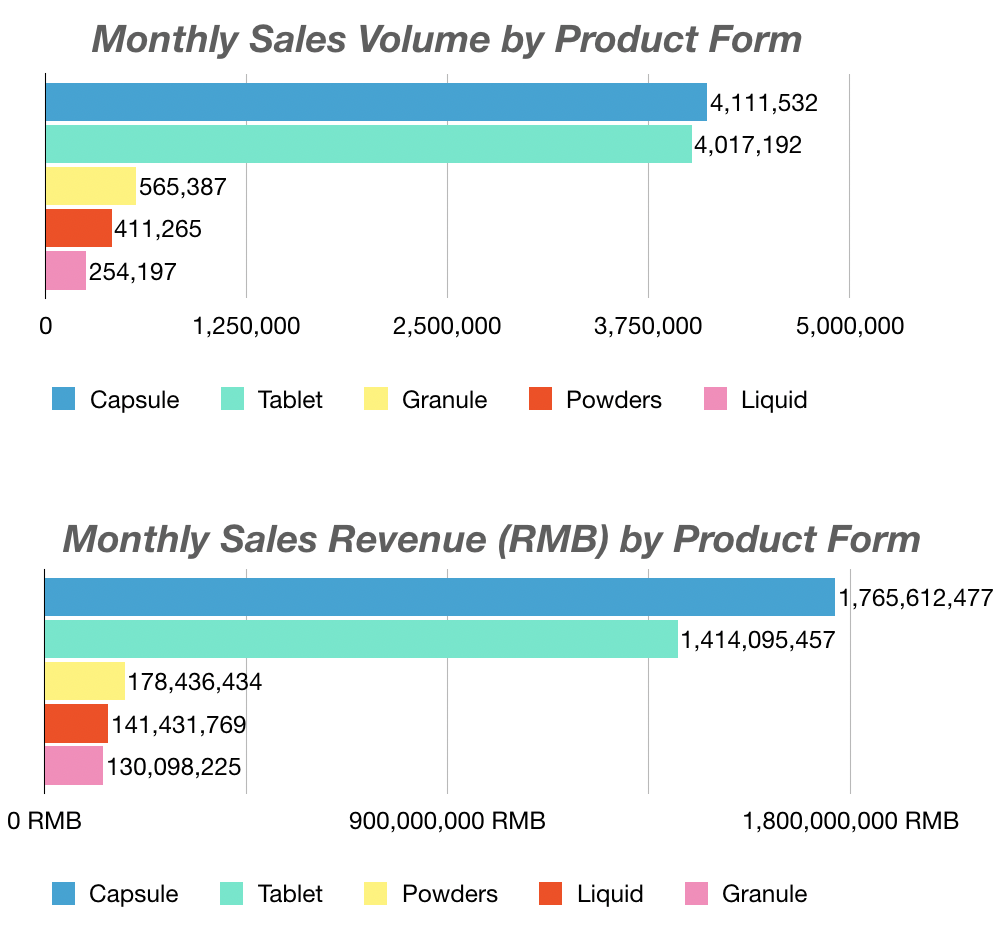

Product Form

From the perspective of product form, the overseas health supplements of capsule and tablet types in November were the best both in terms of sales volume and sales revenue. The unit price of capsule products was higher than that of tablet products. As traditional forms of health supplements, tablets and capsules have many advantages, such as easy packaging and transportation, easy to carry by consumers, long shelf life, and better taste. Therefore, they have become mainstream in the field of health supplements.

However, in recent years, with the gradual rejuvenation of health supplements consumer, there has been a trend of "snacks" in the market. That is, to make health supplements as convenient and interesting as snacks. In order to cater to the young group's "punk health" mentality, some brands have taken the opportunity to introduce snack based health supplements, making them easier to carry and take.

Conclusion

Overall, compared to the previous year, the overseas health supplement market during the Double 11 Festival this year maintained a stable rising trend, although at a slower pace of increase. Swisse and other health supplement giants maintain an unshakeable position in the Chinese health supplement market and continue to lead the industry's development. With the growing customer acquisition costs and more competitors, how to "activate" the existing customer market has become a challenge that must be addressed by traditional e-Commerce platforms. For health supplement brands, they should not only pay attention to the 'pain points'' encountered by some customers in society, such as staying up late, working overtime and drinking for social engagement, but also be alert to developing opportunities, such as "She Economy" and "Silver Economy". It is expected that the health supplement industry would enter a golden age of development during the post-epidemic period, propelled by the government’s favorable policies and increasing health awareness of consumers.

Click here to download theChina Health Supplements Market Data Packs (2022 Annual Collection)This collection includes the China health supplements market premium data packs from January issue to December issue 2022. In addition, source data excel sheets with comprehensive industry information are attached for your reference. free Double Eleven Health Supplement Data Pack in full! And from November, TMO has launched the China Health Supplements Market Data Packs (2022 Annual Collection)This collection includes the China health supplements market premium data packs from January issue to December issue 2022. In addition, source data excel sheets with comprehensive industry information are attached for your reference.upgraded paid version of Health Supplement Data Pack with more valuable content, download to check it out!

For more information, you can visit our official website to learn more about TMO group and our services. You can also send an email or call the hotline +86 (0)21 6170 0396. We have e-commerce and consulting experts with 20+ industry experience who will provide you with exclusive solutions.