REASON 1 . CHINA’S E-LUXURY MARKET HAS PROVED ITS GROWTH POTENTIAL

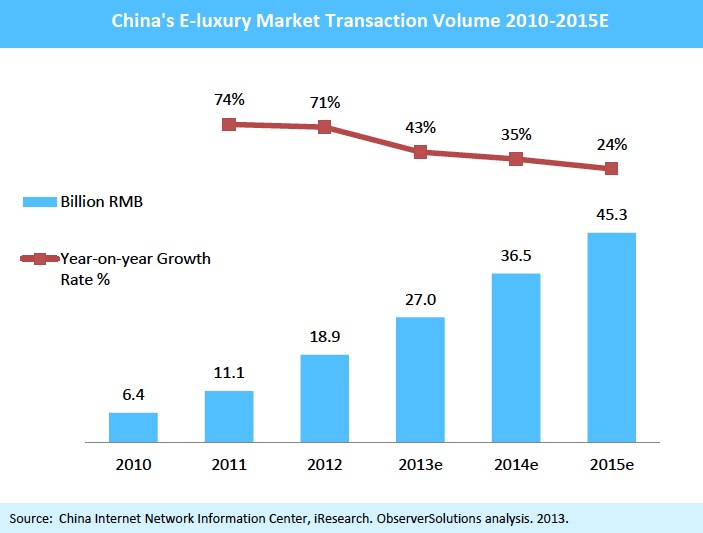

The Chinese e-luxury industry has already shown great growth potential.

The market has exploded since 2011, with growth rate continuing to increase, registering 71% growth to RMB 18.9 billion in 2012.

Given the growing acceptance of consumers and brands, there is an unprecedented opportunity awaiting the company that comes out with a winning business model first.

REASON 2 . THE WAR FOR CHINA’S E-LUXURY MARKET HAS ALREADY STARTED

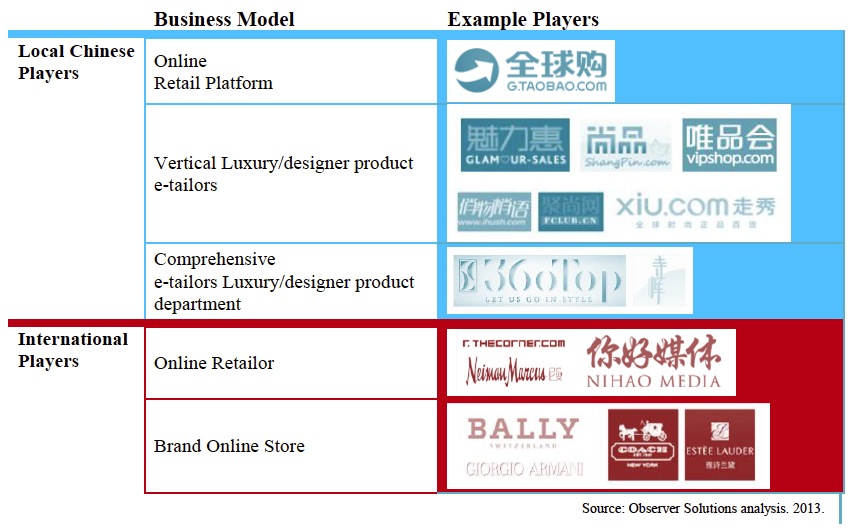

Due to China’s exorbitant tariffs, the price of luxury goods in mainland China is on average one third higher than the price of the same products in the US or Europe. This differential bred opportunity for low-overhead middlemen. For instance, as early as 2005, groups of Chinese individual sellers began purchasing luxury products overseas for re-sale on small stores hosted by Taobao.com. This informal market is still thriving. Since 2010, dozens of vertical B2C luxury shopping sites have emerged, and many, such as Vipshop and ihush, have even become household names. JD, the country’s second-largest online shopping site, has since opened its couture-oriented 360Top site.

REASON 3 . LUXURY BRANDS NEED TO BE ONLINE :

1. Realities or Lower-Tier Expansion

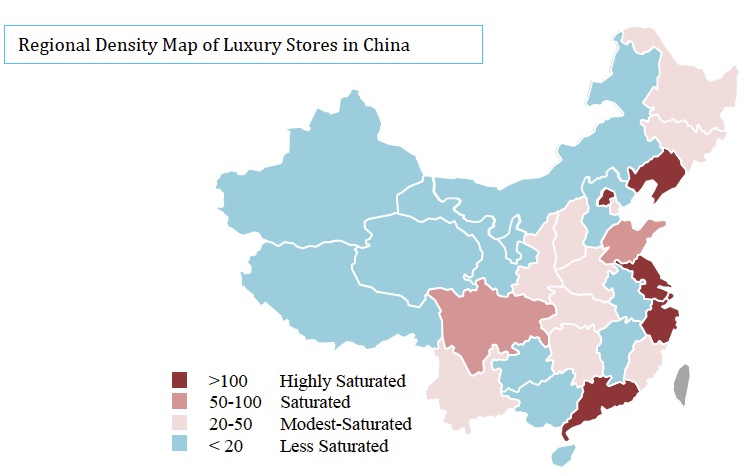

E-commerce is a smart way to solve the offline expansion dilemma. Many luxury brands have slowed expansion of brick-and-mortar stores in China in the past year. Retail infrastructure in lower-tier regions cannot meet the standards of luxury experience stores. On the other hand, penetration and competiveness of luxury brands in China’s 1st and 2nd tier cities are already high, and there is still huge unmet demand from consumers in lower-tier cities. E-commerce is a more flexible and cost-efficient approach to reaching new consumers in remote areas of China.

2. Luxury Brand Reputation Management

When luxury brands ignore the potential of their house-owned online channels, they create opportunity for unauthorized competitor channels, which can damage brand image and distribution control.

Luxury brands tend to be conservative when it comes to selling online. They fear e-commerce will tarnish brand image and disrupt the delicate balance between short-term sales growth and artificial product scarcity. With so many unauthorized retailers already online in China, luxury brands need to adopt a proactive approach to managing their brand in the e-luxury space. An official online presence is critical to effective brand management in China.

Digitally Challenged

“Over two-thirds of Chinese use the internet to research brands, but most luxury firms have pitiful digital strategies. One study found that luxury websites take four times as long to load in China as elsewhere (because most firms do not put servers inside China’s Great Firewall, which slows access to foreign sites) and rarely offer yuan prices or purchasing options. Mobile commerce is growing in China, but few luxury firms’ websites are optimised for mobile devices.”

-The Economist

Luxury Goods in China: Beyond Bling (June 2013)

Via: Observer Solutions