In a previous blog on Assessing Digital Maturity: 3 Stages for B2B eCommerce GrowthWe look at the various degrees of Digital Maturity and features that B2B organizations should consider in their journey to eCommerce success.Assessing Digital Maturity for B2B eCommerce, we covered the key milestones that B2B organizations can implement in their progression towards full Digital Transformation in the field of eCommerce. Today, we will dive a bit deeper into this framework and explore how businesses in each phase can build a comprehensive Digital Asset System that takes their digital operation from an "unstructured online product presence" to one that fully leverages the features of a digitalized operation.

TMO specializes in helping B2B brands optimize their online operation with Custom B2B eCommerce Solutions for projects in China and overseas.

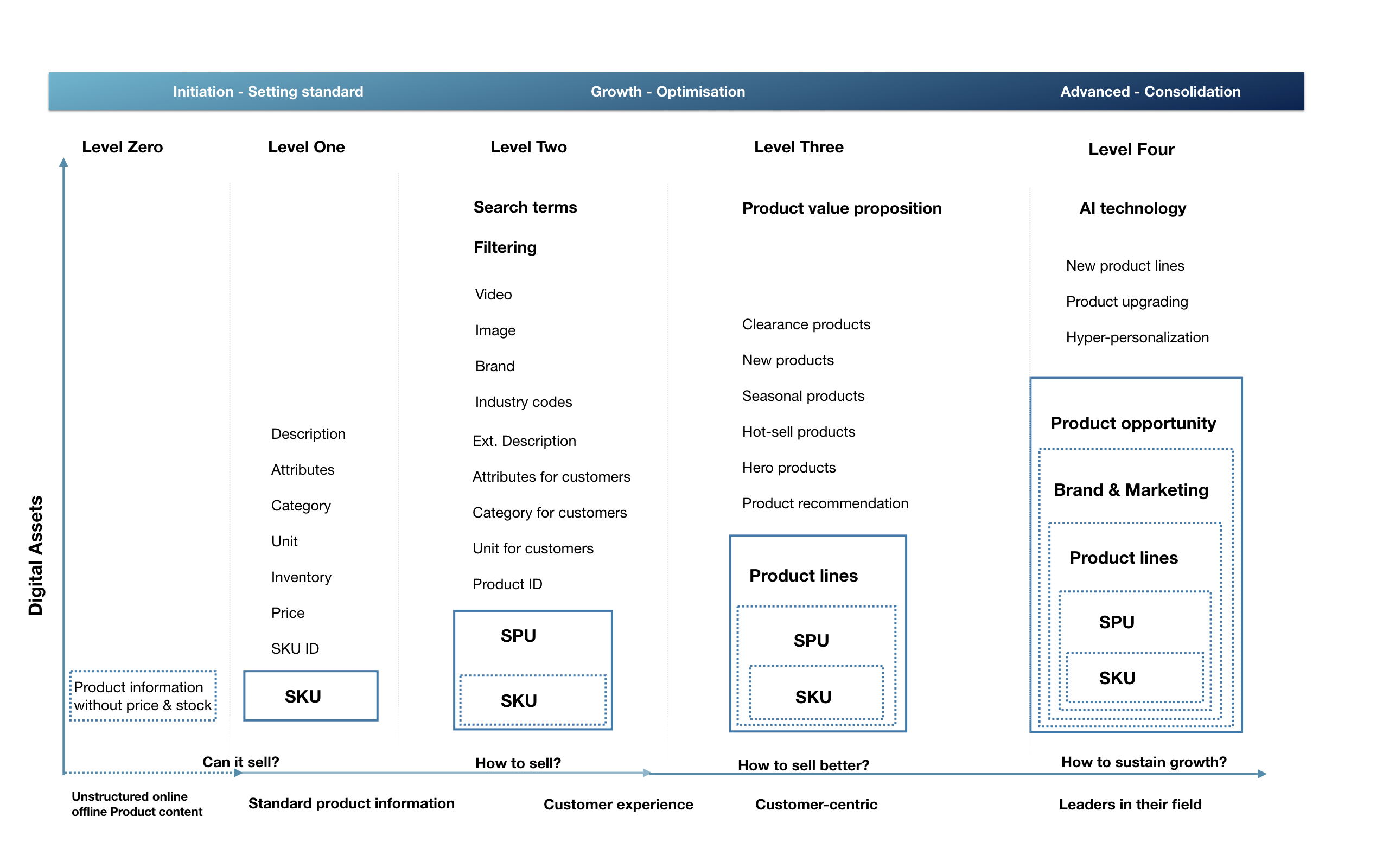

First, let's look at the following chart for a quick recap of what the Initial, Intermediate, and Advanced stages of Digital Maturity look like for various aspects of the business:

As we can see, as companies move through the stages of digital maturity and transform their offline business models to online, they need to become more sophisticated in their approach by leveraging various tools that a digital footprint can offer in terms of asset management.

Digital Assets and Implications for B2B

In the context of eCommerce, digital assets can refer to the digital material owned by a business, and can commonly be divided into Product & Brand assets:

Product Assets

- Product catalogs

- Multimedia (for example product pictures)

Brand Assets

- Brochures

- Case studies

- Testimonials

As simple as this sounds, given the diverse, wide-ranging, and highly specialized nature of most of the products in the B2B sector, managing these digital assets can easily become quite complex and digitalization might not be as straightforward as with B2C operations.

Even for organizations with high digital readiness, the need for accommodating various purchase scenarios such as Direct or Adjusted Repurchase, as well as New Purchases presents the question of how to best display, manage products, and optimize the business logic in a way that matches the purchasing needs and user requirements of corporate buyers.

For an introductory guide on getting started with B2B eCommerce, check out our blog on B2B eCommerce: 4 Phases for your Digital Transformation JourneyWe explore some of the ways B2B eCommerce digital transformation can help your brand, and the steps you can take to succeed.4 Phases for your Digital Transformation Journey

Building a Digital Product System that leverages your Digital Assets

As previously discussed, the complexity of business workflows, user-facing strategies, and long-term business growth demands make digitalization in B2B a process that is better tackled by stages.

From product conceptualization to business logic optimization along the product line, let's look at how organizations in every stage of Digital Maturity can build a digital product system, leveraging its digital catalog, product marketing content, user experience, and operational content resources. This framework can give B2B brands the tools to progressively answer the following questions:

- Can it be sold?

- How can it be sold?

- How can it be sold better?

- How can long-term growth be maintained?

The following figure shows the buildup of digital assets through the different stages of digital maturity:

Now, let’s now go through this process in more detail for each of the stages.

Early Stage – Setting Standards

B2B eCommerce companies in the initiation stage of digital maturity are limited in their digital approach and will have traditional methods of utilizing their product and brand assets. They will also be more traditional in the way they market their product line and are still likely pondering the question "can it be sold?" about their products.

With little or nothing in the way of customer insight data, companies will still be deciding what products to actually sell, and are not yet set on their product lines. The Initial Stage can be divided into segments:

0. Level Zero: Unstructured Online and Offline Product Content

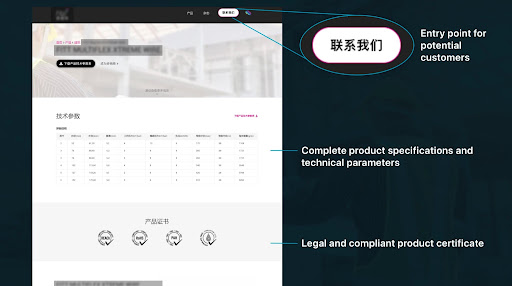

At this level, companies at the very beginning of their digital transformation journey will likely have just basic product information on their website, with no listing of a product’s price or stock levels. Others may not even sell their products online or have a website yet, with communication limited to offline brochures or product information with little to no coherent structure. Digitalization typically takes the form of a corporate website.

Let's look at an example of a B2B company website for Level 0, where only basic product information is shown and no online purchase options available:

Companies at this stage will likely also have little in the way of a customer base or at least loyal customers, and users become potential new customers through inquiries, and interactions cannot result in a completed order. Therefore, the next logical step to scale operations is setting up a means to sell onlinean SKU system, and a website to sell their stock, as soon as possible.

What is an SKU?

SKU stands for Stock Keeping Unit. It is a unique code of numbers and letters that enables the digital identification of a product by the seller. The main two benefits of SKUs are:

- Inventory Tracking: Since every SKU consists of a unique code, products can be identified individually, which can help to accurately track products from dispatch in the warehouse to delivery, and inform you when stocks need to be replenished. Keeping track of inventory flows can also give companies a picture of the sales performance of products, giving useful insights to the sales and marketing departments on which products they can push in their promotions.

- Improve the customer experience: In B2B, product specifications can be very specific and be hard to distinguish from others. However, having an SKU takes this potential issue away. Merchants can also quickly offer alternatives to customers if the product they have requested is out of stock.

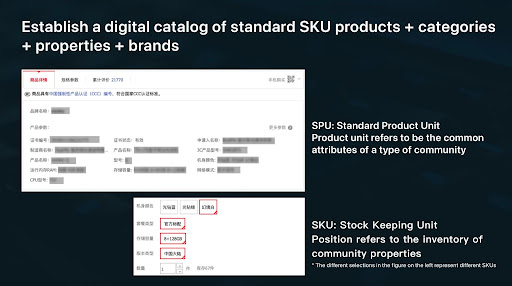

1. Level One: Standardized Digital Product Catalog

In terms of digital assets at Level 1, they are likely to be limited to online product catalogs, where the customer can browse the products but will likely still need to go offline to make purchases. However, SKU data can be consolidated by integrating your company’s Enterprise Resource Planning (ERP) program with eCommerce solutions such as Adobe Commerce.

How Digital Catalogs Can Kickstart B2B Lead Generation SuccessWe look into how building a digital catalog can be a smart, cost-effective strategy for B2B companies to start their digital transformation journey and enhance lead generation.Building a digital catalog can be a smart, cost-effective strategy for B2B companies to kickstart online lead generation.

On the software, inventory information and real-time data of the product can be maintained, and various back-end business processes integrated, thus facilitating the process of product delivery from warehouses.

Mid Stage – Continuous Optimization

By the intermediate stage of digital maturity, companies have begun to expand their channels to include mobile and implement an expansion in the product searching functions for the customer. Just like the early stage, we can split the growth stage into two segments:

2. Level Two: Developing Customer Experience

Initially, as a company moves into this first segment, they are pondering "how can it be sold?" regarding their product, now thinking more about the customer experience. Also, there is a scaling of their digital efforts. As a consequence, the number of digital assets that a company possesses and they have at their disposal increase significantly in this stage.

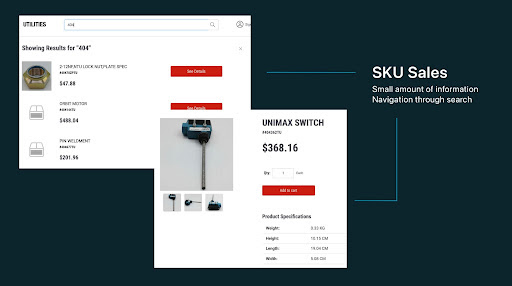

In this stage, product information begins to be expanded beyond simply SKUs. The Standard Product Unit (SPU) is also introduced.

What is an SPU?

The SPU is similar to the SKU in that it is essentially the product ID, but it is used for the purposes of the customer, not the seller:

- As well as identifying the product itself, the SPU gives specifics about the size, type, and color of the product.

- With the SKU, customers are able to find the exact product they want quickly and easily. For the B2B eCommerce customer, this is a very important factor, because they are often very specific in what they are looking to purchase.

From this stage, the product brochure is expanded into a product database, and at the same time, the eCommerce process where each product can be added to the shopping cart is started. Industry standards should be the basis of the database, with products being described with professional industry terms and structured fields to form a unified standard.

The digitalization of B2B product information is difficult, mainly due to the large number of SKUs, complex parameters, and high upload and maintenance costs. It may be wise therefore to implement digitalization processes in the company in phases, so as not to overwhelm company resources.

You may be interesting in reading: Magento: Key Features for B2B eCommerce GrowthAdobe Commerce (Magento) is a powerful eCommerce Solution, check out our overview of the top B2B features for enterprises.Adobe Commerce (Magento): Key Features for B2B eCommerce Growth

Additionally, by this stage, there should be more search options for customers, including a filtering function. Categories should be expanded, as well as descriptions and images of the product. The brand information and videos of the product may also be included, and industry terms specific to the product used as part of the description.

Also, there should be a wider range of product details, including pictures, manual downloads, and the use of industry-standard codes for product authentication, such as CAS codes for chemicals products.

Here, customers will start to leave their digital footprint, by way of things like pages they have browsed, and items they have purchased. This information will be able to be picked up by data analytics tools. Although the company will lack the technical capabilities to act upon this data yet, this data will prove to be very useful for helping to steer the direction of elements of the company’s brand strategy going forward.

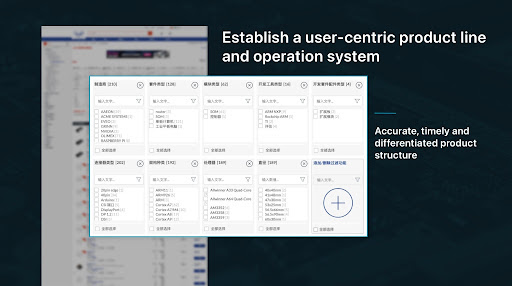

3. Level Three: Building User-Centric Product Lines and Operating Systems

Moving into the next segment, companies will start to implement a customer-centric approach, with the goal of cultivating long-term customer relationships and loyalty, and customers making repurchases on a consistent basis.

The company by this stage will have figured out how to sell, but should now be thinking "how can it be sold better?" meaning how can they successfully market their products. Furthermore, companies will likely have begun to have forged long-term relationships with customers—something very important in B2B. But, how can these relationships be consolidated, and how can brand loyalty be built up?

- Complete product data: Continuously improving search, filters, and results, allowing users to perform more precise searches based on product characteristics and improving operational efficiency.

- Accurate promotion of special features: For example, integrating online and offline sales and establishing clear product data standards.

- Use sales volume, competitive analysis, and traffic analysis to shape core, new, seasonal, and trending product lines. Identify “explosive” products that meet customer needs, guiding SKU analysis for customer selection.

- Explore product relationships and recommendations: This is crucial to optimizing the product experience.

- Leverage operational metrics: Enhance the perception of brand and product value from aspects such as functionality, emotional connection, and social influence, ensuring competitive positioning. For instance, premium brands should focus on quality and reliability to increase market recognition and brand value.

By this stage, companies should be looking to build up an emotional connection between the customer and the product. This should be a fundamental goal of any product marketing strategy, but it will differ in its approach from B2C.

Through the analysis of customers’ consumption behavior, personalization can match customers with products that will fit their preferences. But B2B customers will be more swayed by the technical specifications of the product more than anything else. They want (and need) products they can rely on over a long period of time, not something they may enjoy on impulse.

By this stage, optimization should be at the core of operations, so an emphasis should be placed on improving product data, continuously improving search functionalities, screening, and other results, sorting out product marketing characteristics (with the integration of offline sales), and building data standards for each product line. Attributes should now come with a considerable amount of detail, as shown in the example below:

Mature Stage – Growth and Expansion

4. Level Four: Category Growth with Integrated Business Models, Strategies, and Industry Trends

When companies eventually reach the advanced stage of digital maturity, they are thinking about how can long-term growth be maintained. Realistically, not many companies are in this stage yet—only long-established companies, leaders in their field, who possess the digital infrastructure capabilities that are currently beyond most companies who are still yet in the stages of growth when it comes to digital maturity. But in the coming years, as more and more companies expand their digital operations, this bracket will inevitably grow in size:

- Penetration of Related Categories: Creating demand scenarios and splitting existing categories into segments for expansion and upgrades.

- Increased Repurchase: Expanding category demand scenarios, extending the category's lifecycle, and triggering frequent repurchases, activation, and retention of old customers.

- Upgrading Value: Customer purchase upgrades, product packaging upgrades, function/attribute upgrades, creating emotional value based on emotional appeal.

- Expansion into Related Categories: Identifying new opportunities through industry trends, exploring category segmentation and value chain extension into new categories.

The brand strategy by this stage should be a consolidation of the foundations of growth that have already been laid and incorporate artificial intelligence (AI) technology and big data analysis to shape the customer experience. The increasingly sophisticated algorithm software can be used by this stage to step up predictions of market trends, identify the core competition pattern of categories, and gain insight into new potential categories and products, and upgrading of products.

Additionally, by this stage, hyper-personalization is used commonly by companies. AI can track past customer behavior data to present product feeds specifically tailored to the customer.

Looking for inspiration? Check out our selection of 10 Outstanding B2B Magento / Adobe Commerce SitesWe cover 10 B2B eCommerce websites built on the Adobe Commerce (Magento) framework, from multi-vendor to self-operated platforms.10 Outstanding B2B websites with advanced features

Also, analysis of big data and industry trends can now be used to determine what new categories can be created, and what strategies can be devised to wake up dormant customers. Brand and marketing teams should by this stage be extensive, so a full range of digital assets are used in their campaigns, with video being used as a big part of their marketing.

Leveraging your Assets into full Digital Maturity with TMO

B2B eCommerce digital transformation is a multi-phase process, requiring thoughtful planning and the right tools. From building a robust product catalog to integrating offline and online channels, each phase is critical for success.

TMO specializes in crafting tailor-made digital experiences for B2B users, as well as developing integrated systems and procurement flows that can support your digital operation. If you'd like to know more about how your B2B brand can benefit from digital transformation or eCommerce integration, don't hesitate to contact our experts at TMO and discuss which online strategy might be the best fit for you.