Despite being the second-largest market after the US, Direct Sales in China in 2025: Market Overview, Top Companies, TrendsDirect Sales is a rich although peculiar market in China. In this post we will look at the Direct Sales regulatory landscape, key players (international and local), and examine challenges and trends.Direct Selling in China has long been characterized by strict regulations that set it apart from most other markets where the line between this sales model and Multi-level Marketing is more blurred.

Starting with the 2005 "Regulations on Direct Selling Management", the government addressed unethical practices and drew a clear line between itself and pyramid selling, which decided to only allow for Single-level Sales within the country. This drove traditionally Direct Selling in China: Multi-Level Marketing, But Not As You Know ItTraditional MLMs had to adapt their businesses to China's strict requirements on direct selling models, and now the business looks very different.Direct Sales-driven firms to adapt their business model in China by employing multichannel strategies such as D2C and eCommerce to grow their business—as of 2023, only 88 companies hold a direct selling license, generating upwards of 878.5 billion yuan (around US $120.9 billion) in revenue over the last 10 years.

TMO has 10+ years experience designing and implementing fully compliant cross-border and multichannel eCommerce strategies for overseas direct selling brands.

In recent years, the Chinese government has worked closely with direct selling companies to foster a more supportive yet structured environment for growth as evidenced by major regulatory discussions and meetings in 2024. Could this signify a new chapter marked by promising regulatory reforms and industry-wide efforts to modernize and adapt? In this article, we will explore 6 positive signals for direct selling in China according to 2 gatherings that took place this year with high-level industry and government actors, offering insights for brands seeking growth in this dynamic market.

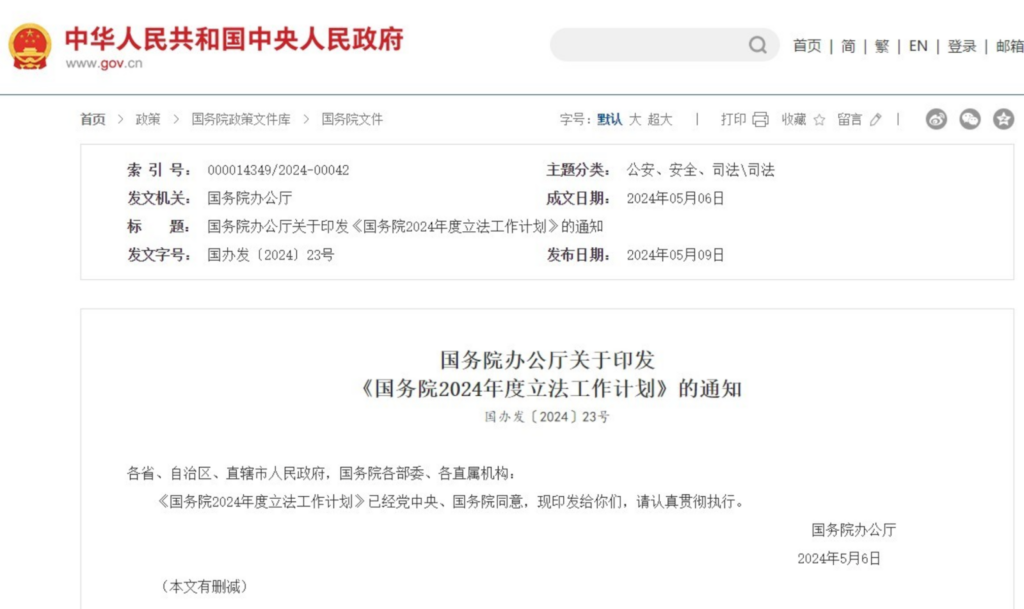

1. State Council to Revise Direct Selling Laws

On May 9, 2024, the General Office of the State Council issued its annual legislative work plan for the year. This document—which outlined seven areas of focus 21 draft laws to be submitted, and 30 administrative regulations to be amended—includes both the "Regulations on Direct Selling Management" and the "Regulations on Prohibition of Pyramid Selling" promulgated in 2005 in the list of preliminary revisions.

This significant shift reflects the growing recognition of the industry's potential to contribute to economic growth, and a concrete follow-up to the Roundtable on Direct Selling Companies’ Fulfillment of Social Responsibilities hosted by the "Price Supervision, Inspection and Anti-Unfair Competition" Bureau of the State Administration for Market Regulation (SAMR) that was held in Beijing in March this year.

In this meeting, leaders affirmed that while the two aforementioned laws had played a positive role in standardizing the direct selling industry, and publicly stated for the first time that with the development of China's economy, some provisions in them were no longer compatible with current economic growth, further showing how the State intends to address the situation:

- The Ministry of Commerce (MOFCOM) is working with the State Administration for Market Regulation (SAMR) to actively promote the revision of these regulations, with a focus on guiding direct selling companies to innovate, develop, and standardize operations.

- The SAMR has formulated a mature draft revision of the "Regulations on Direct Selling Management" and is currently optimizing relevant regulatory rules.

- The Ministry of Justice has included the revision of the two regulations in the 2024 legislative plan of the State Council.

2. Moving from a "Positive" to a "Negative List"

During the same Roundtable, another hot topic of discussion was the possibility of a major shift in scope for direct selling products.

Historically, direct selling in China have been governed by a “positive list” of permissible products, limiting the types of items companies can sell. The proposed shift to a “negative list” approach, wherein only prohibited items are specified, represents a dramatic expansion of product possibilities. This flexibility opens new opportunities for companies to diversify their product offerings, particularly in high-demand categories like health supplements, wellness products, and beauty items.

We recently covered wrote about the opportunities, business models, and regulations for China market entry in our China Market Entry: A 2025 Guide for Foreign Supplement BrandsFrom establishing a legal entity to selecting entry mode, logistics, & sales channels, these are the key routes for a successful China entry.China Entry Guide for Foreign Supplement Brands.

3. Pilot Program for Multi-level Direct Selling in China

At the Roundtable, the General Administration also announced that it would select the best direct selling brands from among the licensed direct selling companies for Multi-level Direct Selling pilot projects. The meeting revealed that the pilot project had been approved in terms of procedures, and the General Administration will communicate closely with the Ministry of Commerce to implement it.

For further reading, read how Direct Selling in China: Multi-Level Marketing, But Not As You Know ItTraditional MLMs had to adapt their businesses to China's strict requirements on direct selling models, and now the business looks very different.Multi-level Marketing had to change in China and the trend towards hybridization and a multichannel approach.

4. Establishment of a China Direct Selling Association

At the meetings, the relevant leaders of the General Administration have also announced the promotion of a Direct Selling Industry Association in China after communicating with the Ministry of Civil Affairs. As the supervision of Direct Selling involves multiple actors, the relevant departments of the General Administration are also actively communicating with other ministries and commissions, including the Ministry of Commerce.

Regulatory bodies have emphasized a more collaborative relationship with direct selling companies, inviting industry players to contribute to discussions on policy refinement and market best practices. This collaborative spirit was evident at the 2024 conferences, where industry representatives and regulators worked together to outline a roadmap for future growth, and a commitment to balancing regulation with industry support.

5. Direct Selling License Approval System will not change

One important aspect to emphasize from the meeting is the State Administration for Market Regulation clearly stating that even if the two regulations are revised and passed, the core direct selling license approval system will not be changed, meaning that enterprises without direct selling licenses will not be allowed to engage in direct selling business activities.

The top direct selling brands adopt a multichannel approach. Learn how TMO helps companies leverage Cross-border eCommerce and Social Commerce for success in China.

6. Possible License Annual Review and Renewals

Held from October 15th to 16th in Shanghai, the International Seminar on Direct Selling Regulation and Law Enforcement was organized by the State Administration for Market Regulation (SAMR) and its Price Supervision and Anti-Monopoly Bureau, alongside international regulatory bodies. The seminar, themed “Guard, Develop, Win-Win,” focused on fostering a transparent, fair, and dynamic direct selling market. Attendees included representatives from regulatory enforcement agencies, direct selling associations, and leading domestic and international direct selling companies. Key participants included over 60 direct selling companies such as Amway, Mary Kay, Perfect (China), Sunrider, and international brands like Atomy and PM-International.

Another major signal for the industry revolves around the potential for “annual reviews” and “renewals” of direct selling licenses. This approach could reflect a shift towards more dynamic oversight and accountability, ensuring that only compliant and ethical businesses operate in the market, all while streamlining the license renewal process to encourage continuous compliance while reducing administrative bottlenecks for responsible companies.

Future Outlook: Balancing Consumer Protection with Industry Growth

The focus of these reforms extends beyond compliance. The government’s willingness to collaborate with the industry underscores its recognition of the economic contributions made by direct selling companies. With a commitment to fostering economic growth, these reforms aim to create an environment where businesses can thrive under fair and consistent regulations. Initiatives such as streamlined administrative processes and improved communication between regulators and businesses are expected to enhance operational transparency and build greater consumer trust.

To explore more about how digitalization, retailization, and multi-channel strategies are driving the transformation of China’s Direct Selling industry, check out Digitalization, Retailization, and Multi-channel Trends in China Direct Selling IndustryDiscover success cases and key measures as valuable references for overseas brands amidst the trend of digitization, retailization, and multi-channel sales in China's direct selling industry.Digitalization, Retailization, and Multi-channel Trends in China Direct Selling Industry.

The industry, historically known for its relationship-driven approach, now finds itself navigating a modern landscape defined by technological innovation, heightened regulatory standards, and an increasingly discerning consumer base. 3 Keys that are likely to drive direct selling in China are:

- Leveraging Digital Platforms for Growth: Mobile CRM systems, digital training platforms, and data analytics enable distributors to provide tailored recommendations, manage customer interactions in real-time, and track sales performance with precision. By embracing these tools, distributors are evolving from traditional sales representatives to digitally-savvy brand ambassadors, capable of building deeper, data-driven relationships with customers.

- eCommerce and Direct Selling Convergence: By establishing a digital presence, businesses can blend traditional in-person engagement with the convenience of online shopping. This multi-channel approach offers consumers seamless access to products, combining personalized service with digital convenience. Brands such as Herbalife have embrace D2C selling in China.

- Social Commerce: Real-Time Consumer Engagement: The rise of social commerce, characterized by live-streaming, influencer collaborations, and community-driven engagement, is reshaping how direct selling companies connect with consumers.

If you are looking to take your eCommerce operation in China to the next level, TMO offers a suite of digital solutions from legal compliance, to market entry, social commerce, web design and development services. Reach out to our team of experts to discuss how we can make your project a reality.