From March 30 to April 2, TMO Group took part in the 2025 Foodaily Expo in Shanghai, one of the region's most influential showcases for food and beverage innovation. With over 4,000 new products on display and 5,000+ industry decision-makers in attendance, the event brought together pioneers across the F&B value chain to rethink category innovation, brand building, and new retail models.

TMO's participation centered around high-potential markets such as North America, the Middle East, and Southeast Asia (SEA). At the "Going Global" forum, TMO Business Director Jing Zhou, served as chairperson and speaker, sharing insights drawn from years of cross-border eCommerce work in SEA. While the forum primarily spotlighted the outbound journeys of Chinese brands, the underlying takeaways resonated widely for any international company eyeing regional growth in this dynamic market.

TMO offers Marketplace Intelligence Services that help global brands localize and compete smarter in Southeast Asia.

In this recap, we’ll cover key takeaways from the session and show how SEA is emerging not just as a growth destination for Chinese brands, but a strategic battleground for local disruptors, regional champions, and global giants alike.

The Three Pillars of Cross-Border Growth

In her keynote address, Jing Zhou reframed the traditional export mindset through a lens of long-term, regional brand building. She highlighted three foundational pillars that consistently define success when entering new markets, particularly in complex, fragmented eCommerce landscapes such as SEA's:

1. Product Relevance Through Local Use Cases

It's not enough to ship what's selling at home. Brands must understand how products are actually used in the target market. One hotpot base brand, for example, discovered through data analysis that a significant portion of American buyers were using the product to make spicy pizza. This insight led to a new format, tailored recipe content, and a dramatic rise in adoption by non-Asian consumers.

2. Trust Infrastructure for Digital-First Markets

From regulatory compliance and payment options to reviews and customer service, building trust is a prerequisite for growth. Brands entering SEA must localize credibility signals across multiple touchpoints. This includes working with local creators, investing in product education, and maintaining consistent omnichannel messaging to build emotional and transactional confidence.

Ready to scale into Asia? Explore our Asia Market Entry Solutions to build your go-to-market strategy.

3. Scalable Operational Strategy

SEA expansion requires more than a marketing plan—it needs operational backbone. From market entry models and supply chain flexibility to data-driven decision-making and multi-platform logistics, scalable systems separate one-time success from sustained growth. As Jing Zhou noted, brands with a systemized go-to-market framework are significantly more resilient than those operating opportunistically.

Together, these three pillars represent a shift from transactional thinking to strategic regional integration—a playbook not just for Chinese exporters, but for any brand aiming to win in SEA.

How SEA F&B Trends Are Being Shaped by Local and Global Brands

A recurring theme throughout the event was the competitive interplay between global giants and regional upstarts across markets . On categories from cooking staples to plant-based beverages, both multinationals and local brands are adapting to rapidly shifting consumer preferences.

Some key dynamics that stood out:

- Category Leadership Is Fragmented, Not Dominated. While global brands like Nestlé and PepsiCo perform strongly in beverages and dairy, local brands still lead in food staples, sauces, and niche snacks. In some countries, the top 10 brands make up less than 10% of the market, showing just how open the landscape remains.

- Local Flavor Innovation Pays Off. In markets like Vietnam and the Philippines, regional players are winning with SKUs tailored to traditional flavors and culturally resonant formats. Brands like Vinamilk, Gao ST25 rice, and Pasarteh demonstrate how local heritage is being turned into modern eCommerce success.

- Health-Forward Positioning Is Going Mainstream. Zero-sugar drinks, oat milk, functional dairy, and kombucha are no longer niche. These segments are gaining traction across SEA, especially among younger and urban consumers. Global brands that lead in this space—like Abbott, Oatside, and Pokka—are being joined by nimble local entrants with category-specific innovation.

- Price Bands Vary Widely by Market. Products in the $2–$10 range dominate across the region, but premiumization is clear in segments like dairy (Vietnam, Malaysia) and beverages (Singapore). This suggests space for both mass-market and aspirational positioning strategies.

For brands evaluating SEA market entry or expansion, these patterns offer not just inspiration but tangible pathways to differentiate and scale.

Using Data to Navigate the SEA Opportunity

As markets grow more saturated and consumer preferences fragment across borders, gut feeling is no longer a sufficient compass for expansion. This is where TMO’s eCommerce market intelligence comes into play.

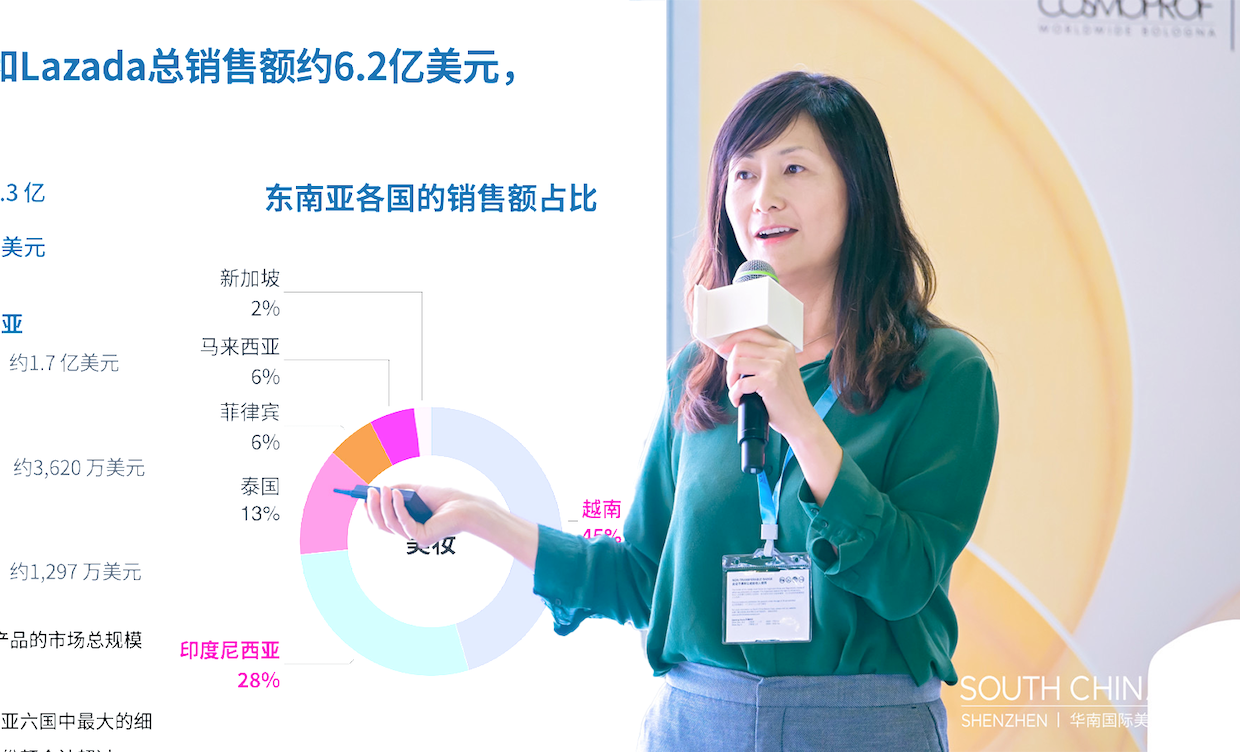

During the forum, TMO presented highlights from its latest Food & Beverage (Southeast Asia Outlook September 2024)This free PDF looks at the food & beverage market in Southeast Asia: market segments, price ranges, popular brands, and much more.Food & Beverage eCommerce Sales Outlook for Southeast Asia, a data-driven report covering six key countries and nearly 1 million SKUs across Shopee and Lazada. The report surfaces:

- Category breakdowns by country and price band

- Market share shifts among leading local and international brands

- Cross-border performance of functional, plant-based, and health-focused products

- Emerging subcategories and innovation pockets

These insights help brands move beyond surface-level assumptions and instead prioritize markets and product segments based on real buyer behavior.

Looking for resources across multiple industries? Browse our full library of free downloadable reports.

Roundtable Reflections and Final Takeaways

The "Going Global" forum wrapped up with a high-energy roundtable discussion moderated by Jing Zhou. Executives from leading F&B brands—including hotpot chain Xiaolongkan, digital-first exporter Qumeili, and smart food manufacturing brand Pandian—shared their candid perspectives on market selection, cultural adaptation, and supply chain resilience.

What stood out most was the diversity of strategies:

- Xiaolongkan emphasized the balance between digital marketing and traditional distribution when entering new markets.

- Qumeili highlighted the importance of validating product-market fit before scaling through platforms like Amazon or TikTok.

- Pandian shared how automated production lines have enabled faster localization of SKUs for different regional palates.

Whether facing pricing pressure, localization challenges, or regulatory hurdles, the consensus was clear: there’s no shortcut to regional success without deep market immersion and long-term commitment.

For brands entering these markets, TMO's Southeast Asia eCommerce Solutions cover market intelligence and digital compliance services.

For TMO Group, this event reinforced our mission: helping brands—wherever they come from—build meaningful, scalable businesses in SEA and the rest of Asia. From foundational market research to tailored strategy and operational execution, we’re here to partner with you on every step of your regional journey. Get in touch today to explore how we can support your project.