For many brands expanding internationally, marketplaces like Shopee, Lazada, Tmall Global, and Amazon are the obvious launchpads. They offer a lower-cost model to initially test the market thanks to built-in traffic, streamlined logistics, and trusted payment infrastructure—all of which remove friction from selling online.

...but what happens once your brand has demonstrated product-market fit?

As your business grows, so do the hidden costs and constraints of relying exclusively on public domain traffic* (i.e., third-party marketplaces). You don’t own the customer relationship. You can’t fully control your pricing, merchandising, or experience. And worse, every order you fulfill becomes less profitable over time as commissions, advertising, and fees stack up. That’s where Direct-to-Consumer (D2C) eCommerce comes in.

Selling via private domain traffic* (e.g., your brand-owned website) offers a complementary path to build long-term brand equity, improve margins, and create a loyal customer base you can actually reach. But making the shift requires clarity: not just about tech, but about business model, costs, and control.

*In Asia eCommerce, these terms are commonly used to distinguish the different traffic pools: Private traffic includes a brand's official website, apps, and its WeChat mini-program, accounts, and communities. Public traffic includes social platforms and third-party marketplaces.

In this article, we’ll compare marketplaces and D2C models through the lens of cost, flexibility, and growth, and explore when it’s time to take more control of your brand’s traffic.

TMO provides brands expanding into international markets with Global eCommerce Solutions, from custom web development to design localization as well as system integration.

1. Marketplace vs Branded Website: The Cost That Grows With Your Success

Marketplaces are built for ease of entry. You can create a flagship store, list products in a few clicks, tap into massive traffic, and let someone else handle payment processing, fraud protection, and even last-mile delivery. For new brands, it’s the obvious move.

But with scale comes cost—and most of it’s invisible at first.

Cost Analysis: Selling via Marketplaces

Let’s break down the real price of marketplace dependence:

| Marketplace Cost Drivers | Typical Range |

|---|---|

| Transaction commission | 10–20% of GMV |

| Platform or listing fees | Fixed or % of sales |

| Paid advertising (visibility) | Often required |

| Fulfillment/warehouse fees | Weight-based |

| Security deposits / onboarding (e.g. Tmall Global) | US $5,000–$15,000+ |

Across Shopee, Lazada, Amazon, and Tmall, the cost model is performance-based—but not always in your favor. As your GMV grows, so does your total fee exposure. The more you sell, the more you pay, not to your team or your tech stack, but to the platform.

Cost Analysis: Selling via D2C Branded Website

By contrast, D2C website costs tend to be front-loaded and more predictable:

| D2C Cost Drivers | Typical Range |

|---|---|

| Initial Website Development (Enterprise) | Highly variable, US $30,000 |

| Platform subscription/license | US $300–$2,300/month |

| Payment gateway fees | 1.4%–3.5% per order |

| Hosting & infrastructure | Traffic-based, predictable |

| DevOps / technical support | Retainer or hourly |

| Apps / integrations | Fixed or usage-based |

With D2C, you pay for ownership, not access. This unlocks a wide array of possibilities to grow, retain, and nurture your customer base that are otherwise limited or unavailable through public domain traffic.

From Magento to Shopify and more, we previously compared the best solutions in our eCommerce Platform Comparison: Magento, Shopify, & moreFrom entry-level site builders to powerful eCommerce solutions, we ranked the top platforms, as well as their advantages and disadvantages.eCommerce Platform Comparison

Are Fees Killing your Brand? How to Save over US $2.2M Yearly

While it's obvious that marketplaces' huge traffic and resources have their place, especially for market entry projects in eCommerce, it is easy for brands to miss the financial inflection point that eventually catches up to their operation. This happens because D2C costs decrease proportionally as you scale, while marketplace costs generally remain fixed as a percentage of every transaction.

For a brand doing $50,000 USD in monthly GMV, marketplace fees alone can exceed $5,000–$10,000—not far from what you'd pay for an eCommerce implementation project with your own traffic, your own data, and your own customer list.

We usually see situations like these. TMO worked with one Chinese Cross-border brand having successfully entered the US market through Amazon, recently reaching US $10 million in annual sales. Let's look at their main operational costs:

| Concept | Amazon Operation |

|---|---|

| Platform Sales (Annual) | + US $10 million |

| Sales Commission (15%) | - US $1.5 million |

| Fulfillment by Amazon (FBA) Logistics Fee | - US $800,000 |

| Advertising (Amazon Ads) | - US $700,000 |

| Sales Margin (excl. COGS) | = US $7 million |

While sellers are immersed in the joy of "explosive orders", the platform is quietly devouring the real dividends of brand growth through commissions, advertising, and logistics costs. What's worse, with little to none ownership of customer data, remarketing capability, or control over product positioning, one can easily become a hostage to the platform. But what would it look like under a D2C operation?

| Concept | Branded Website Operation |

|---|---|

| Platform Sales (Annual) | + US $10 million |

| Shopify Plus Transaction Fee (2.9%) | - US $290,000 |

| Advertising, Server, and Fulfillment | - US $500,000 |

| Sales Margin (excl. COGS) | = US $9.21 million |

As we can see, the difference is as much as US $2.21 million. That is enough money to set up a team of 10-20 people in the company's Shanghai headquarters, or even open up another production line. While it can take some time for a branded website to gain a similar traffic/order volume as a marketplace, the contribution margin speaks for itself.

This is not an isolated case. According to Marketplace Pulse data, the average profit margin of Amazon's top sellers had fallen below 10% in 2023, while the average profit margin of Shopify merchants in the same period remained at 22%-35%.

As an Adobe Commerce and Shopify certified partner agency, TMO can provide customized development to fuel your global ecommerce expansion!

2. A "Data Black Box": A Cost That Doesn’t Show Up on Your Balance Sheet

It’s easy to calculate commissions, shipping fees, and ad spend. But the real long-term cost of marketplaces isn’t in the transaction—it’s in what you don’t get to own or control.

During its "Amazon Era" (2019-2021), a huge pain point for this brand was its inability to determine the cause of user loss, as reporting limited the Marketing & eCommerce Operations teams to basic analysis on order count, ratings, and other traffic data. With a repurchase rate of only 15% that relied on the platform's natural traffic, and a 30% inventory backlog, they were also unable to effectively reach users.

Why are your Users Converting/Leaving?

After implementing its branded online store in 2022, the client enriched its data visibility to build a complete user portrait based on geographic location, device preference, website behavioral heatmaps, and shopping cart abandonment rate analysis. The following improvements were observed:

- 23% of abandoned checkouts were recovered through email marketing automation

- Repurchase rate increased 45% and inventory turnover reduced by 40%

- The product portfolio was optimized, discontinuing 12 slow-selling SKUs

Let’s break down the most critical data availability constraints and what enabled this improvements:

| Data Dimension | Public Traffic (Amazon) | Private Traffic (Brand Website) |

|---|---|---|

| User Click Behavior | ❌ Shows only clicks for search terms | ✅ Heatmaps and events to track navigation and each button click |

| Shopping Cart Abandonment | ❌ None | ✅ Records the specific steps leading to abandonment |

| Customer Lifetime Value (LTV) | ❌ Unable to calculate, limited to platform's remarketing | ✅ User stratification reporting, remarketing, segmentation, and loyalty |

3. The "Invisible Chains"of Marketplace Control

Traffic Control: Users do not belong to you

When you sell through marketplaces like Shopee, Lazada, Tmall, or Amazon, the traffic might be abundant — but it isn’t truly yours. The platform owns the customer, their data, and their journey. You can’t see who bought what, how often they return, or what makes them churn. And once that order is complete, there’s no direct line to bring that customer back—unless you pay the platform again.

In a D2C model, the traffic you generate becomes a long-term asset. Every visitor can be tagged, segmented, and retargeted. You’re not just collecting transactions—you’re building relationships. With the right tools in place, you gain the ability to:

- Build search equity tied to your brand through organic traffic (SEO)

- Offer email and SMS sign-up lists for owned re-engagement

- Segment customers based on behavior, not just demographics

- Launch personalized product recommendations and winback flows

- Retarget across channels (Meta, Google, TikTok) with precision

- Measure LTV, CAC, and repeat rate over time

Instead of paying for the same customer over and over, you invest once—and build equity with every interaction.

Limited Control over Brand Equity and Experience

Marketplaces are built for standardization, not storytelling. Your product listing looks just like everyone else’s — constrained by rigid templates and rules designed to prioritize comparison over brand value. You can’t choose how your content is presented, can’t test what works best, and can’t visually differentiate your brand from the dozens of others in your category. Your identity is flattened into a product title, a price, and a shipping estimate, and the users are trained to directly compare you based on this reduction.

The result? Brand equity gets lost in the scroll. Customers make decisions based on filters and discounts, not trust or affinity. Your product becomes a commodity, not a choice. And as more competitors enter your space, your ability to stand out diminishes—unless you keep lowering your prices.

D2C flips this dynamic. Your website becomes a canvas for brand-building—a place where you control every touchpoint of the customer journey. With platforms like Shopify Plus and Magento, you can:

- Customize product pages with rich visuals, videos, and content blocks

- Launch landing pages tailored to specific audiences or campaigns

- Test bundles, subscriptions, upsells, and A/B offers

- Optimize mobile layouts, checkout flows, and trust-building elements

- Reinforce your brand story at every step — from homepage to confirmation email

In short, you’re not just selling a product—you’re shaping an experience customers actually remember.

Platform Risk Exposure

One of the most overlooked risks of marketplace dependence is the fact that you’re building your business on someone else’s land. That means you’re always vulnerable to changes in the platform’s rules, fees, product visibility or worse, sudden enforcement actions you can’t predict or control.

In 2021, Amazon’s infamous “account ban wave” impacted more than 50,000 Chinese sellers, wiping out years of work and credibility almost overnight. The estimated total losses exceeded 100 billion yuan, with many businesses losing their primary sales channels. One major seller reportedly had $20 million worth of inventory stranded in Amazon’s warehouses after being banned for “suspected fake reviews.”

When you operate your own site, you control the rules, the risk, and the roadmap. That means:

- No fear of sudden delisting, policy changes, or algorithm drops

- Customizable return, warranty, and promotional policies (e.g., sweepstakes, loyalty programs)

- Full control over what’s featured, what’s promoted, and how you engage your customers

- Freedom to adapt quickly to regulatory changes across regions

4. Should You Leave Marketplaces Behind? Not Necessarily.

Despite the growing appeal of D2C, the solution isn’t always to walk away from marketplaces entirely. Platforms like Shopee, Lazada, Amazon, and Tmall have undeniable value: They drive discovery, simplify logistics and fulfillment, and are great for price-sensitive acquisition—but they shouldn't be your endgame.

A Smarter Approach: Marketplace for Reach, D2C for Growth

Think of your marketplace presence as your front door, and your D2C site, although will also drive discovery and branding, as the home you invite customers into.

- Use marketplaces to validate product demand, pricing sensitivity, and buyer behavior

- Direct repeat customers to your D2C site for personalized offers, lower prices (due to saved commission), and loyalty perks

- Use your D2C site to test product positioning, launch content campaigns, and build your CRM

This dual-channel model builds a flywheel, where the marketplace drives awareness, and D2C converts customers into owned audiences, reducing Customer Acquisition Costs (CAC) and fueling profitability.

When to Start Investing in D2C? The Marketplace Dependency Index

You don’t need to shut down your marketplace stores to justify D2C. You just need to ask:

- Is your monthly GMV over $30k–50k USD?

- Are you spending more than 10–15% of revenue on commissions?

- Are you relying on ads to re-engage customers who already bought from you?

- Are you launching new SKUs but can’t tell who your best customers are?

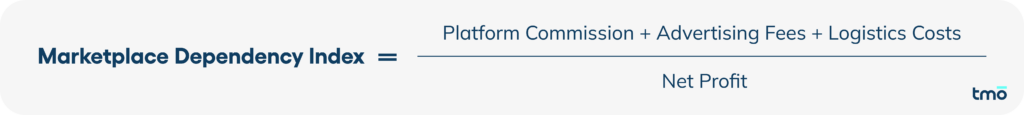

A good rule of thumb is to take your Marketplace Costs (Platform Commission + Advertising Fees + Logistics Costs) and divide them by your Net Profit. The result can shine light on the urgency to establish D2C operations:

- >50%: Consider establishing a Branded eCommerce Website as soon as possible.

- 30%-50%: Establish a test store within 6 months.

- <30%: Optimize existing channels and gradually migrate data.

Which Platform to Choose? Shopify Plus vs Magento

At TMO, we tend to work with 2025 Buyer's Guide for Magento (Adobe Commerce): Costs, Features & AlternativesWe cover the ins and outs of Adobe Commerce (Magento) in order to help you make the best choice for your business, exploring key functionalities, use cases, and examples of successful implementations.Shopify Plus and Magento Open Source for most of our Global eCommerce projects. Feature-specifics and requirements aside that might point brands in one direction or the other, we normally can provide a starting recommendation based on the general operation of one brand:

| Dimension | Shopify Plus | Magento (Adobe Commerce) |

| Brands Best-suited for | Annual sales of US $500,000-$20 million with quick-start demands | Annual sales of US $5 million and over, and in-depth customization needs |

| Technical Threshold | Low (visual editor + use of plugins) | High (requires professional web development team) |

| Typical Costs | Monthly license (from US $2,300 /yr) + Transaction Fee (2.9%) + Development Fee (US $30,000+ /yr) | Server + Development Fees (US $50,000+ /yr) |

| Core Advantages | Stress resistance for big promotions, one-click deployment in multiple languages | Open Source, free customization, and complex business logic support |

Grow Your Private Traffic Pool with TMO's D2C Solutions

Of course, independent brand websites are not a panacea. The initial development, design, and online investment, as well as the subsequent technical maintenance and marketing promotion, all require sellers to make reasonable budgets and control risks. However, it is these initial investments that bring independent control over user data and brand assets.

- Initial investment : website development, domain name and server fees, etc., are one-time investments and can be considered an investment in future long-term benefits;

- Post-maintenance : Compared with the constantly optimized advertising fees and commission fees, it is more fixed and controllable;

- Promotion costs : can be flexibly adjusted according to actual results, and the successful marketing of independent sites can often bring long-term and stable private domain traffic to the brand.

Therefore, it is recommended that companies should not only focus on short-term cost comparisons when making channel selections, but also pay more attention to the accumulation of long-term brand assets and the value of user data.

Marketplaces are where many brands begin and for good reason. They provide traffic, infrastructure, and instant reach. But long-term success isn’t about renting growth. It’s about building a foundation you control. If your brand is scaling fast on Shopee, Lazada, Amazon, or Tmall Global, now is the time to evaluate whether your current infrastructure supports your next stage of growth or holds it back. Ready to take the next step? Reach out to TMO's team for an expert consultation into your eCommerce lifecycle!