Direct selling is a business model that involves person-to-person selling. In the Chinese Direct selling market, only single-level sales are allowed, and multi-level marketing, which is recognized in Western markets, is prohibited. In recent years, the traditional direct-selling model has gradually integrated online platforms and social media, bringing new development paths for direct-selling companies. The transformation of direct selling brands in China is characterized by trends in digitalization, retailization, and multi-channel sales.

For multi-channel sales, by leveraging social e-commerce platforms, third-party platforms, online-to-offline (O2O) models, private domain operations, and live streaming, direct sales companies can quickly expand their brand influence.

Table of Contents:

- Direct Selling and Health Supplement Market Trends in China

- Digitalization: Exploring Digital Transformation

- Retailization: Embracing the D2C model

- Multi-channel Sales of Direct Selling Products

Direct Selling and Health Supplement Market Trends in China

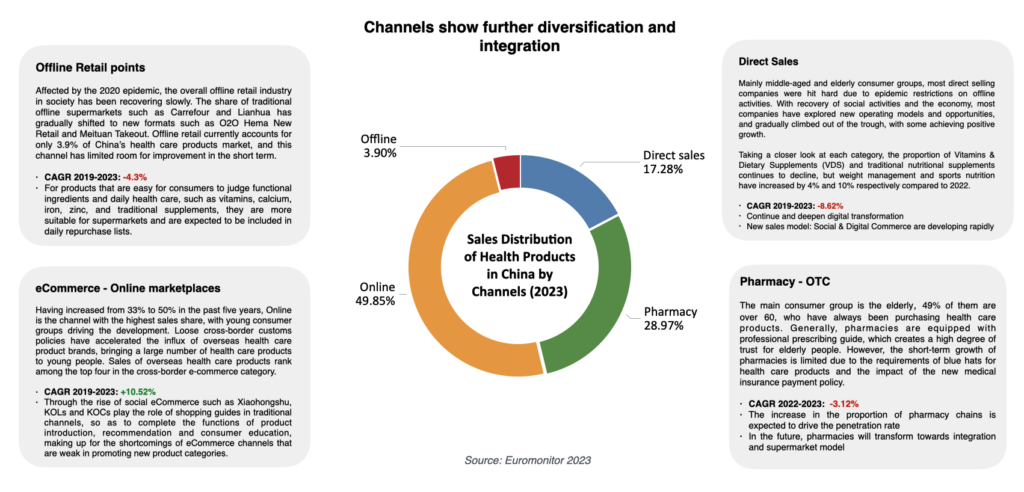

For a long time, direct selling has been the primary sales model for health supplements in China. In the early stages, the model of sales representatives acting as both consumers and promoters effectively built up consumer trust. However, due to direct selling regulations in 2019, product saturation, customer iteration, and channel markups have challenged the direct selling model. From 2019 to 2022, the share of health supplement sales through offline Direct selling channels declined from 30.3% to 17.3%–a compound annual growth rate (CAGR) of 8.62%.

Online purchasing channels provide consumers with a wide range of products and convenience in purchasing, leading to a shift in purchasing channels, particularly among younger consumers. The impact of the COVID-19 pandemic has further accelerated the growth of the online channel, with the share of health supplement sales through online channels surpassing 30% in 2020. On the other hand, older consumers are more willing to purchase products recommended by their acquaintances, highlighting the strong social nature of direct selling. These trends also indicate the significant potential of social e-commerce in the industry.

Health supplement sales channels in China

Digitalization: Exploring Digital Transformation

In order to adapt to the new market environment and changes in consumer behavior, direct sales brands are embracing digitalization and exploring ways to improve business efficiency and customer experience.

Nu Skin: has launched the "2025 Nu Skin Vision" and the EMPOWERME strategy, aiming to create a comprehensive digital ecosystem that connects customers, distributors, and operators. Nu Skin actively explores the integration of virtual digital personalities with the brand. In late July 2022, Nu Skin unveiled its first virtual spokesperson, Vera, who made an appearance at the launch event of the brand’s new product LumiSpa iO. In the 20th anniversary of its Chinese mainland market entry, Nu Skin has focused on the three core factors of products, technology and community mentioned in the “Empower Me” strategy.

Nu Skin unveiled its first virtual spokesperson, Vera

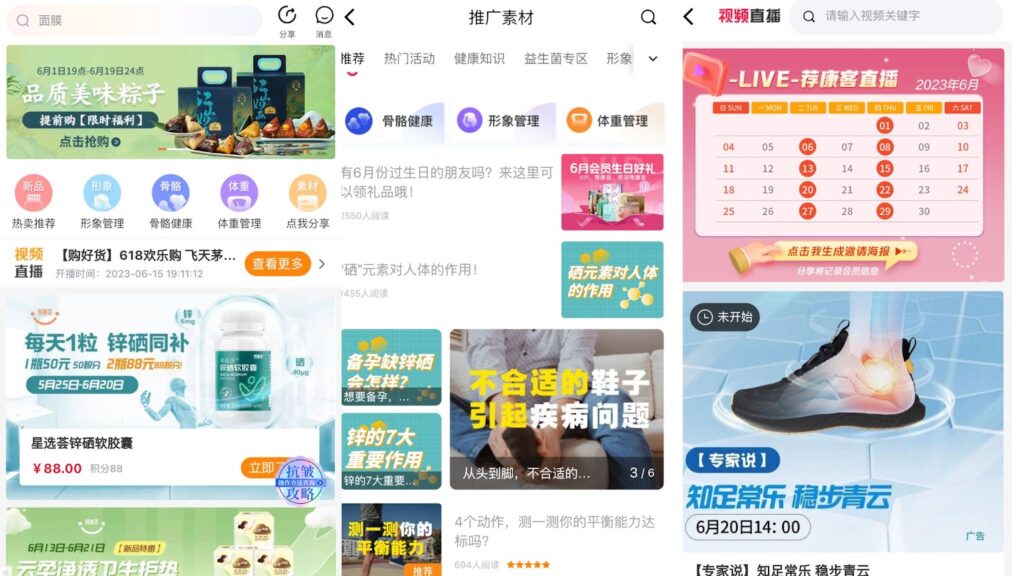

Amway: Amway continues to advance towards smart, personalized, and lifestyle-oriented approaches, using digital solutions to support distributor expansion. The convenient and powerful features of the Amway Cloud Purchase Mini Program (安利云购) allow customers to instantly connect with sales representatives and personal consultants. It also directs them to WeCom (enterprise version of WeChat)where long-term customer engagement could be maintained. The activity section offers diverse sectors such as Live Studio, and Long-Term Customer Club which cater to the needs of different customers.

Amway Cloud Purchase Mini Program (安利云购)

Herbalife: Investing $400 million in 2022 to create a digital growth platform, marking the largest single investment in company history.

Infinitus(无限极): Celebrates its 30th anniversary with initiatives such as an upgraded identity system and empowering distributors with digital tools.

New Era(新时代): Boosts sales and customer acquisition with the sharing mechanisms of their digital sales platform.

New Era’s Jiankangke Platform

Retailization: Embracing the D2C model

The younger generation of consumers is increasingly embracing the direct-to-consumer (D2C) retail model, as compared to traditional hierarchical direct selling. Data shows that the online retail channel for health supplements in China grew rapidly from 19.7% in 2017 to 37.8% in 2022, making it the fastest-growing sales channel. The relaxed cross-border customs policies have also facilitated the influx of overseas health supplement brands.

We previously discussed the main China Market Entry: A 2025 Guide for Foreign Supplement BrandsFrom establishing a legal entity to selecting entry mode, logistics, & sales channels, these are the key routes for a successful China entry.Entry Models and Sales Channels for Foreign Supplement Brands in China.

The D2C model simplifies the sales process by interacting and transacting directly with consumers, providing them with transparent pricing while allowing brands to achieve higher profit returns. By establishing close relationships with consumers, brands gain better insights into consumer preferences, enabling them to offer personalized products and services.

E-commerce platforms, social media, and mobile applications are all great ways to directly reach customers. For example, Herbalife has its "Self-Operated Section" on JD.com, allowing consumers to purchase products conveniently.

Herbalife’s "Self-Operated Section" on JD.com

Multi-Channel Sales for Direct selling Products

Social commerce: Key Transformation for Health Supplement Direct selling

Regardless of generational changes, direct sales will always revolve around "social" interactions. Due to the direct impact of health supplements on the body, consumers prefer to purchase products that their friends genuinely recommend. This makes social commerce, which operates within a private network of acquaintances, an ideal platform for dissemination. The rise of "WeChat social commerce(微信电商)" around 2014-2015 in China is a great example.

The traditional direct selling system, characterized by distinct hierarchical levels and full-time dedication, has somewhat diminished in popularity among the younger generation, particularly in Generation Z. Individuals are more inclined to view recommending products to friends as a socially rewarding behavior. Thus, instant reward systems, such as point-based incentives, are more readily accepted. In new social commerce scenarios, sales representatives are no longer seen solely as promoters but rather as a combination of users, loyal customers, and key opinion leaders (KOLs).

This insight can also inspire brands seeking to enter the Chinese health supplement market. Since obtaining a direct selling license has become more challenging, brands could leverage marketing channels with higher acceptance among Chinese consumers.

LemonBox leverages friend invitations and rewards within its Mini Program

WeChat Mini Programs are also powerful tools for social commerce, including the health product industry. For example, custom vitamin brand LemonBox utilizes WeChat Moments advertisements to attract users to fill out nutrition questionnaires, and users receive customized recommendations for nutritional supplements, leading to conversions and orders. LemonBox also leverages WeChat's strong social sharing mechanisms. Through friend invitations and rewards within the Mini Program, LemonBox stimulates viral spread of the campaign. Other marketing features within Mini Programs, such as subscription-based purchases, and user-generated content (UGC), could generate word-of-mouth effects.

In addition, brands can also integrate social commerce into their own platforms. For example, the newly launched NU Store Mini Program by Nu Skin allows distributors to have a clear view of customer profiles. In NU Store, operators can customize product recommendations, store designs, and engage in WeChat network marketing through diverse activities, combining data feedback from social membership systems, thus transforming NU Store into a personalized business card.

In NU Store, operators can customize product recommendations, store designs

Entering Third-Party Marketplaces such as Tmall and JD.com

Utilizing third-party e-commerce platforms for distribution is an excellent strategy for direct selling brands to expand their online channels. Local platforms like Taobao, Tmall, and JD.com have a massive user base and offer sales tools, data analysis, and marketing support. However, in the past, third-party platforms seemed like forbidden territory for the direct selling industry, as the direct selling pricing systems and the interests of personnel could be compromised. Today, this barrier is continuously being broken.

In a publication by TMO on the Direct Sales in China in 2025: Market Overview, Top Companies, TrendsDirect Sales is a rich although peculiar market in China. In this post we will look at the Direct Sales regulatory landscape, key players (international and local), and examine challenges and trends.current state of China's Direct selling companies in 2023, many top-ranking brands have achieved impressive sales results on platforms like Taobao and Tmall. For example, in the TOP 100 list of overseas health supplement sales on Taobao during the spring of 2022 to the same period the following year, Herbalife ranked 42nd with sales exceeding 100 million. Amway ranked 93rd with sales close to 70 million. USANA's sales also entered the top 100 brand sales rankings in December 2022 and January of the following year. With the platform exposure and influence, direct selling brands can swiftly penetrate markets and attract more consumers.

USANA products selling on Taobao

Short Video Live Streaming: Mastering the Attention Economy

This year, Douyin e-commerce has updated the industry regulations for traditional health supplements. Specifically, they have revised the entry requirements for the subcategory of "health foods" brands. Following these changes, health food brands only need to meet the criteria like having a "strong brand presence" and achieving "over 50 million RMB in online sales within the past 12 months, while being among the top 50 brands on mainstream online platforms", etc. With these new conditions, a vibrant new avenue has opened up for online sales of health supplements.

Currently, direct selling companies such as Amway, Kangmei, and Nu Skin are leveraging short video live streaming channels for their sales activities. For example, Nu Skin has joined Douyin and achieved impressive engagements through the release of short videos. These brands are successfully tapping into the interactive and dynamic world of short video platforms, gaining traction in their online sales efforts.

Amway, Kangmei, and Nu Skin are leveraging short video live streaming channels for their sales activities.

Exploring the O2O New Retail Model: Integrating Online and Offline Channels

In the context of direct selling, the key to driving industry growth lies in integrating digital modes such as online e-commerce, social consumption, and online-to-offline (O2O) models. By leveraging e-commerce and online social platforms, direct-selling businesses can expand their reach. At the same time, utilizing physical stores provides a reassuring experiential space for consumers, enhancing their trust and fostering the development of social commerce and new retail models. In recent years, offline consumption, which was impacted by the pandemic, is slowly recovering, and consumers are increasingly open to interesting and diverse offline experiences.

For example, Herbalife has established brand experience centers in major cities such as Beijing, Shanghai, Guangzhou, Qingdao, and Xi'an. These centers feature store designs infused with sports elements, creating a captivating showcase of Herbalife's allure. Nu Skin also frequently organizes offline events, such as the official launch of the Nu Bank pop-up store at the Yuet Fang ID MALL in Changsha, Hunan in May 2023.

Herbalife’s offline brand experience centers

Private Domain Operation: Transforming Marketing Channels

In recent years, private domain traffic has become a focal point for many companies' digital marketing strategies. For direct sales brands, the focus of private domain operation is gradually shifting away from heavy reliance on a few core distributors to building a broader trust with consumers.

For direct sales brands, especially in the health supplement category, the first step is to attract core fans into the private domain traffic pool through traditional social circles and personal networks. Subsequently, the traditional sales hierarchy needs to be upgraded to incorporate content marketing, community engagement, and traffic conversion. Through these efforts, brands gradually transform their marketing channels and enhance consumer awareness and loyalty.

For example, in 2022, Amway leveraged its "Healthy Living Community" to drive high growth. The community covered various topics such as weight management and seasonal wellness. Utilizing features like team check-ins on the WeChat mini-program "Let's Take Action" and community health practice activities, increased community engagement.

Private domain operation allows direct selling brands to establish closer connections with consumers, foster loyalty, and create a more personalized and engaging shopping experience. By leveraging social networks, content marketing, and digital tools, brands can effectively nurture and expand their customer base.

Amway‘s WeChat mini-program "Let's Take Action" for team check-ins

In summary, currently direct sales licenses issuing in China is still suspended. This has made overseas companies hesitate to enter the Chinese market. However, the digitalization, retailization, and multi-channel trends in the China health supplement market, along with the success stories of existing brands, have prompted more companies to explore new avenues. They are transforming their marketing strategies and combining cross-border e-commerce and social commerce.

At TMO, we specialize in creating compliant cross-border e-commerce and social commerce models for overseas direct selling companies. We can help you plan the most suitable approach to introduce your brand and seize the market. Feel free to contact us to obtain direct selling e-commerce development solutions and a list of available features.