Currently valued at US $100 billion (2024) and expected to reach US $160 billion by 2025, South Korea’s is the world's fifth largest eCommerce market and one of the most advanced in Asia, thanks to the country's 97% internet penetration rate, 5G technologies, and shopping habits (over 50% purchases taking place online).

As the country’s dominant online marketplace with US $30 billion in sales as of 2024, Coupang attracts global attention for its speed, scale, and consumer trust. The platform's "Rocket Delivery" service boasts over 90% territory coverage and is an attractive third-party channel for cross-border brands selling online.

For overseas brands considering market entry, refining product strategy, or monitoring local competitors, keeping up with category shifts and fast-moving trends is crucial.

To support these goals, TMO Group now offers a monthly Coupang Data Pack—a free downloadable resource summarizing:

- Sales performance by product category and subcategory

- Top-selling products and their price range distribution

- Notable brand activity and high-performers

These reports provide a strategic snapshot of the platform—but they’re also just the beginning. Each data pack serves as a sample of our larger data capabilities, which include long-term category monitoring, competitor benchmarking, and custom eCommerce intelligence tailored to your brand’s goals.

For full-scale tracking, brand-specific monitoring, and tailored market dashboards, explore our Marketplace Intelligence Data Services.

March: Coupang eCommerce Highlights

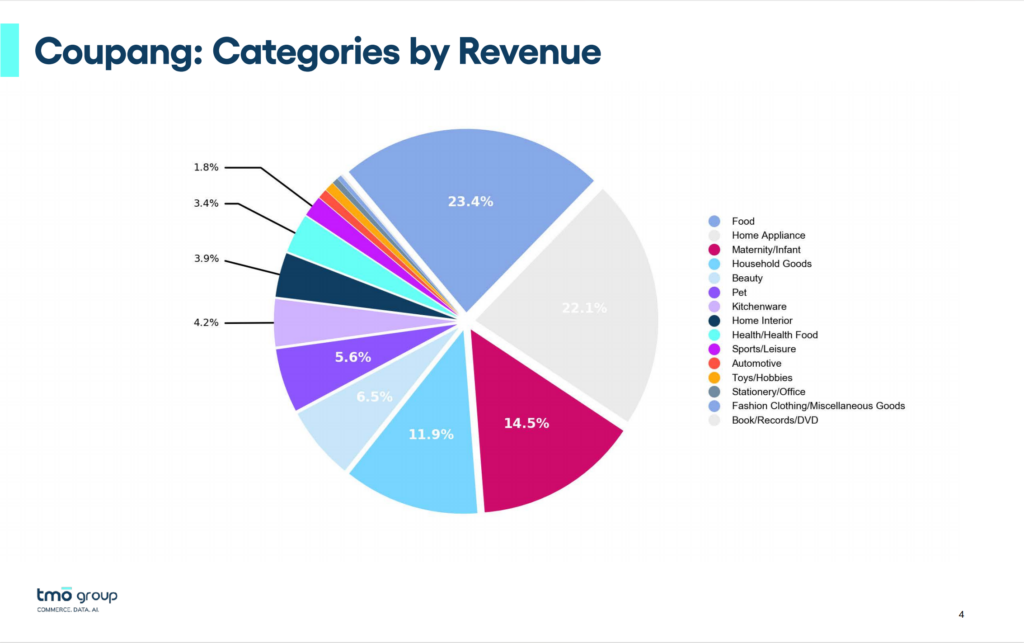

- Category Performance: Food, home appliances, maternity and baby, and household goods were the leading categories in March, together accounting for over 70% of the online market share.

- Best-selling Products: Despite facing the world's lowest fertility rate in 2023 (0.72), South Korea's maternity and baby market has demonstrated resilience through strategies such as premium product offerings and service diversification. This trend was evident in March, where a premium infant formula product led the platform-wide sales rankings. Furthermore, Huggies diapers ranked among the top five best-selling products across all categories. In the household goods category, diaper-related products also achieved substantial sales figures.

- Within the food category, which constituted 23.4% of total sales, Korean consumers showed a strong preference for bottled water, beverages, vegetables, and dairy products, including ice cream. A notable bestseller was a honey-glazed sweet potato product, which topped the food category's sales chart. Additionally, an imported cappuccino-flavored candy from Indonesia gained significant popularity.

- Brand Performance: Known for their brand consciousness, Korean consumers favored international brands in the electronics sector. Apple smartphones continued to dominate the bestseller lists in March, securing multiple top positions.

February: Coupang eCommerce Highlights

- Category Performance: Food, home appliances, pet supplies, and household goods were the leading categories in February, together accounting for over 70% of the online market share.

- Best-selling Products: In the food category—which accounted for nearly 30% of total sales in February—Korean consumers showed high interest in rice and grains, bottled water, and beverages. In particular, premium white rice products experienced booming sales, with a 10kg bag of rice becoming the best-selling product across the entire platform for the month.

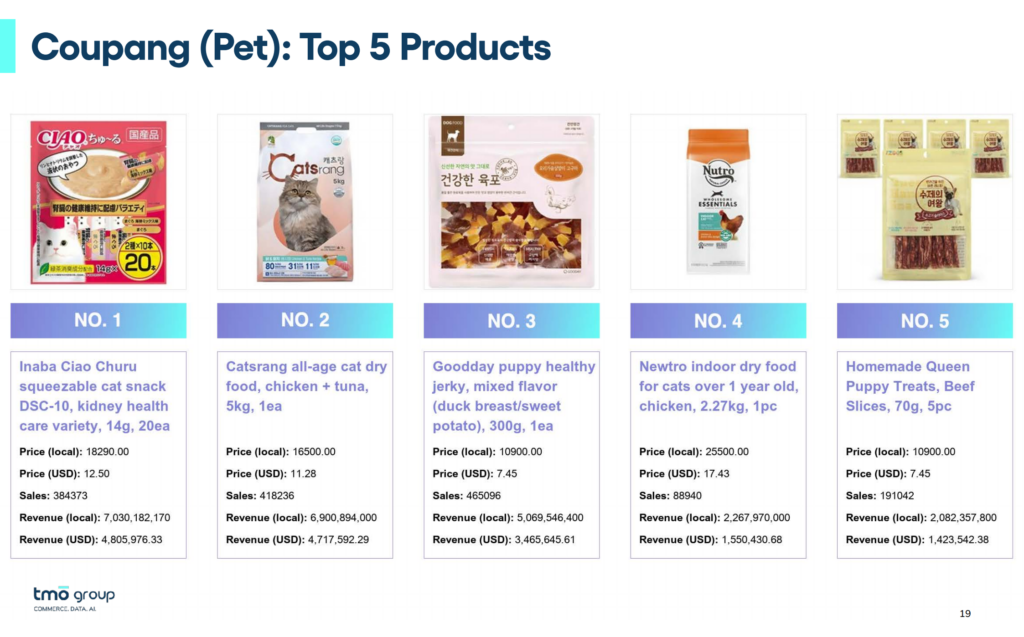

- South Korea’s pet market has seen continuous growth in recent years, reaching trillions of Korean won in 2023, with online channels becoming the primary sales avenue. This explains why pet supplies climbed into the top three best-selling categories on Coupang in February. The Top 5 best-selling pet products reveal a strong demand among Korean pet owners for high-quality pet food. Notably, a kidney care cat treat became the category sales champion, highlighting the growing potential of the emerging pet health supplement segment.

- Brand Performance: Korean consumers, known for their strong brand awareness, prefer overseas brands when purchasing electronics. For instance, Apple smartphones held several positions on the best-seller list.

Why These Insights Matter

Each month’s Coupang snapshot offers more than just trendspotting. For brand owners, category managers, digital strategists, and others, the data can support you in navigating the Korean eCommerce landscape:

- Evaluate Market Entry Potential: Understand which categories are growing, what price points are winning, and where gaps exist—before investing in localization or inventory.

- Optimize Product Strategy: Identify fast-rising formats, ingredient trends, and feature preferences at a subcategory level. Use this to guide R&D, messaging, and packaging decisions.

- Monitor Competitors & Brand Share: See who’s climbing the ranks each month. Benchmark against leading players—both domestic and international—across multiple subcategories.

- React to Shifts in Consumer Demand: Track real-time changes in what customers are buying, when, and at what price. This is especially critical for seasonal campaigns and product launch planning.

Showcase: Read how SanofiSanofi's custom data architecture allows continuous monitoring of product categories, brands, and competitors across multiple mainstream eCommerce platforms.TMO supports global brands with long-term data monitoring and a custom data architecture to standardize analysis across regions and platforms.

TMO helps brands like yours stay ahead of the market with tailored eCommerce datasets and monthly monitoring dashboards that help inform market entry and competitive strategies. While these data packs offer a high-level view, if you are interested in tracking competitor SKUs, localizing product attribute mapping, and monitoring long-term trends across platforms and countries, reach out to us for a custom proposal!