The Beauty Industry has become one of the most attractive growth tracks for eCommerce worldwide. The "2024 Overseas China Beauty Report" released by Ebrun Research and Ant International estimated the global Beauty market growth to stand at 8.9% year-on-year in 2023. According to Statista's forecast, the Southeast Asian market size is expected to reach US $34.21 billion in 2024 and maintain steady growth between 2024 and 2028.

This trend shows that Southeast Asia is becoming a golden market for beauty brands expanding overseas, including Facial, Eye, and Lip Makeup, Beauty Devices & Tools, Nail Care, and Makeup Removal brands.

For the last 2 years, TMO Group has been helping brands explore and successfully enter the SEA market. Read more about our SEA eCommerce Solutions.

Having collected first-hand market data from almost 370,000 SKUs across Shopee and Lazada, the two major marketplaces in the region, we analyzed the market structure, categories, best-selling brands, price ranges, and consumer trends across the 6 countries with the biggest online eCommerce markets: Indonesia, Malaysia, Thailand, Vietnam, the Philippines and Singapore.

This article is based on the Cosmetic (Southeast Asia Outlook July 2024)This free PDF takes a look at Southeast Asia's cosmetic market: market segments, price ranges, popular brands, and much more.Southeast Asia Cosmetics Outlook, which you can download for free to see the full analysis of our research.

Now, let’s dive into the key takeaways from our research into Southeast Asia’s online retail landscape for the Cosmetics industry. We will also cover some findings of the different subcategories within the segment.

1. SEA Cosmetics Market Size - Vietnam and Indonesia account for over 70%

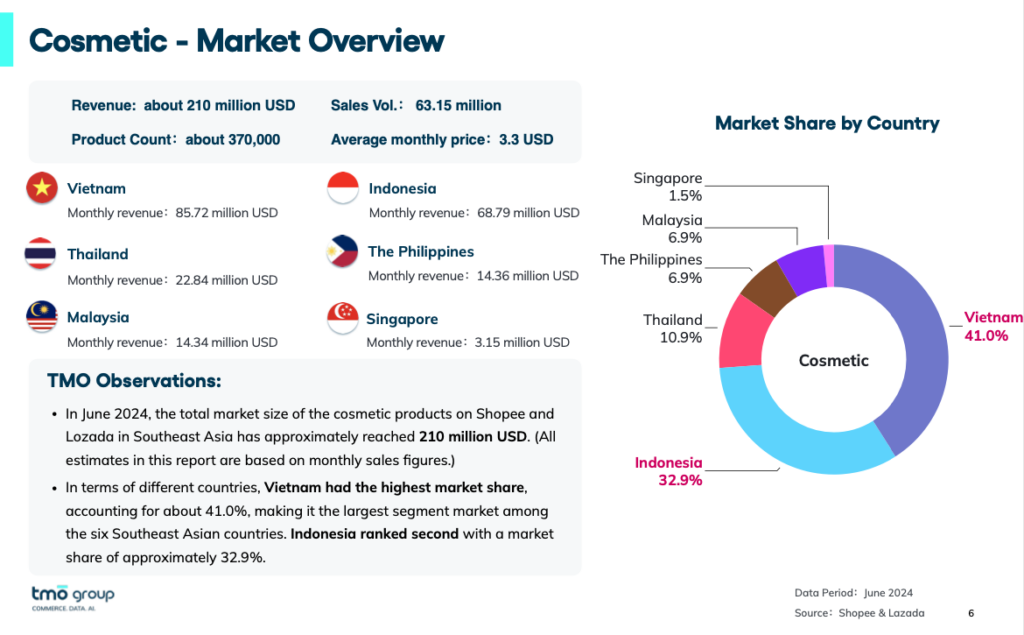

Based on the collected data from Shopee and Lazada, we estimate that the total market size of the six largest Southeast Asian economies stands at around US $210 million in average monthly sales.

On the Shopee and Lazada platforms, Vietnam (41%) and Indonesia (32.9%) have the highest market share of Cosmetics products, which jointly account for more than 70% of the overall market in Southeast Asia, particularly in the Lip Makeup, Facial Makeup, Eye Makeup, and Makeup Removal segments. Cosmetic (Southeast Asia Outlook July 2024)This free PDF takes a look at Southeast Asia's cosmetic market: market segments, price ranges, popular brands, and much more.Download the free report for a full analysis

2. SEA Cosmetics Popular Product Segments

For our research, we divided the Southeast Asian Cosmetics market into 6 sub-categories, taking Shopee and Lazada's top-selling products:

- Facial Makeup

- Eye Makeup

- Lip Makeup

- Beauty Devices & Tools

- Nail Care

- Makeup Removers

Looking at these sub-categories, Lip Makeup is the most popular segment, followed by Makeup Remover, Facial Makeup, and Beauty Devices. Together, these 4 sub-categories account for about 87% of sales on Shopee and Lazada.

Consumers in different countries have different preferences for new energy products. For example, in Indonesia, Thailand, and the Philippines, Facial Makeup and Lip Makeup are particularly popular, while in Vietnam, the largest share goes to Makeup Removers.

It is also interesting to note that in the Philippines' market, the top three best-selling brands for Lip Makeup are Chinese brands, highlighting the potential for overseas brands to penetrate the market. These brands make up over 22% of the market share.

Looking to boost your eCommerce competitive intelligence? Our Customized Marketplace Reports are tailored to support your brand’s data needs with detailed analysis.

3. SEA Cosmetics Best-Selling Brands

In terms of brands, many Chinese brands such as O.TWO.O and Focallure have been performing very well, and are now among the top 10 best-selling brands for the month observed.

As for sub-categories, Eye Makeup is where Overseas brands' domination is particularly evident. Out of the top 10 best-selling brands, 5 of them are Chinese Cosmetics brands. PinkFlash from China and Maybelline from the US are tied for the first place, with a market share of around 5.5% each. Closely after are Focallure and O.TWO.O, with JUDYDOLL and SACE LADY trailing behind. Cosmetic (Southeast Asia Outlook July 2024)This free PDF takes a look at Southeast Asia's cosmetic market: market segments, price ranges, popular brands, and much more. See the free report for specific hot-selling brands in every country.

Learn how Nanfu BatteryAs a pilot for international expansion, in-depth market scans and opportunity evaluation helped Nanfu explore the potential of major markets in Southeast Asia.Nanfu Battery partnered with TMO for its Southeast Asia Market Entry Research and Business Model Strategy Definition.

In addition, in the Facial Makeup segment, Chinese cosmetics also performed well, with CARSLAN, Focallure, O.TWO.O, and SACE LADY entering the top ten best-selling list. CARSLAN's Oil Control Face Pressed Powder Compact topped the list of best-selling products of the month with its waterproof, sweat-proof, and oil-control selling points, and SACE LADY's Full Cover Liquid Concealer was also a hot seller.

The outstanding performance of a number of overseas beauty brands further highlights the huge potential of Southeast Asia as a destination for global expansion within the Cosmetics category and is worthy of close attention from companies planning their next target market for entry.

Growing your Business in Southeast Asia through Online Marketplace Monitoring & Research

We believe that the Southeast Asian market is open and inclusive. However, due to varying cultural and economic levels among countries, consumer preferences also exhibit notable differences. By understanding the market in each country, brands and businesses can better explore Southeast Asia as a destination for expansion.

As part of our comprehensive long-term data monitoring and collection services, TMO Group helps clients dive deeper into Southeast Asia’s eCommerce market with our thorough research and analysis, as well as customized reports for various industries, providing a deep understanding of your niche, including market structure, size, and emerging trends.

If you are looking for an eCommerce agency to assist you in your Southeast Asia business expansion, or want to explore other alternatives to grow in the region, reach out to us to learn more about our Consultancy & Strategy Services, from branded eCommerce website development to Social Commerce and other Cross-border eCommerce Solutions.