As the Southeast Asian markets continue to grow at unprecedented rates, international FMCG brands in the Food & Beverage industry have found great opportunities for expansion into the region. As an example, Mixue Ice Cream & Tea, a Chinese franchise for iced tea and soft-serve ice cream, has gone from 1,000 chain stores in 2023 to almost 3,000 this year. Furthermore, the young demographic makeup of Southeast Asia's population has made eCommerce an important stage of competition in the FMCG sector.

For the last 2 years, TMO Group has been helping brands explore and successfully enter the SEA market. Read more about our SEA eCommerce Solutions.

Having collected first-hand market data from almost 1 million SKUs across Shopee and Lazada, the two major marketplaces in the region, we analyzed the market structure, categories, best-selling brands, price ranges, and consumer trends across the 6 countries with the biggest online eCommerce markets: Indonesia, Malaysia, Thailand, Vietnam, the Philippines and Singapore.

This article is based on the Food & Beverage (Southeast Asia Outlook September 2024)This free PDF looks at the food & beverage market in Southeast Asia: market segments, price ranges, popular brands, and much more.Southeast Asia Food & Beverage Outlook, which you can download for free to see the full analysis of our research.

Now, let’s dive into the key takeaways from our research into Southeast Asia’s online retail landscape for the F&B industry. We will also cover some findings of the different subcategories within the segment.

1. SEA F&B Market Size - Indonesia and Vietnam account for over 45%

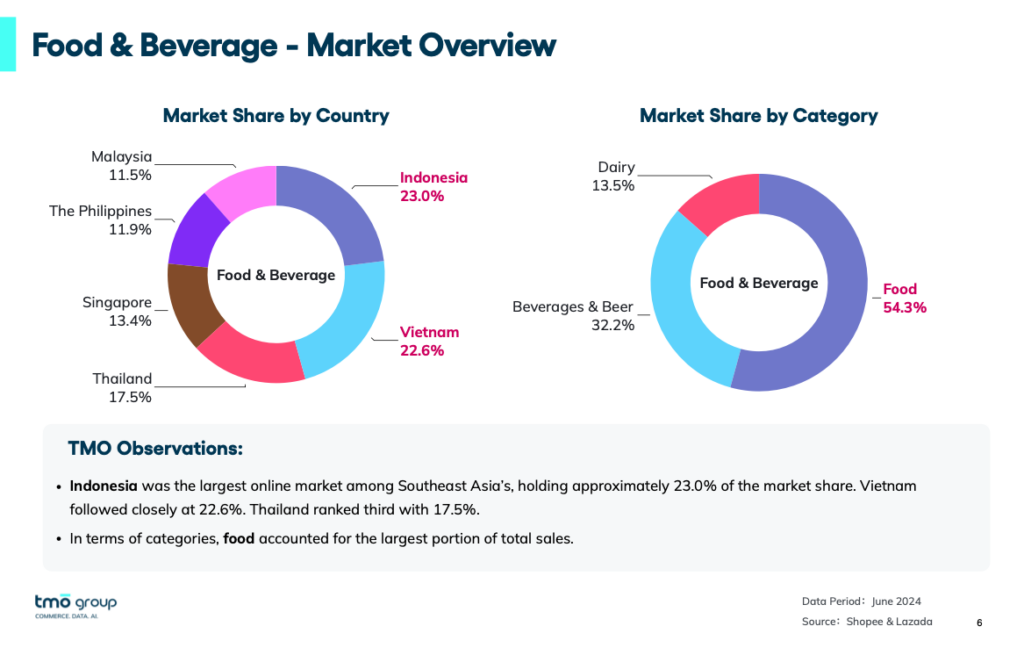

Based on the collected data from Shopee and Lazada, Indonesia (23.0%) and Vietnam (22.6%) have the highest market share of Food & Beverage products, followed by Thailand (17.5%) and Singapore (13.4%)

In terms of our analysis of the 3 main categories, Food products account for 54.3% of the market share, followed by Beverages (including alcoholic beverages) at 32.3% and Dairy products with 13.5%. Food & Beverage (Southeast Asia Outlook September 2024)This free PDF looks at the food & beverage market in Southeast Asia: market segments, price ranges, popular brands, and much more.Download the free report for a full analysis

2. SEA F&B Popular Product Segments

For our research, we subdivided the Southeast Asian Food category—which consisted of 780,000 product SKUs—into 6 sub-categories, taking Shopee and Lazada's top-selling products:

- Food

- Staple Foods and Seasonings

- Snacks & Candy

- Frozen & Fresh Food

- Breakfast & Spreads

- Bake Foods & Ingredients

- Other Food

- Beverages

- Dairy Products

Looking at these Food sub-categories, Staple Foods and Seasonings is the most popular segment overall (34.9%), followed by Snacks & Candy, which makes up 31.2% of the regional market share.

When looking at performance by country, however, Staple Foods and Seasonings is still the best-selling sub-category in Vitenam, Thailand, and the Philippines, with brands like Hong Kong's Lee Kum Kee for Chinese sauces, particularly its Panda Oyster Sauce. Indonesia and Malaysia show strong demand for Snacks & Candy, while Frozen & Fresh Food are the most popular in Singapore.

Looking to boost your eCommerce competitive intelligence? Our Customized Marketplace Reports are tailored to support your brand’s data needs with detailed analysis.

As for Beverages, it is worth noting that coffee is the best-selling product in Thailand and Malaysia, with sales accountling for nearly 50%. Alcoholic beverages are the most popular on Shopee and Lazada in Singapore, with a market share of about 33.2%, much higher than other countries.

3. SEA F&B Best-Selling Brands

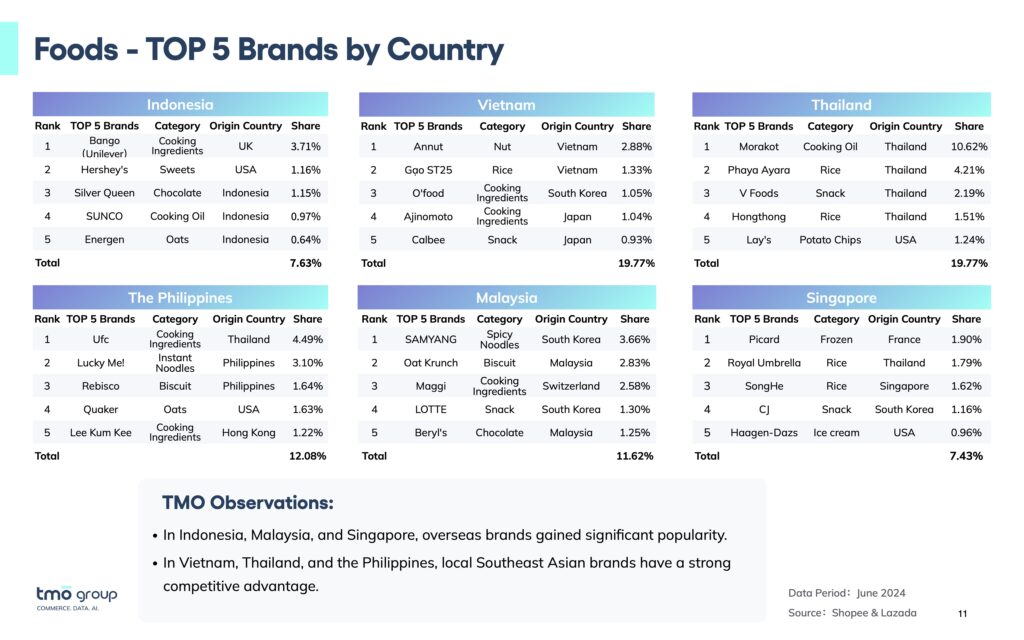

In terms of brands, we can appreciate strong presence from Western brands from Unilever, Nescafé, and Ensure, as well as from other regions such as New Zealand's Anlene or Japan's POKKA. Notably, unlike in other industries covered in our free market outlooks, Chinese brands are not yet as prominent in the top rankings. Their market share is still rising though, with brands like Weilong and Nongfu Spring gradually expanding their market presence.

Learn how Nanfu BatteryAs a pilot for international expansion, in-depth market scans and opportunity evaluation helped Nanfu explore the potential of major markets in Southeast Asia.Nanfu Battery partnered with TMO for its Southeast Asia Market Entry Research and Business Model Strategy Definition.

Growing your Business in Southeast Asia through Online Marketplace Monitoring & Research

We believe that the Southeast Asian market is open and inclusive. However, due to varying cultural and economic levels among countries, consumer preferences also exhibit notable differences. By understanding the market in each country, brands and businesses can better explore Southeast Asia as a destination for expansion.

As part of our comprehensive long-term data monitoring and collection services, TMO Group helps clients dive deeper into Southeast Asia’s eCommerce market with our thorough research and analysis, as well as customized reports for various industries, providing a deep understanding of your niche, including market structure, size, and emerging trends.

If you are looking for an eCommerce agency to assist you in your Southeast Asia business expansion, or want to explore other alternatives to grow in the region, reach out to us to learn more about our Consultancy & Strategy Services, from branded eCommerce website development to Social Commerce and other Cross-border eCommerce Solutions.