More than 400 million monthly users and an explosive growth of 4.884% in the past year. WeChat mini programs have definitely found their niche to roaring success in the past months. We highlighted strategies and case studies on successful mini program strategies in How to be Successful in Multi-Channel eCommerce in the Chinese MarketWeChat is a crucial part of the Chinese online landscape. Localisation in China thus means adapting and building a multi-channel eCommerce strategy.a previous article. But what is currently happening with mini programs? Is it necessary to develop a mini program in addition to a WeChat store? Can you reach a foreign audience? Read on to see the newest WeChat mini program statistics and trends!

Mini Program vs. WeChat H5 Store: Which One Do You Need?

According to Questmobile, there are now 400 million monthly active users on mini programs. In the online mobile store top 50, 52% is taken up by mini programs.

However, many brands not only have a mini program, but also a WeChat H5 store. Should you have both as well?

Mini programs are relatively light-weight. This creates a quicker and smoother user experience than a WeChat H5 store which obviously affects conversion.

Furthermore, mini programs also gain advantages from WeChat’s own social ecosystem. For example the possibility to access a mini program from a WeChat official account. Thus, mini programs can receive more organic traffic through WeChat SEO.

Diverting traffic

Mini programs can be embedded in KOL messages or brand promotions. Besides widespread display, it makes the process of diverting traffic for see and buy impulsive purchases much easier.

Social sharing

Compared to a WeChat H5 Store, mini programs are more eye-catching and easier to promote in WeChat groups. In this digital and social era, it is much better suited to China’s social environment.

Returning customer convenience

19,7% of mini program eCommerce traffic comes from the pull-down chat window. When a returning customer wants to come back for a purchase, they can just pull down the chat window and quickly find you.

For brands that focus on user experience and are interested in social traffic, a mini program will be a better fit than a WeChat H5 Store.

Wechat Mini Program Statistics That You Need To Know

Let’s first look at some more stats about mini program users. Regarding spending power, 84% of mini program users can be split up in 2 tiers: those purchasing less than 200 RMB and those spending between 200 and 1.000 RMB. 42% of products on eCommerce mini programs fit in this tier, so unit prices are actually relatively high.

We also see that products under 1.000 RMB will probably better fit the majority of customers looking for quality - cost-effectiveness - experience. Since mini programs have a smoother customer experience, consumers are also more likely to make quick decisions or impulse purchases within the range of 1.000 RMB. Although consumer trust is rising, products that cost too much may cause consumers to drop out of a purchase.

So within these limits, how can you get the highest value out of these quick-buy consumers? "Less is more" is the answer. We see that many brands develop mini programs for a specific goal or need. If the mini program suits your audiences and works perfectly it is sure to make them feel instant satisfaction.

For example, Jingdong has 5 mini programs that cater towards different segments. For price-sensitive consumers they have a group buy mini programm for brand fans they have a special brand day mini program etc.

For example, Jingdong has 5 mini programs that cater towards different segments. For price-sensitive consumers they have a group buy mini programm for brand fans they have a special brand day mini program etc.

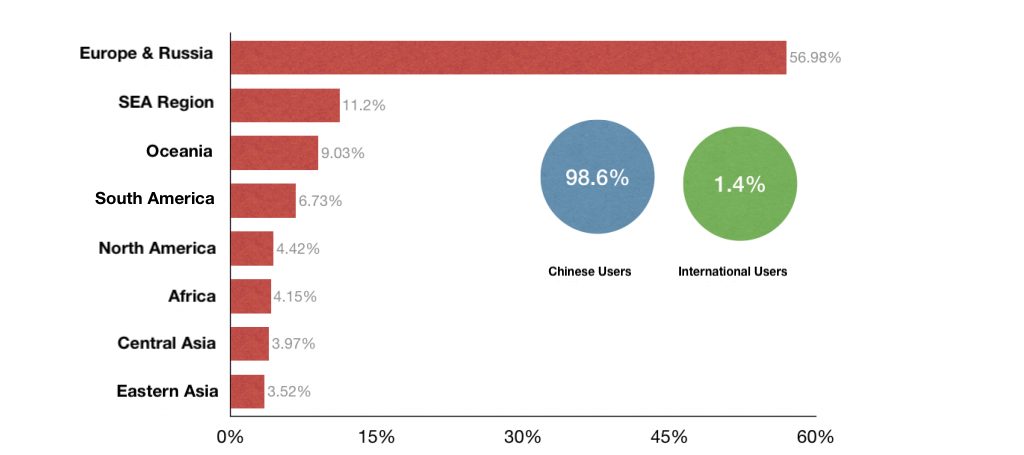

Lastly, the mini program overseas market provides obvious business opportunities, and brands will be further developing this.

At present, the total percentage of overseas registered mini program users is 1,4%. Among the overseas users, the top 3 are from Europe & Russia (56,98%), Southeast Asia (11,2%) and Oceania (9,03%).

With the internationalization of WeChat, more and more foreign users get involved with WeChat. Mini programs could be a new platform for overseas brand promotion. Easier to develop and less expensive than developing an overseas brand eCommerce website. Additionally, there are also less legal implications to take into account.

Further Developments For Mini Programs In 2018

Lastly, below trends we see further developing this and the next years.

New Retail

Mini programs are becoming an important part of the new retail strategy. They can easily link online to offline (O2O), for example allowing brands to provide gift cards, online discounts, loyalty points etc.

User Segmentation

With the large amounts of data that mini programs collect, there will be further user segmentation. Like JD.com’s different mini programs, others will also focus on specific user groups per mini program.

eCommerce Purposes

Mini programs will increasingly replace WeChat H5 stores and provide an even better user experience. We mentioned in How to be Successful in Multi-Channel eCommerce in the Chinese MarketWeChat is a crucial part of the Chinese online landscape. Localisation in China thus means adapting and building a multi-channel eCommerce strategy.our previous article that mini programs already fulfil many eCommerce purposes such as pop-up stores, customer service center, CRM etc.

Social Sharing And Buying

The social aspect will remain crucial. With KOL’s promoting mini programs brands can easily create see and buy campaigns. Furthermore, using WeChat groups or Moments to encourage spending, like Pinduoduo successfully capitalized on, will also become more widespread.