As consumers grow more experienced with online shopping, they will come to demand even better service and quality from e-commerce sites. They already express a great deal of dissatisfaction regarding delivery quality, cost, and lead-time. The future will see a shift in demand from low-priced but non-guaranteed items sold by sometimes dubious or unknown vendors to high-quality service and products from trustworthy sources.

Taobao’s Loyal Core

Market leader Taobao both suffers and benefits from the fact that users often need a great deal of time to feel adept at using the site. This is an ad- vantage in that many consumers began using the site three or four years ago, when there were few other options, and over the years they have become deeply loyal, “sticky” users. This core group of customers spends huge amounts of time on Taobao and will pore through hundreds of reviews in their hunt for the best deal and the most trustworthy merchants. They recognize that Taobao has problems with reliability, but they enjoy the search process and are confident they can find good deals.

On top of Taobao

This learning curve is a disadvantage for Taobao, however, when it comes to newer and increasingly busy shoppers who are frustrated by the time-consuming and inefficient nature of the Taobao experience. In the past two to three years, several strong business-to-consumer sites have emerged that cater to specific consumer needs and don’t require that customers become experts before they can feel confident about getting a good product.

As a result, these sites are winning market share from Taobao. And though the user base of the top business-to-consumer sites is still much smaller than that of Taobao and Tmall,some of them enjoy much more frequent visits from the users they do have. Online shoppers who have moved away from Taobao to these other sites overwhelmingly perceive them as offering much better quality assurance, professionalism, delivery speed, reliability, flexibility, and after-sales service.

Notably, these sites are penetrating quickly into the highest-value categories. For example, in casual wear, Taobao and Tmall are the default channels for 76 percent of e- shoppers. In the high-margin category of computers, though, only a little more than half of e-shoppers use Taobao and Tmall.

Business-to-consumer companies have been growing at more than 200 percent in categories that demand high reliability and service-fulfillment capabilities, such as consumer electronics. It is clear that shoppers can be won over by sites that may have higher prices and less selection than Taobao, but whose quality assurance is perceived to be better.

Despite this, Taobao’s leadership position will be difficult to shake anytime soon, given the large base of loyal customers who are already comfortable with the site and the company’s efforts to continually diversify—including the debut of Tmall, which improves service quality by accepting only qualified, authenticated business merchants. Taobao’s market share is bound to decline in the future from the 80 percent share it enjoys at the moment, but it will remain a significant force.

The Multichannel Advantage

The Multichannel Advantage

The one sure bet for companies is to address a trend among consumers toward multistop online shopping. Consumers frequently visit more than one type of website for different product categories, and their desire for multiple options will only increase. In fact, consumers who shop in more than one channel can be three to five times more profitable than single-channel shoppers. Thus, it is increasingly crucial for companies to actively manage their online presence and engage consumers with a diversity of online options.

The Offline Factor

Offering an online-only experience—even at multiple shops—is not sufficient. The offline, in-store experience remains a key factor that influences consumers’ purchase decisions. Our survey shows that, on average, more than 50 percent of consumers pay a visit to offline retail stores before making an online purchase. Some browse online first and then visit the store to get a better sense of the look and feel of the product, while others develop their intention to buy at the retail store but make the final purchase decision on- line afterwards.

Furthermore, because of the rising demand for better e- commerce service and quality, companies with an offline presence have great potential to further differentiate themselves from online-only firms by providing after- sales services that leverage their offline assets and capabilities. This is particularly relevant to categories where exchanges (as in the case of apparel) or repairs (as in the case of consumer electronics) are often needed.

Online-only firms should think about how to have an integrated offline strategy, especially given that most sales do require some offline element to close the deal. For offline companies, a multichannel strategy that leverages brand trust and offline assets will expose their products to a new group of online customers and potentially offer superior economics.

Shopping by Mobile Phone

Shopping by Mobile Phone

Roughly half of urban Chinese consumers have access to a mobile phone, and of those, about half use their phones to gain access to the Internet. These rates are on par with developed markets such as the United States, Europe, and Japan. However, China far exceeds those markets when it comes to people who indicate an interest in using their phone in the shopping process, whether to check prices or to find additional product information while shopping in physical stores. In fact, Chinese shoppers are already doing this, so as mobile-shopping platforms develop, it should be easy for customers to make the transition to actually shopping via mobile phone.

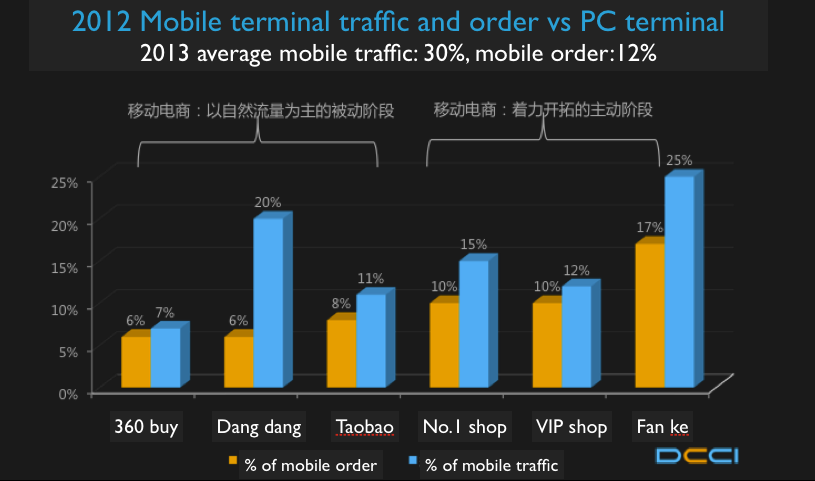

A look at mobile versus computer-accessed Internet penetration in China points to opportunities that differ according to geography. In urban areas, where more than half of Chinese consumers get on the Internet via computer, mobile phones function as a supplemental rather than a primary means of going online. In these parts of the country, computer accessed Internet, which enjoys such advantages as faster connections and easier-to-design interfaces, will be the primary driver of e-commerce. However, mobile shopping will grow quickly from its current small base, as e-commerce companies begin to introduce more mobile offerings. And once the country starts rolling out 4G net- works with higher data speeds, and as more consumers correspondingly begin switching to smart phones, the growth of mobile-phone commerce will be stimulated still further.

Opportunities in rural China, however, are different. Here, mobile-phone penetration is high, but people are just beginning to have access to the Internet with computers—18 percent. Companies that count rural residents among their target customers should think about making mobile commerce their primary focus. This parallels the situation in India, where mobile penetration far outpaces Internet penetration.