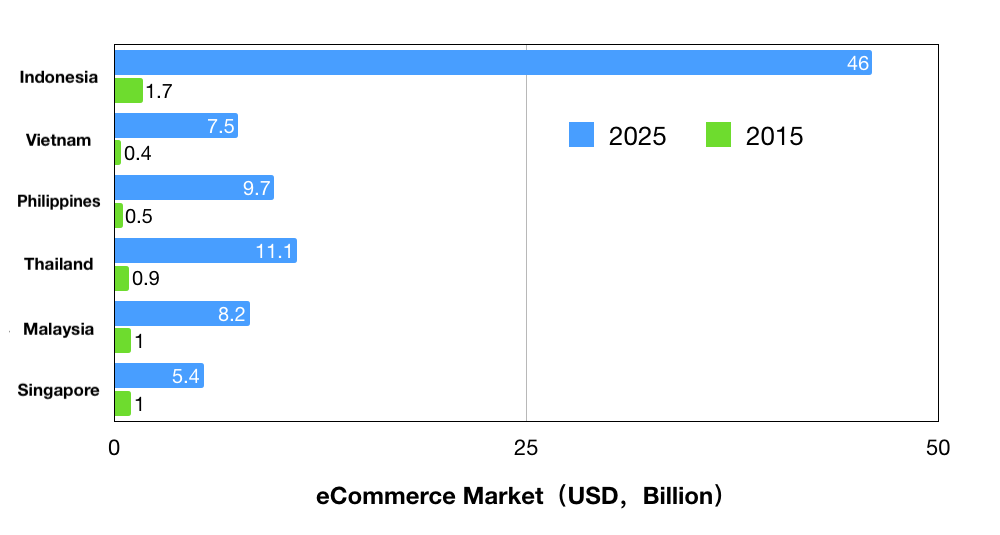

Operating a successful eCommerce business in China and ready for your next step? Well, stay close by because the Southeast Asian (SEA) Region is booming. Google and Temasek’s e-Conomy SEA Spotlight 2017 report predicts Southeast Asia’s internet economy will reach USD 200 billion in 2025, a 664% increase from 2015. Online travel, eCommerce, and online media will primarily drive this development.

Want to make sure you do not miss any opportunities? Keep on reading because we will map out the Southeast Asia eCommerce market below. From its consumers, distribution and logistics, payment methods as well as marketing and social media.

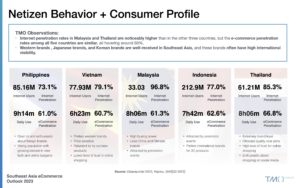

The annual growth rate of Southeast Asia eCommerce (32%) will far exceed the growth rate of offline retail sales (7%). Like China and the further East Asia region, a large part of this growth is propelled by mobile. DataReportal’s Latest 2023 Global Overview Report estimated 470 million monthly active internet users in the main SEA Markets of the Philippines, Vietnam, Malaysia, Indonesia, and Thailand.

At the same time, ASEAN’s middle class is exploding and will account for 67% of the region’s total population by 2030. From this point of view, an emerging market composed of young people, the middle class and mobile Internet users will be more receptive to consumption upgrades and e-commerce overseas shopping.

Southeast Asia eCommerce Shopping Behavoir and Trends

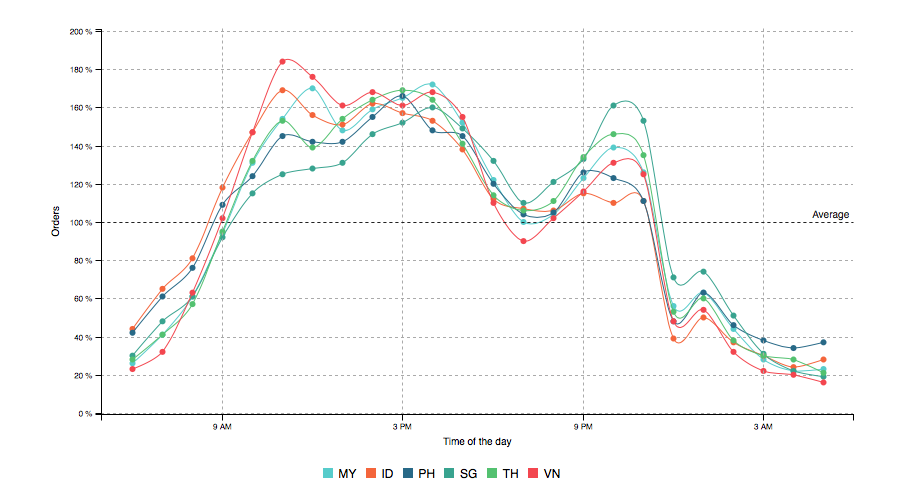

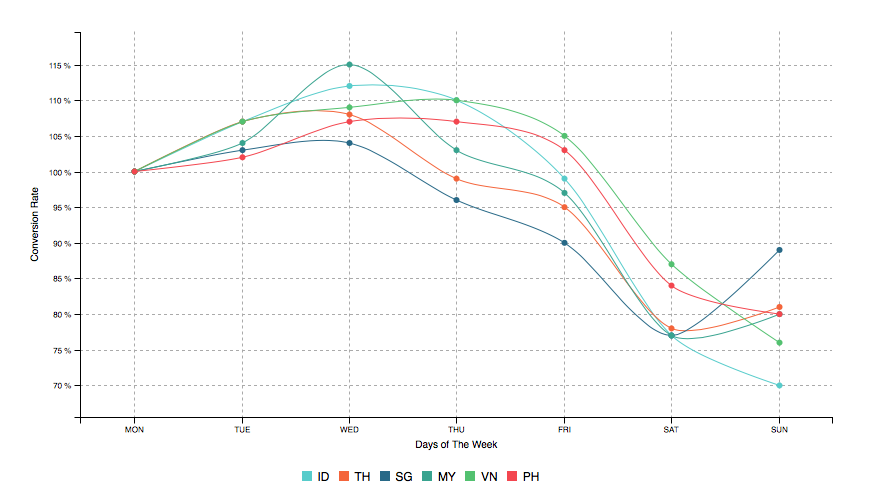

Shopping Peak Activity Times

Southeast Asian consumers are generally keen on shopping every Wednesday, and between 10AM-5PM and 9PM-11PM every day. At the same time, this also provides a strong basis for targeted brand advertising and targeted promotion of activities.

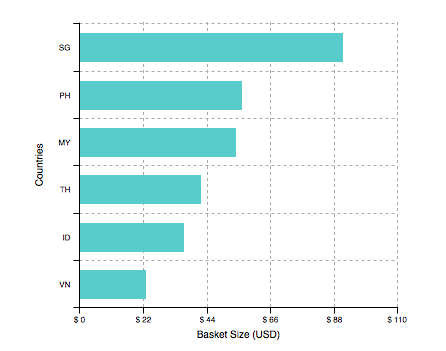

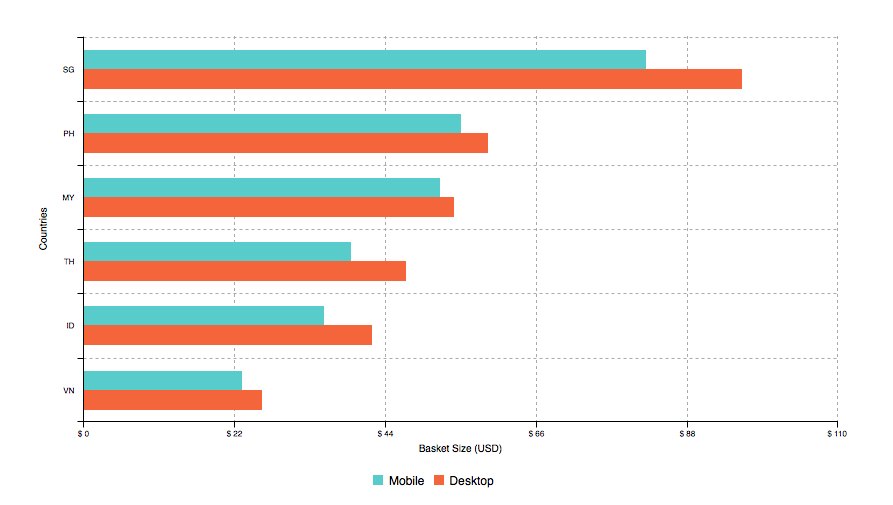

Value of Basket Sizes

A key metric for eCommerce operators, basket size measures the average total amount that customers spend for every order over a defined period of time. It should thus come as no surprise that these numbers greatly vary per country - they relate to the GDP per capita.

The per capita customer price is closely related to the degree of development of the country. Singapore tops the list with a whopping USD 91, followed by the Philippines with USD 56 and Malaysia with USD 54. Thailand, Indonesia, and Vietnam are relatively much lower. This reflects the unit price of the product, and the category strategy should be proportional to the national conditions.

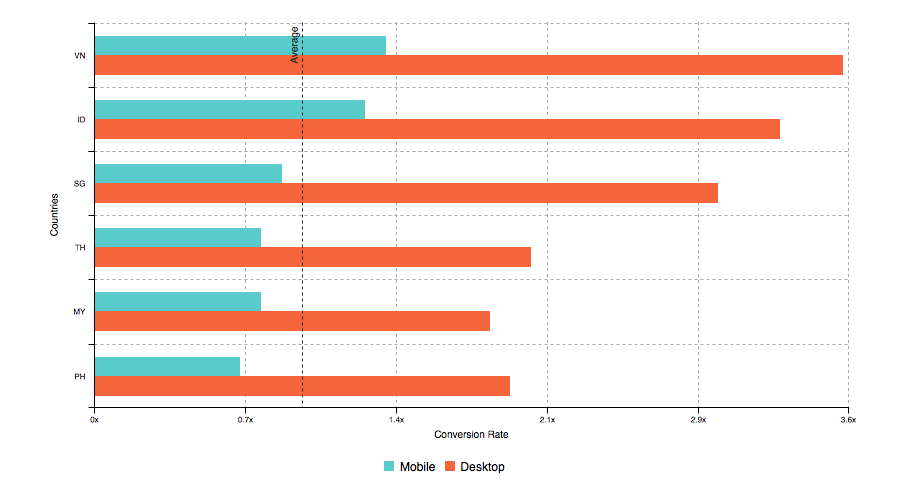

Mobile vs. Desktop Conversion Rates in SEA

Not only are desktop purchases worth more, the conversion rate is also much higher. Though mobile is bringing in the most traffic to eCommerce sites in SEA countries, the total conversion rate of desktop is 137% higher.

Looking at Southeast Asia, the conversion rate of desktop is 1.7 times higher than that of mobile. In sharp contrast, the mobile penetration rate in Southeast Asia is increasing day by day. Currently, the mobile traffic of Southeast Asian websites has reached the total website traffic. 72%.

Coincidentally, the unit price per customer on the desktop side in various countries is 15% higher than on the mobile side. It can be seen that a two-pronged approach for desktop and mobile applications and joint optimization is a good strategy.

Price Sensitivity

Southeast Asian consumers are highly price-sensitive. Discounts and cost-effective products are the main factors driving local consumer enthusiasm. Of course, factors such as pre-sales, mid- and after-sales services, and logistics services will also have varying degrees of impact on consumer decisions.

Shopping Trust

Trust in brands and products is an everlasting cross-border proposition. Internet fraud is common in Southeast Asia. Recommendations from acquaintances will subtly affect local people's consumption decisions to a large extent (this is similar to China). It is worth noting that Southeast Asia is a region that heavily uses Facebook. How to build brand trust and convey brand value through mainstream social media is an issue that must be considered.

Top-Selling Products by Country

For a detailed overview of each country’s eCommerce market, as well as sales estimates by SKUs, sales volumes, and revenue for major product groups sold on Lazada and Shopee, download our Free Data Packs for your Target Country.

Philippines

Electronics is the most popular category, followed by personal and home care, and furniture.

Thailand

The most popular categories are electronics, personal and home care, and beverages.

Malaysia

Electronic products, fashion, toy hobbies and DIY categories are particularly popular.

Vietnam

Best-selling electronics, fashion, toys, hobbies and DIY products.

Indonesia

The most popular products are still electronic products, followed by toy hobbies, DIY, and fashion.

Distribution and Logistics

Logistics is one of the biggest challenges for the SEA region to tackle. Important factors are the lack of logistics experience in new markets, challenging geography, personnel management, and Cash on Delivery (COD). Because a large part of the region exists of island archipelagos, there is no unified infrastructure and often a backward traffic environment with weak last-mile delivery options that severely affect the speed and efficiency of the product delivery process.

Of course, the entire Southeast Asian market is in a period of rising logistics dividends. With the continuous influx of capital markets, competition in the logistics market has become increasingly fierce, and start-up companies are also emerging. The most direct situation is the "low-price" price war. When technology and services are similar, lowering logistics costs seems to reduce costs for companies. However, as startups continue to collapse, they also continue to bring hidden risks to companies.

Logistics Developments

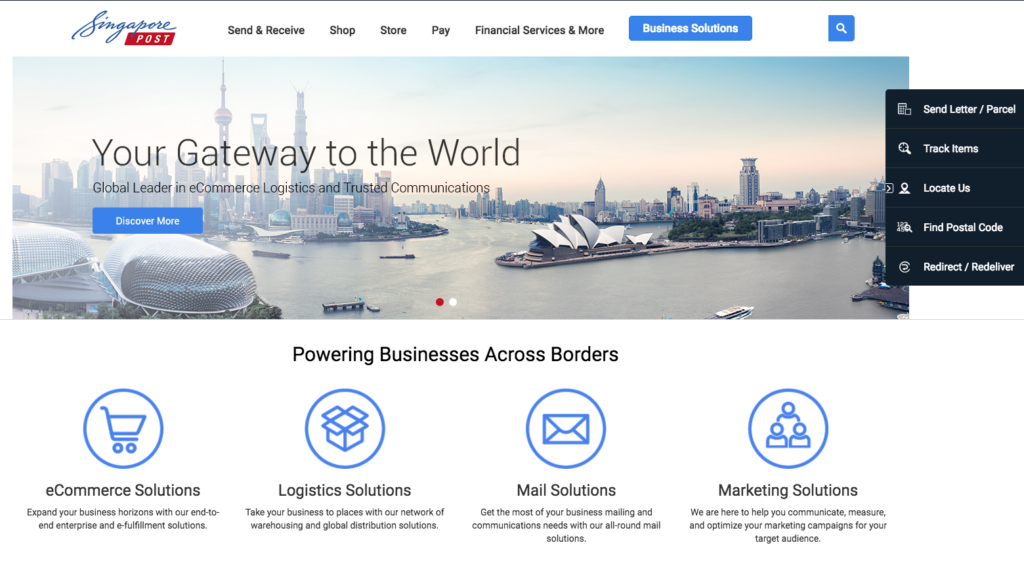

The SEA countries are tackling this challenge in their own ways. Singapore, as the most mature eCommerce market in the region, already has a relatively complete logistics network. Its well-known postal service SingPost already earns 26% of its revenue through eCommerce related services. They also established a 24 hours warehousing network in many countries within the region.

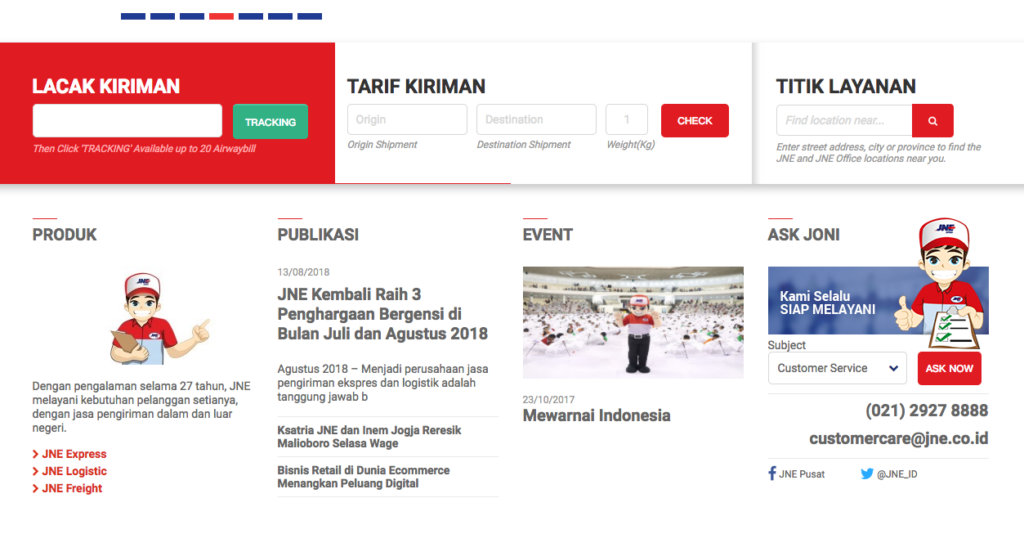

Indonesia's main challenge is last-mile delivery. Express delivery service company JNE is the most well-known and it technically services the entire country. It still lacks in on-time delivery and accurate tracking, but remains the main player in Indonesia for now.

Philippine players lack experience in delivering small eCommerce packages, being more used to high-volume freight services. These challenges are only larger since they are an island nation which increases logistics costs and delivery difficulties.

By far the country with the least basic logistics facilities is Malaysia. Especially last-mile delivery is difficult, with companies like POSMalaysia, NationwideExpress and SkyNet lagging behind in the use of new technologies. However, there are improvements, often by foreign players. A promising one is Ninja Van which launched in 2014.

It currently has a presence in Singapore, Malaysia, Indonesia, Thailand, the Philippines and Vietnam. They use algorithms to provide the best delivery routes, allowing their delivery staff to bring items to their intended recipients within the shortest possible time.

Payment Methods

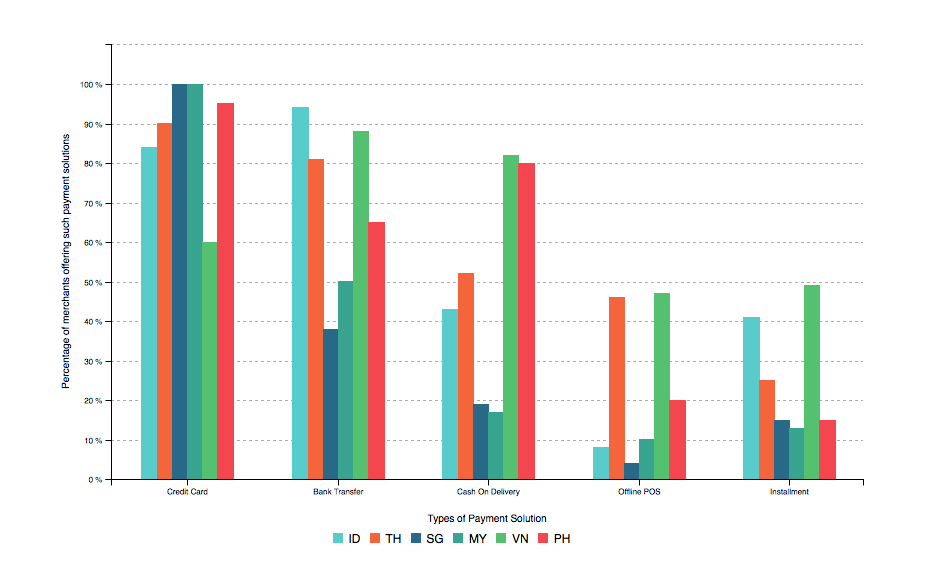

Fragmented is the keyword for the payment situation in Southeast Asia. Except for Singapore, credit and debit card penetration is low, and they are far from the most popular ways to make an online purchase. Instead, there is a dizzying array of online banking, ewallet, ATM, and cash-based payment methods.

Although penetration is low in all other SEA countries, credit card is the undisputed king in Singapore. Consumers even tend to have multiple cards for online purchases. In comparison, Malaysia also has a slightly higher credit card usage.

Cash on Delivery (COD) is offered by more than 80% of the players in both Vietnam and the Philippines. Cash-based payments are also still predominant in Indonesia, although mobile payments are predicted to grow in the coming years.

Bank transfer is another very popular payment method across SEA, with 94%, 86% and 79% of merchants in Indonesia, Vietnam and Thailand offering it.

In Thailand and Vietnam, almost 50% of merchants offer offline points of sale. This means that consumers pick up their purchases at an offline destination, for example, a 7-ELEVEN convenience store.

Payment by installments proves to be very popular (and increasing) in both Vietnam (47% of merchants) and Indonesia (42%)

Marketing and Social Media

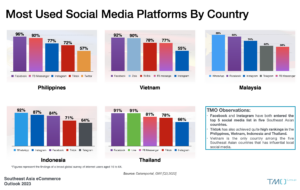

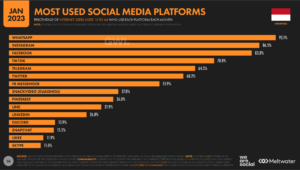

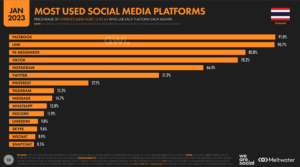

Finally, we take a look at marketing and social media in the region. Overall, Facebook is the ruling social media platform across all countries, having entered the top five mainstream social media in five Southeast Asian countries. TikTok has also achieved quite high rankings in the Philippines, Vietnam, Indonesia, and Thailand.

Vietnam’s local social media “Zalo” has a large number of users in Vietnam, ranking second among mainstream social media. It is also the only country among the five Southeast Asian countries that has influential local social media.

Philippines

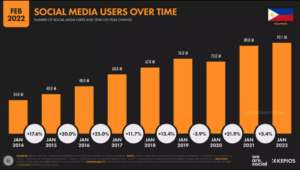

Facebook, Facebook Messenger and Instagram are the most popular social media in the Philippines. According to Datareportal, there were 84.45 million social media users in the Philippines in January 2023. The number of social media users in the Philippines is equivalent to 72.5% of the population, but be aware that social media users may not represent unique individuals. More broadly, in January 2023, 99.2% of the Philippines’ internet user base, regardless of age, used at least one social media platform. At that time, 53.5% of social media users in the Philippines were female, while 46.5% were male.

Vietnam

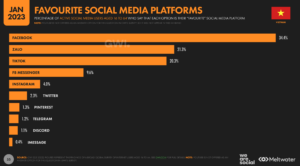

Facebook and Zalo are the most popular social media in Vietnam. In January 2023, the number of social media users in Vietnam was 70 million. Social Media User Growth Trends in the Philippines The number of social media users in Vietnam is equivalent to 71.0% of the total population as of early 2023, but social media users may not represent unique individuals. At the same time, data shows that as of the beginning of 2023, the number of users aged 18 and above using social media in Vietnam was 64.4 million. Data released by Meta shows that at the beginning of 2023, Facebook had 66.2 million users in Vietnam. But Facebook’s potential ad reach in Vietnam fell by 4.2 million (-6.0%) between 2022 and 2023. Zalo is an instant chat and dating software launched by Vietnam's VNG company. It was officially launched in December 2012 and quickly attracted a large number of Vietnamese users. Today, Zalo's scope of use has expanded to the United States, Myanmar, Japan, Taiwan, Thailand, South Korea, Malaysia and other countries.

Malaysia

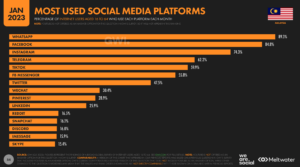

Whatsapp and Facebook are the most popular social media in Malaysia. In January 2023, there were 26.8 million social media users in Malaysia. As of early 2023, the number of social media users in Malaysia is equivalent to 78.5% of the total population, and 24.8 million users aged 18 and above use social media, equivalent to 99.8% of the total population aged 18 and above. Data shows that 89.3% of Malaysian Internet users aged 16 to 64 use WhatsApp every month, while Facebook’s figure is 84.4%. Data released by Meta shows that Facebook had 20.25 million users in Malaysia at the beginning of 2023. And between 2022 and 2023, Facebook’s potential ad reach in Malaysia decreased by 1.5 million (-6.7%).

Indonesia

Whatsapp and Instagram are the most popular social media in Indonesia. In January 2023, there were 167 million social media users in Indonesia. Data published in Meta inventory shows that Facebook had 119.9 million users in Indonesia at the beginning of 2023. Facebook's potential ad reach in Indonesia decreases by 10 million (-7.7%) between 2022 and 2023. Data published in the Meta advertising tool shows that Instagram had 89.15 million users in Indonesia at the beginning of 2023. The company's most recently revised figures show that Instagram's ad reach in Indonesia was equivalent to 32.3% of the population at the start of the year.

Thailand

Facebook and LINE are the most popular social media in Thailand. In January 2023, the number of social media users in Thailand was 52.25 million. As of early 2023, the number of social media users in Thailand was equivalent to 72.8% of the total population. Data shows that there are 49.4 million users in Thailand aged 18 and above using social media, equivalent to 84.8% of the total population aged 18 and above. Meta data shows that Facebook had 48.1 million users in Thailand at the beginning of 2023. Facebook's potential ad reach in Thailand fell by 2 million (-3.9%) between 2022 and 2023. LINE is an instant messaging software launched by NHN Japan, a subsidiary of South Korean Internet group NHN. There are more than 400 million registered users worldwide. There are more than 250 kinds of "chat emoticons" in LINE, giving users an additional tool to express their mood when using Line. 90.7% of Thai Internet users aged 16 to 64 use LINE every month.

eCommerce Market Localisation

Interested to capitalise on eCommerce opportunities in worldwide markets? At TMO Group, we provide crucial services for your eBusiness success such as eCommerce Consultancy and Strategy, UX / UI Design, eCommerce Website Development, or Cloud Hosting and Support.

Specifically interested in one Southeast Asian market, or those of China or Italy? You also might be interested in our eCommerce Market Localization Guides, which include in-depth guides to some exciting markets. The guides are based on our 20+ years of experience and are composed by our team of eCommerce market researchers. Each also offers a free Starter Guide for those who aren't ready to make a stronger commitment.

Disclaimer: All pictures in this article are sourced from copyright-free platforms. If however, you believe that infringement has occurred despite this, please contact us and we will remove the offending image immediately.